Key Inflation Data

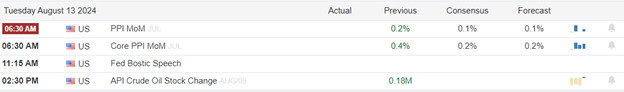

U.S. stock futures climbed early Tuesday as investors eagerly anticipated the release of key inflation data this morning. The focus is on the producer price index (PPI), a critical measure of wholesale prices, which is scheduled for release at 8:30 a.m. ET. According to Dow Jones consensus estimates, the PPI is expected to show a monthly increase of 0.2% in July, mirroring the previous month’s growth.

European stocks saw an uptick on Tuesday, maintaining a cautiously positive trend following last week’s volatility. The latest data from the U.K.’s Office for National Statistics revealed that wages, excluding bonuses, increased by 5.4% year-on-year between April and June, marking the slowest growth rate in two years. Additionally, the unemployment rate dropped to 4.2% from 4.4%, defying economists’ expectations of a rise to 4.5%, as per a Reuters poll.

Asia-Pacific markets experienced a general uptick, reflecting investor optimism despite a turbulent session in the U.S. overnight. This volatility in the U.S. was largely due to anticipation surrounding the upcoming release of the U.S. consumer price index (CPI) for July, a crucial metric for gauging the health of the U.S. economy. Meanwhile, in Asia, market participants were busy analyzing Japan’s producer price index data and Singapore’s second-quarter GDP growth figures, both of which are significant indicators of economic performance in the region.

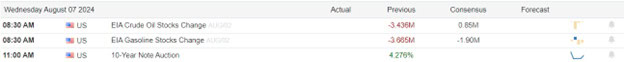

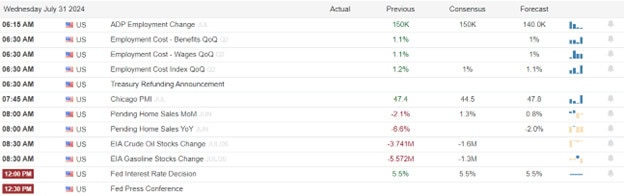

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include HD, HBM, HUT, HUYA, HIS, JHX, LOAR, MLCO, MRSN, MSGS, ONON, PSFE, SE, SLF, TLN, & TME. After the bell include DUOT, FNV, IBTA, INTA, KYTX, MRCY, NATL, NPCE, NU, USPH, & XP.

News & Technicals’

Share transactions in China have plummeted to their lowest level in over four years, driven by a fervent local bond rally amidst a weakening economy. The world’s second-largest stock market is on course for its fourth consecutive year of losses, exacerbated by an unprecedented housing crisis that has severely restricted investors’ options. This situation has led to a surge in demand for government bonds, raising concerns among regulators. Historically, similar episodes in China have triggered panic-driven selling, pushing the market to new lows, and the current scenario appears to be following this troubling pattern.

Shares of Home Depot dropped over 2% in premarket trading after the home improvement retailer issued a warning about weaker-than-expected sales for the second half of 2024. The company now anticipates full-year comparable sales to decline by 3% to 4%, a significant adjustment from its earlier forecast of a roughly 1% decrease. This revised outlook has raised concerns among investors about the company’s performance and the broader economic environment affecting consumer spending.

Carry trades, a popular foreign exchange strategy where investors borrow in low-interest currencies like the Japanese yen to invest in higher-yielding assets, have gained significant traction in recent years. This popularity stemmed from expectations that the yen would remain cheap and Japanese interest rates would stay low. However, this trend took a sharp turn last week when the Bank of Japan’s interest rate hikes strengthened the yen, triggering an aggressive unwinding of yen-funded carry trades. This sudden shift led to a dramatic sell-off in global markets, highlighting the volatility and risks associated with such strategies.

The Social Security Administration (SSA) is grappling with a “record-breaking backlog” of open cases, which has resulted in an estimated $1.1 billion in improper payments to beneficiaries, according to a recent report from the SSA Office of the Inspector General. This backlog has highlighted significant challenges within the SSA, with experts emphasizing the urgent need for increased budgetary funding to address what they describe as a “customer service crisis.” The situation underscores the critical importance of adequate resources to ensure timely and accurate service delivery to beneficiaries.

The wait for the key inflation data of the PPI report. The question now, will it inspire the bulls or bears? We should also consider the possibility of a sideways move as we wait for the more important CPI numbers on Wednesday. That said, be prepared for anything including gaps and big point whipsaws as the market reacts.

Trade Wisely,

Doug