With a mighty shove by the tech giants, the SP-500 solidified a new record high for the 33rd time this year, with the QQQ set new closing records as well. Unfortunately, most of the move was again encapsulated in the morning gap as we spent the rest of the day choppy sideways in a narrow range. As the 2nd quarter comes to an end, watch for the possible end-of quarter-window dressing with jobs data in focus for the rest of the week.

Overnight Asian markets traded mixed in a choppy session. European markets trade with modest declines across the board this morning as inflation and the rising delta variant become widespread on the continent. Ahead of earnings and economic data, futures point to a modestly lower open as we wait on private payroll data. As you plan forward, keep in mind the Employment Situation number Friday morning and the upcoming 3-day holiday weekend that could see declining volumes.

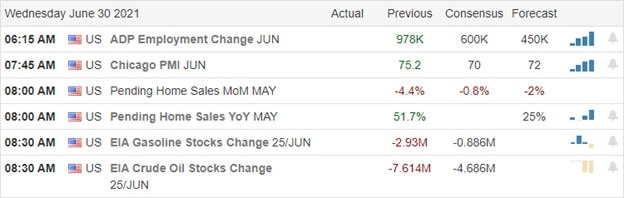

Economic Calendar

Earnings Calendar

As we finish up the 2nd quarter, we have 11 companies listed on the earnings calendar, with a few that are not verified. Notable reports include BBBY, MU, STX, FC, GIS, and SJR.

News & Technicals’

On this last trading day of June and the end of the 2nd quarter jobs, data will come into focus for the rest of the week. Warren Buffett is one of the only big investors to recognize the highly uneven impact on small businesses during the pandemic. Bailouts and massive amounts of federal money flowed to big businesses while the small on-street business was primarily ignored as regulators forced their closure. There have been calls to ban British visitors into the U.K. in order to stop the spread of the delta variant that is already widespread on the continent. HSBC says Asia faces a‘ bumpy road’ ahead as Covid cases remain high. Still, vaccine rollouts offer hope as countries like India, Indonesia, Malaysia, and Nepal continue to deal with elevated infection rates. Treasury yields are moving lower this morning, with the 10-year down slightly to 1.475% and the 30-year dipping to 2.087%.

For the 33rd time this year, the SP-500 closed at a new record high, with tech giants proving the majority of the lift. But, of course, the QQQ also set a new record while the DIA and IWM turned slightly lower but holding on to crucial technical support levels. The next three days’ jobs data will keep traders and investors on their toes and guess if the results will continue to support these high prices. The SP-500 P/E ratio is now 89% above its historical 10-year average, and one has to wonder just how high can we go with the Fed keeping the stimulus pipeline continuing to pump out 120 billion per month. Futures trade slightly lower this morning with ADP, Chicago PMI, Pending Home Sales, and Petroleum Status number on deck. Please don’t rule out the possibility of the end-of-quarter window dressing and plan your risk carefully as we slide toward the Employment Situation number and the holiday shutdown.

Trade Wisely,

Doug

Comments are closed.