Futures had a bit of a temper tantrum last night after the Senate failed to pass the massive stimulus bill. We can expect significant price sensitivity through-out the day as they legislators scramble to resolve issues and vote again later today. A passage could trigger a quick rally, but a failure could really bring out the bears, so keep an eye to the news as they wrangle party politics.

Asian markets closed mixed but mostly lower as Hong Kong and Australia saw heavy selling during the night. European markets continue to tumble with the FTSE down another 3.5% as the coronavirus continues to ravage the euro block. With tremendous overnight volatility, US futures point to a substantial gap lower this morning that will test the lows of last weeks as support. Hang on for another wild day of price action.

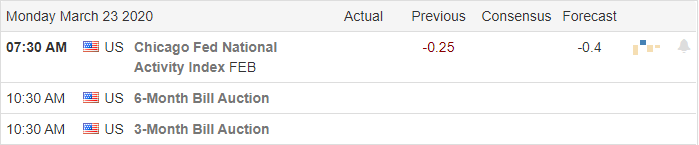

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have over 80 companies stepping up to report quarterly results today. However, after looking through the list, I don’t see any particularly notable or market-moving reports.

Top Stories

After another volatile evening where the futures briefly dropped to limit down, they point to a substantial gap down this morning. The massive stimulus bill failed to pass last night but will try once again today. If passed or fails to pass, it’s likely to be a market-moving event, so keep an eye to the news as we progress through the day waiting on the vote.

The Olympic committee is under pressure to postpone or cancel the Summer games hosted in Japan due to the virus concerns. Canada and Australia are the first countries to announce they will not send athletes should the games move forward as scheduled.

Last evening the President activated the National Guard in New York, Californa, and Washington to expedite the moving of medical supplies and equipment as their outbreaks continue to grow at an exceptional rate.

Technically Speaking

The QQQ had the best chance of recovering the 500-day average last week, but on Friday left behind a very disappointing bearish engulfing candle. This morning the four major indexes are set to open at or below recent market lows. Although most charts paint a pretty grim picture, there was an effort by the bulls to defend the week’s lows. In a surprise and very bold move, Goldman upgrades BA suggesting they have enough cash to get through the crisis and that air travel will return following the crisis. I assume the Goldman is also anticipating that the government will swoop in with a considerable bailout for the company in an attempt to prevent massive layoffs.

We can continue to expect extreme price volatility and sensitivity to the congressional vote on the stimulus bill. I would not rule out the possibility of a quick and substantial rally should the bill pass. However, another failure to pass could easily trigger another sharp selloff that could easily trip circuit breakers. Keep in mind no matter what happens, holding positions overnight will remain very dangerous due to the overnight swings. I think a V-bottom recovery is unlikely because we are still weeks if not months away from seeing an improvement in the war against the outbreak.

Trade Wisely,

Doug

Comments are closed.