105 Billion Per Month

The Fed will back off ever so slightly on its easy-money policies but continue to print debit at a rate of 105 billion per month despite the inflationary pressures. Without a doubt, the market loves all the printing, setting new records on the news with the IWM joining in for the first time this year. So let the party continue but keep in mind this rally is getting long in the tooth, and rest is well overdue.

Asian market rallied with green across the board overnight in reaction to the Fed decision. This morning, European markets are also in a bullish mood with the easy money policies tapering only slightly. However, with a massive day of earnings and Jobless data ahead, U.S. futures point to a muted open except for the Nasdaq gapping to another record at the open.

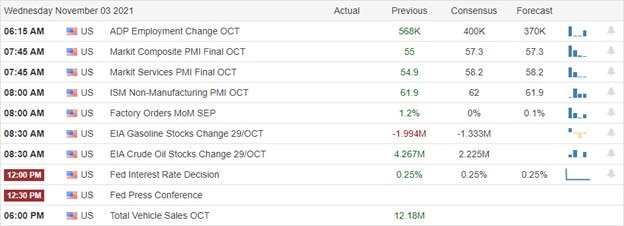

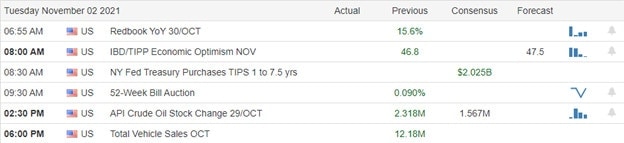

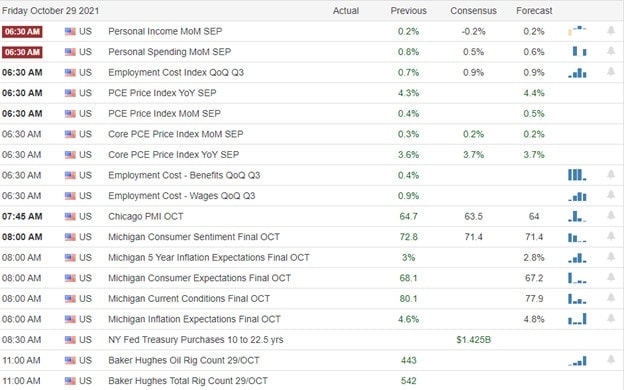

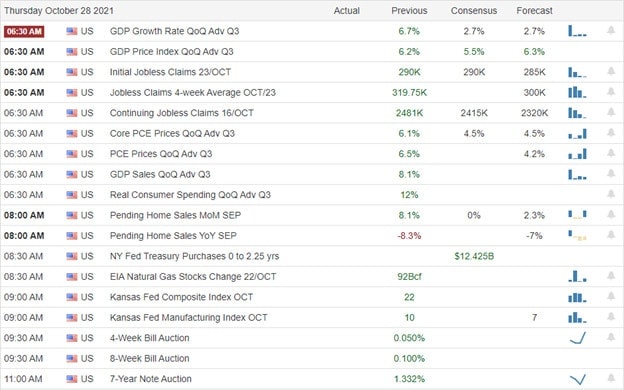

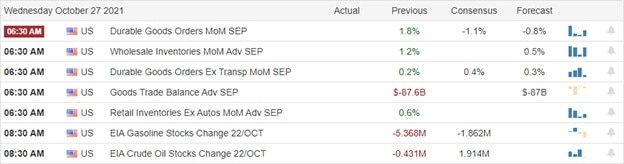

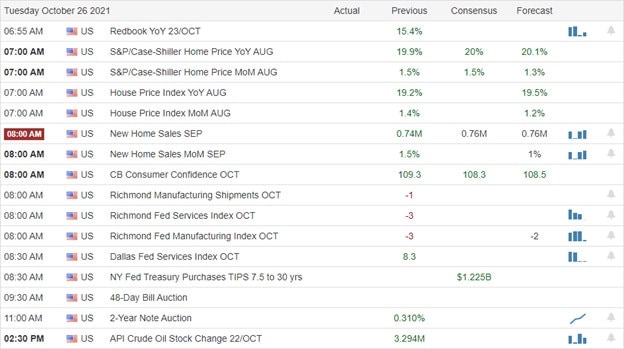

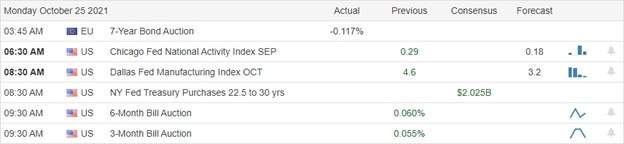

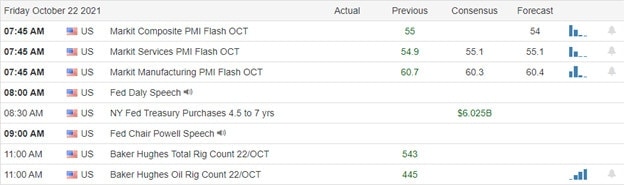

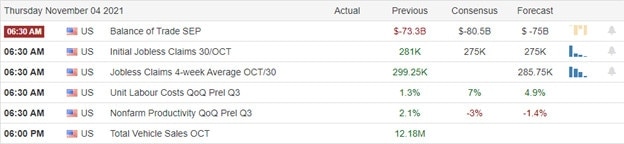

Economic Calendar

Earnings Calendar

Today, we have a massive day of reports with more than 350 companies listed on the earnings calendar. Notable reports include SQ, MRNA, ACIW, WYNN, APD, ABNB, ALL, AIG, ABC, AAOI, APTV, GOLD, BDX, CNQ, CARS, CVNA, CC, LNG, CI, CTXS, CLNE, ED, CS, CUBE, CYBR, DDOG, DPSGY, DIN, DBX, SUK, EGLE, LOCO, ENDP, EOG, EXPE, FSLR, FTNT, FNKO, GOGO, GPRO, GPRE, GPP, HBI, HL, IAC, IHRT, ILMN, K, LITE, MCHP, MNST, NKLA, NTDOY, NLOK, NVAX, NRG, PH, PTON, PENN, PINS, PLNT, REGN, RKT, SHAK, SWKS, SO, SFM, RUN, SSYS, SYNA, TGH, TM, HEAR, UBER, OLED, VIAC, W, WWE, WW, YELP, & ZTS.

