As violent price gyrations continue, so does the extreme danger for retail traders. Although we have had several big one day rallies, we have yet to see the bulls able to follow-through the next day. Instead was we see is overnight reversal ripping the heart out of traders that tried to hold positions just one more day. This morning is a repeating that pattern once again with US Futures limit down wiping out most if not all of yesterday’s hopefulness.

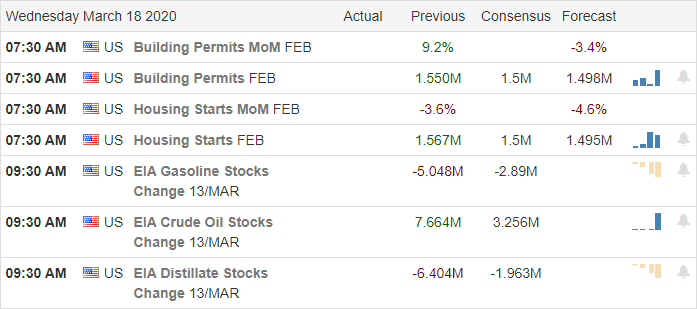

Asian markets seesawed back and forth overnight, finally closing the day lower across the board. European markets are sharply lower this morning with the DAX, FTSE, & CAC, all showing losses fo more than 5%. Ahead of a Housing Starts number and 60 earings report Dow futures to point to an overnight reversal of more than 800 points, and fear and uncertainty continue to drive extreme price volatility. Prepare for another wild day.

Economic Calendar

Earnings Calendar

On the hump day earings calendar, we have about 60 companies reporting results. Notable reports include GIS, FIVE, GES, HABT, TLRD, TCOM, & WSM.

Top Stories

Biden swept three primary elections last night as he doubles the delegate lead over Sanders can drawing closer to clinching the Democratic nomination. President Trump has now won enough delegates to lead the Republican party in the 2020 election.

After a day of rally closing the Dow up more than 1000 points, futures now point to an overnight reversal wiping out the gains waiting on yet another government bailout proposal to be passed. Munchin reportedly warns senators the impacts of the virus could lead to a 20% US unemployment rate as a business shutdown responding to CDC recommendations.

The Vegas strip is quiet for the first time since the Kennedy assassination as all gaming in the state was ordered to shut down. Kansas schools have closed public schools for the rest of the year! The first such state to make such a drastic decision.

Technically Speaking

Yesterday’s relief rally was a nice change to the extreme selling pressure, but sadly it looks as if a second day of follow-through is too much to ask for amid such wild volatility. After another wild night of price, action futures reached another limit down trading halt. The QQQ rally moved up to test the resistance of its 500-day average, but sadly the overnight reversal will wipe out almost all of yesterday’s hopeful gains at the open.

With the VIX closing, the day above a 75 handle, and a likely sharp move higher this morning options, prices will remain very dangerous and virtually untradeable. While there are some tempting values in stock prices, the volatility requires a tremendous tolerance for risk that few retail traders are willing to ride out. The best course of action for most is to continue to remain disciplined to your trading plan and protect your capital while market prices continue to gyrate violently.

Trade Wisely,

Doug

Comments are closed.