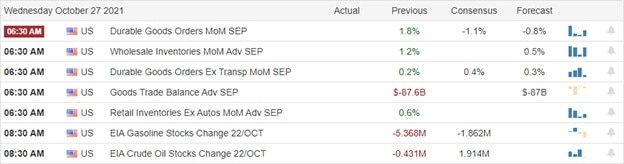

In anticipation of strong big tech earnings, the DIA and SPY set new records yesterday before pulling back as we approached the close. That left behind possible topping candle patterns, but with all the earnings energy coming our way in the next couple of days, anything is possible. That said, a rest or minor profit-taking pullback to test price support seems to grow in probability from this extended condition in the indexes. Traders will also have to grapple with the Durable Good data before the open that analysts suggest may come in negative.

Overnight Asian markets closed the day mostly lower, with Hong Kong leading the way down 1.57%. This morning, European markets trade in the red across the board with modest losses keeping an eye on the UK budget debate. Facing another massive day of earnings and economic data, U.S. futures currently point to modest declines. So buckle up; it could be another wild earnings season adventure.

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have a busy day with 194 companies listed. Notable reports include AFL, AEM, ALGT, NLY, ADP, AVB, BA, BOOT, BSX, BMY< BG, CINF, KO, CDE, DB, DRE, EBAY, EXR, FISV, F, GRMN, GD, GM, GSX, HOG, HLT, IP, KHC, LC, MAS, ORLY, PPC, RJF, R, NOW, STX, SF, TDOC, TWLO, VICI, WH, XLNX, YNDX, & YUMC.

News & Technicals’

Alphabet topped analysts’ expectations on the top and bottom lines. However, CFO Ruth Porat said Apple’s privacy changes had a “modest impact on YouTube revenues.” As a result, the company’s shares were little changed after reporting. Microsoft’s Azure revenue growth slowed slightly in the quarter, although it accelerated from the prior quarter on a constant-currency basis. In addition, PC supply constraints cut into sales of Windows to device makers. Third-quarter transaction-based revenue totaled $267 million, with only $51 million coming from cryptocurrency trading. Revenue from crypto trading totaled $233 million in the second quarter. Robinhood said that, barring any change in the market environment, the headwinds that dragged down last quarter would persist into the end of the year. Senate Democrats on Wednesday unveiled a new billionaires’ tax proposal, an entirely new entry in the tax code designed to help pay for President Joe Biden’s sweeping domestic policy package and edge his party closer to a comprehensive agreement. The proposed tax would hit the gains of those with more than $1 billion in assets or incomes of more than $100 million a year, and it could begin to shore up the big social services and climate change plan Biden is racing to finish before departing this week for global summits.

The SPY and DIA found themselves trading at new records yesterday but struggled to hold intraday highs as we moved toward the close and heavily anticipated giant tech reports. The pullback slightly relieved the short-term overbought condition in the T2122 indicator as the VIX rose slightly off intraday lows. Today, we ramp up the number of earnings reports and have the potential market-moving Durable Goods report to digest. Analysts expect a -0.9 reading falling from the prior report of 1.8%. International Trade data will follow that as well as the Petroleum Status. Indexes remain in a very extended condition adding danger to those entering positions, so plan your risk carefully. Remember, healthy price action commonly tests price supports, and the current rally has left little support behind and lots of open gaps in the process.

Trade Wisely,

Doug

Comments are closed.