News & Technicals’

The Federal Reserve said Wednesday it would begin tapering the pace of its asset purchases later in November. The reduction will see $10 billion less in Treasurys and $5 billion less in mortgage-backed securities every month. There also was only a slight change to Fed’s view on inflation. The post-meeting statement kept the word “transitory” to describe price increases running at a 30-year high. However, it qualified the term somewhat by saying pressures are “expected to” be temporary. Chairman Jerome Powell said he expects conditions pushing inflation to last “well into next year.′ In its shareholder letter, the company said the slowdown results from “global supply chain disruptions that have impacted the U.S. TV market.” “The pandemic continues to disrupt global supply chains,” CFO Steve Louden told CNBC. “For the TV industry, you’re having elevated component pricing, inventory availability issues, and supply chain logistics delays,” he said. Treasury yields traded mixed this morning, with the 10-year dipping to 1.5735% and the 30-year rising slightly to 1.9958%.

Markets love money printing rising after the Fed said it would continue printing at the pace of 105 billion per month. We are a market inflated by massive debit at taxpayer expence, and we can’t seem to get enough of it! That said, we set new records in all four indexes as the IWM joined in on the party busting through more than a year of price resistance. So stay with the trend but always be on guard because a tumble from these heights could be painful and simple logic would suggest a rest is well overdue.

Trade Wisely,

Doug