A Reminder that Bears STILL Exist

Yesterday’s selloff was a reminder that bears still exist and how quickly sentiment can shift with these lofty company valuations. Though the SPY and the QQQ experienced substantial selling, there is no significant technical damage. However, that is not the case with DIA, as it joined the IWM below the 50-day average. We now have overhead price resistance in all the index charts, and with the VIX above a 22 handle, expect volatile price action to challenge even the most experienced traders. With valuations so high, inflationary pressures on the rise amid earnings season, the threat of a Covid rebound will be a lot for the market to sort out.

Asian markets closed overnight red across the board as China keeps the benchmark lending rate unchanged. European markets are trying to rebound this morning, but so far, the gains are modest as traders worry about more Covid impacts. As earnings events ramp up, U.S. futures point to a substantial gap up as we bounce back. The question is, will it be a sustained relief rally or a short-lived dead cat bounce. Buckle up the road ahead could be pretty challenging.

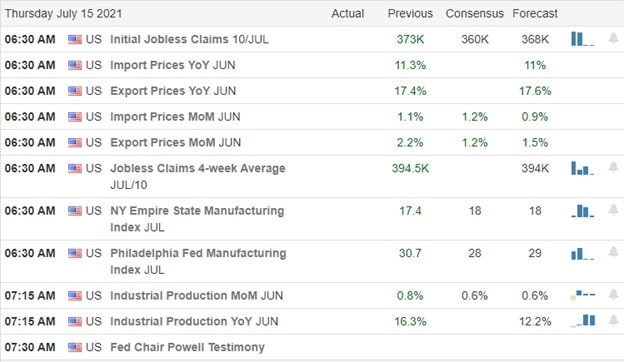

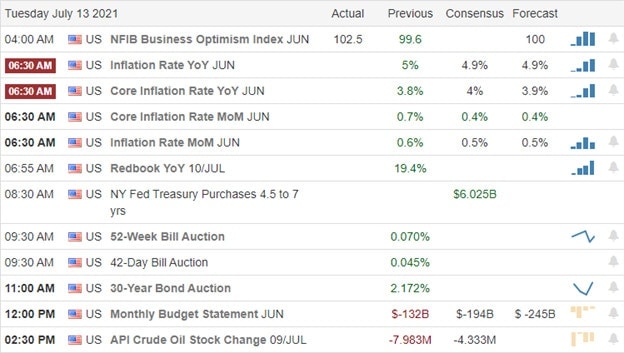

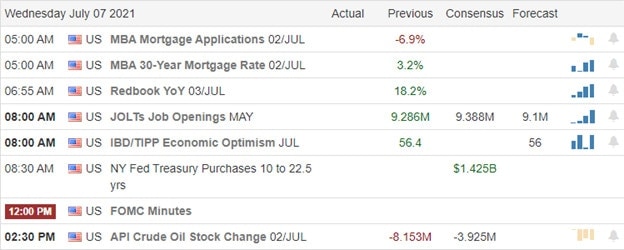

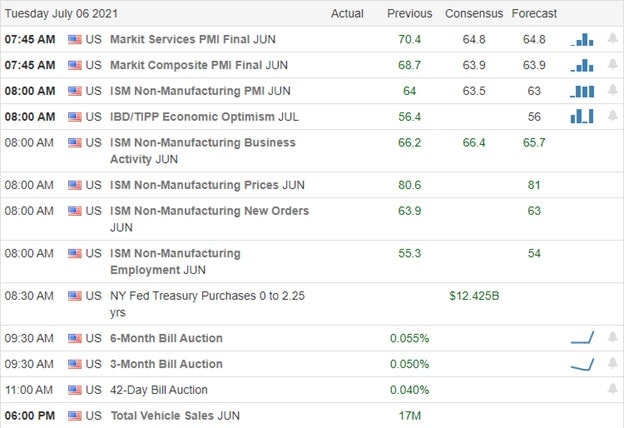

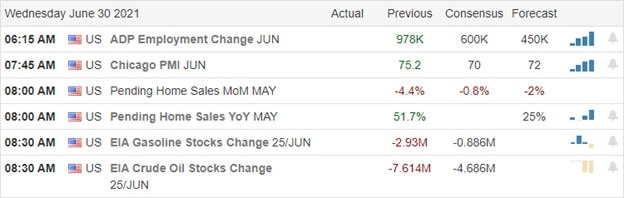

Economic Calendar

Earnings Calendar

The number of earnings ramp-up with more than 30 companies listed stepping up to report quarterly results. Notable reports include NFLX, ALLY, CMG, CNI, HCA, CFG, HAL, ISRG, KEY, OMC, PM, UAL, TRV, UBS, & SYF.

New & Technicals’

Bitcoin holders are squealing from the feeling as the popular crypto drops below $30,000, wiping away about $100 billion in valuation. Another billionaire is making a quick trip to space today as Jeff Bezos prepares for launch in a flight expected to take about 11 minutes to complete. The United States is asking folks to avoid travel to the UK due to the rising covid numbers. Warnings from the CDC and the State Department reached Level 4, which is the highest warning level.

Yesterday was a painful reminder that bears still exist and that complacency can damage retail trader’s accounts. The DIA joined the IWM below their 50-day moving average, suffering the brunt of the technical damage. The SPY tested its 50-day but found buyers by the end of the day to hold it as support. Though the selling was painful for big tech, the QQQ remains significantly elevated its 50-day averages maintaining the title of the strongest of the indexes. However, as the market works for a bounce this morning, we have created substantial overhead price resistance levels. With earnings numbers on the rise and the VIX elevated above a 22 handle, expect price action to be challenging and volatile. Significant morning gaps, quick intraday whipsaws, and full-on reversals are likely as the market struggles to balance high valuations and inflationary pressures as Covid increases threaten the recovery. Plan your risk carefully and remain alert and agile as the market tries to sort out the details.

Trade Wisely,

Doug