Yellen says we should expect several months of rapidly rising inflation. At the same time, Powell defends the FOMC easy money policies, and the bond king, Jeffery Gundlach, says the U.S. Dollar is doomed in the long term due to deficits in budget and trade. That said, the trends in the DIA, SPY, and QQQ remain bullish, while the Absolute Breadth Index bounces along the bottom. Retail sales numbers will be in focus this morning and remember we have an FOMC rate decision next week as earnings ramp up.

Asian markets traded mixed but mostly lower to end their trading week as the Bank of Japan holds a steady monetary policy. European market trade cautiously mixed this morning while U.S. rally off overnight lows suggesting a bullish open across the board ahead of retail sale data. I wish you all a great day of trading profits and a wonderful weekend!

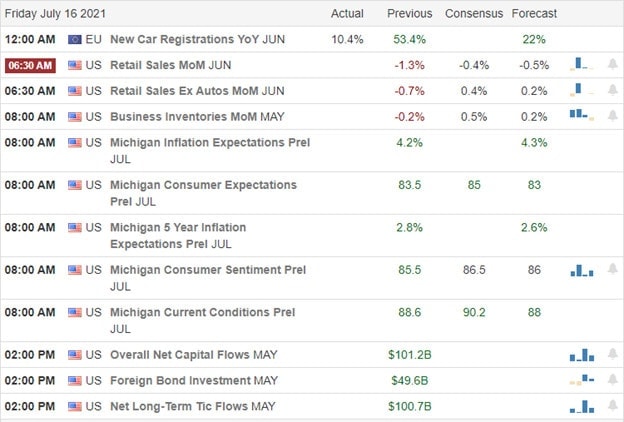

Economic Calendar

Economic Calendar

We have just nine verified reports on the Friday earnings calendar. Notable reports include SCHW, KSU, & STT.

News & Technicals’

Janet Yellen says she expects the U.S. economy will see several more months of rapidly rising inflation. However, she goes on to say it will ultimately fall back to more normal levels. Some analysts now suggest we will enter a longer-term deflationary market cycle after the inflationary surge. That sentiment would seem to support Jeffrey Gundlach’s ideas, the so-called bond king, which yesterday said the U.S. dollar is “doomed” over the long term. The Doubleline Capital CEO went on to say,” the dollar is going to fall pretty substantially” due to increasing U.S. trade and budget deficits. Treasury yields rose Friday morning, with the 10-year up three basis points to 1.329% and the 30-year climbing 3.9 basis points to 1.958%.

Although we saw a little selling in the tech sector pulling back, we experienced no technical damage across the DIA, SPY, and QQQ indexes. Unfortunately, the same can not be said about the IWM creating a lower low after failing at its 50-day average. Futures we slightly lower overnight after Yellen’s comments that she expects several more months of rapid inflation. That being the case, Jerome Powell defended the easy money policies of the FOMC and planned to keep the pedal to the metal pumping $120 Billion per month. As you plan forward, keep in mind an FOMC rate decision is on for next Wednesday. Until then, let the good times roll, staying with the uptrend while avoiding complacency.

Trade Wisely,

Doug

Comments are closed.