Yesterday we were reminded that bears are still around and hungry. It was all big tech holding up the market yesterday as most everything else slipped sideways or south. Their market dominance is clear, but one must wonder how much longer tech can maintain this buying pressure as valuations soar and P/E ratios hit new record highs. If nothing else occurred yesterday, the bears gave us a warning not to become complacent. Stay with the trend but stay focused and flexible because bear attacks and price volatility could signal a top is near.

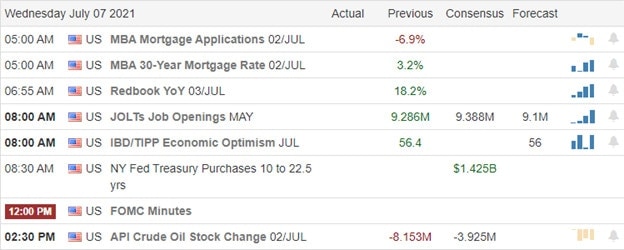

Asian markets closed mixed overnight in a choppy market session. European markets are primarily bullish this morning, keeping an eye on the muted global sentiment. Ahead of the JOLTS number and the FOMC minutes, U.S. futures are trying to shake off yesterdays selling as the QQQ gaps to yet another record high as the big tech party continues.

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have just eight companies listed and only four verified reports. Notable reports include MSM, SAR & WDFC.

News & Technicals’

With mass pandemic vaccinations continuing across the country, health officials warn we could see a harsh flu season this winter due to the minor season in 2020. Biden is now suggesting door-to-door efforts to increase the number of vaccinations in areas where there are low acceptance rates. At the same time, France is preparing a new law to make the Covid vaccination compulsory for those in the health care industry. The European Central Bank is now raising its forecast to a 4.8% growth rate this year with 4.5% in 2022, raising some inflationary concerns. China’s crypto-crackdown called for the shutdown of a company “suspected” of providing software services for virtual currency transactions. With the FOMC minutes just around the corner, the 10-year Treasury yield dipped this morning to 1.338%, and the 30-year fell to 1.967%.

The bears reminded us yesterday that they are still around and hungry, with the IWM testing its 50-day average and the DIA suggesting a possible test. However, trends remain bullish, and the rally back yesterday afternoon raises the question if the bears have the energy to follow through on yesterday’s threat. That said, the VIX indicated a modest increase in fear, and the Absolute Market Breadth Index saw its first increase in days on the selling wave. So there may be a reason some caution but no reason to run for the door just yet. Instead, consider this a warning shot over the bow not to overtrade or become complacent with valuations so elevated. We know a correction is way overdue and could begin at any time but stay with the trend until then.

Trade Wisely,

Doug

Comments are closed.