A ray of sunshine begins the market day with the first bullish follow-through open setting up this morning. It’s been nearly 2-weeks since we have seen a positive close followed by an optimistic open the next. That said, expect the wild price volatility to continue as infections here in the US begin to spike heading into another uncertain weekend.

Asian markets closed mixed but mostly higher as China holds steady on its price rates. European markets are green across the board this morning, reacting to the massive government stimulus efforts. The US futures point a positive open ahead of economic and earnings data but expect the price action to remain very challenging.

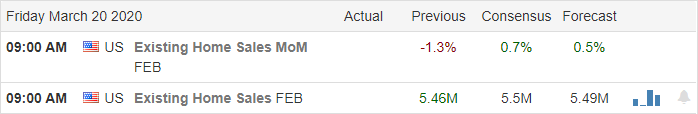

Economic Calendar

Earnings Calendar

On the Friday economic calendar, we have 59 companies reporting. Looking through the list about the only notable stock I can find today is HIIB.

Top Stories

After another turbulent evening where the US Futures traded between 350 down and 900 up currently points to positive open of more than 700 points. However, with such volatility in price, anything is possible by the open.

With virus infections beginning to rise rapidly, the California Governor ordered that all residents stay home and inside. The first state to issue such an extreme lockdown order. Italy now has the distinction of the largest death toll surpassing China as the country calls out the military to move coffins overwhelming the countries cemetery system. Here in the US, infection estimates could reach more than 30,000 by next week.

The Senate has proposed a massive spending bill sending direct payments to US citizens of $1200 per adult and $500 per child, including billions and billions for company bailouts. I doubt this will be the last of the backstop measures that will be required to stabilize the economy.

Technically Speaking

Although we saw more than a 1200 point swing the in Dow yesterday, it was nice to see a positive close. As of now, it looks as if we could get our first bullish follow-through open that we have seen in 2 weeks of massive overnight reversals. Crossing my fingers and hoping it will hold at least to the open, the QQQ could recover its 500-day moving average. The technical damage in the charts is so extreme that even a hold of this week’s lows could lift spirits as we head into another uncertain weekend.

Although there are some fantastic values in stock prices, buying them in the faces of such volatility and extreme uncertainty is not for the faint of heart. With the VIX holding above a 70 handle options are punishingly expensive, and the slippage in the bid/ask spreads make then nearly impossible to trade except for very quick and very dangerous day-trades. Let’s all hope for the best but prepare for the wild price action to continue in the coming weeks as impacts of the outbreak continue to expand. Protect your capital, take care of your family, and support your communities as best you can through these troubling times.

Trade Wisely,

Doug

Comments are closed.