First out of the gate early this morning, PepsiCo kicked off the 3rd quarter earnings season by crushing the estimates and raising forecasts. Soon to follow will be the possible market-movers JPM & GS setting new high records in the DIA, SPY, and QQQ in anticipation. Let’s hope companies can produce the results that support these very lofty valuations! Except for considerable price volatility and possible morning gaps as traders and investors react to the data.

Overnight Asian markets mostly higher, with the HIS leading the way, advancing 1.63%. Europe markets are taking more of a wait-and-see stance with mixed and muted results this morning. Ahead of big bank reports and the latest reading on CPI, U.S. Futures trade mixed but primarily flat. There is a lot at stake this earnings season due to the high valuations so consider your risk carefully as the fireworks begin.

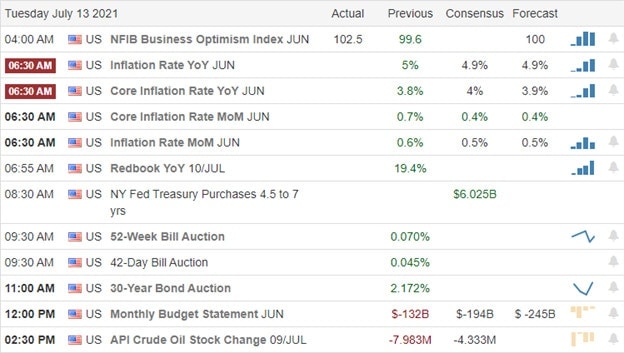

Economic Calendar

Earnings Calendar

Today we kick off the 3rd Quarter earnings season with 12 companies listed to report. Notable reports include CAG, FAST, GS, JPM, KRUS, & PEP.

News & Technicals’

Kicking off the 3rd quarter PepsiCo crushes estimates, and the company raises forecasts seeing a return of demand from foodservice customers. We will hear earnings results from both major market movers JPM and GS this morning. France, the Netherlands, Greece, and Spain all announced new restrictions on Monday in a bid to curb the rise in Covid infections. At the same time, the U.K. confirmed that it would lift its remaining restrictions on July 19th despite its infection rate remaining high. According to Husein Kanji, a partner at Hoxton Ventures, ‘this feels a lot like 1999,’ with tech venture investors writing bigger checks than ever before. A record 249 firms achieved $1 billion “unicorn” valuations in just the first half of 2021, doubling those produced last year. Treasury yields moved higher this morning, with the 10-year up four basis points to 1.368% and the 30-year climbing just one basis point to 1.994%.

The DIA, SPY, and QQQ continue to surge to higher highs with little regard to the inflated valuations as the frenzy of buying continues. New record highs have become so commonplace this year it’s barely newsworthy. However, the 3rd quarter earnings expectation energy is palpable with the big question can companies produce enough to support these lofty prices? Technically the T2122 4-week new high/new low ratio signals a possible over-bought condition, while the Absolute Breadth Index points to an extreme divergence with the index leaders. Though it’s become very redundant, I will continue to suggest we stay with the trend as long as it lasts but avoid over-trading and guard against complacency. We can expect some wild earnings fueled price volatility with substantial morning gaps, so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.