Attention to Inflation

Finishing last week lower, the market will now turn its attention to inflation and the kick-off to earnings with big bank reports on Friday. In addition, Jerome begins congressional testimony on Tuesday, CPI Wednesday, PPI Thursday, and retail sale and industrial production on Friday. All of this with the SPY, QQQ, and IWM in a precarious technical position adding to the uncertainty. I think we can expect price volatility to remain high, so plan your risk accordingly.

Asina markets traded mixed with the HSI rebounding 1.08% overnight. Across the pond, European markets trade mostly lower, albeit a choppy trading session. Facing a big week of market-moving data, U.S. futures have recovered from overnight lows, but with treasury yields continuing to rise, the NASDAQ remains under pressure this morning. So trade wisely; it could prove to be a challenging week ahead.

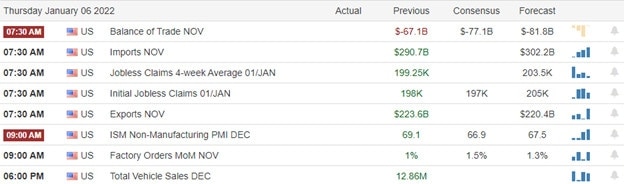

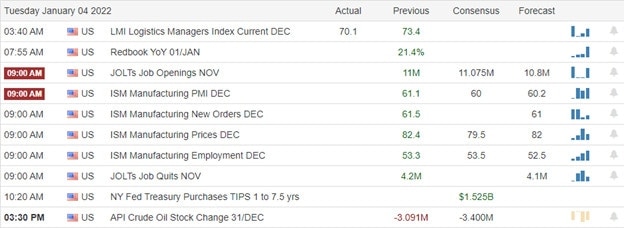

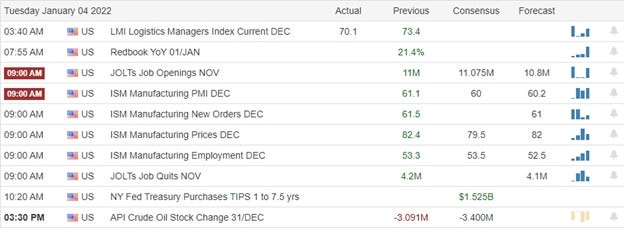

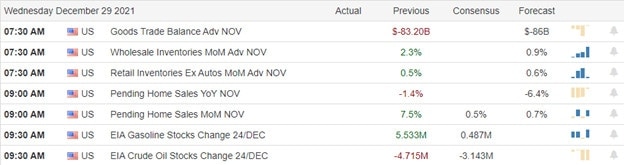

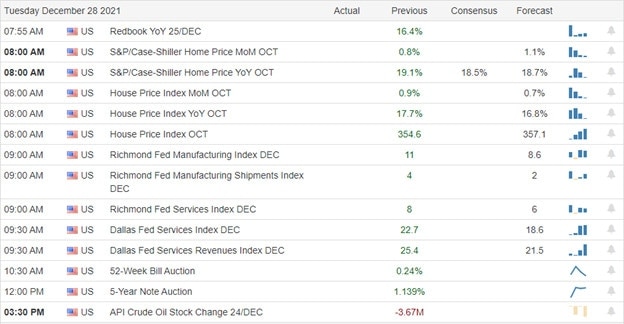

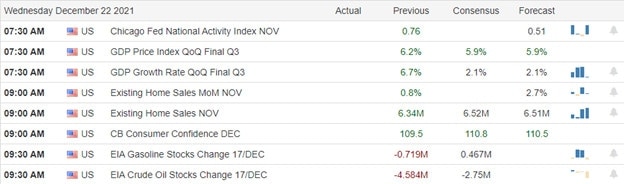

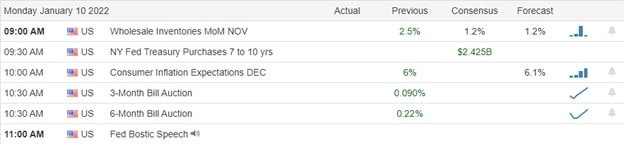

Economic Calendar

Earnings Calendar

We have just eleven companies listed and only six verified reports to kick off the new trading week. Notable reports include AZZ, CMC, and VOXX.

News & Technicals’

U.S. and Russian officials are in Geneva on Monday to begin a series of high-stakes talks this week. Tensions remain higher than ever over Ukraine, but both sides have already warned prospects for a resolution are low. Moreover, Russia has been building up its military presence at its border with Ukraine in recent months, leading to heightened concerns that Russian President Vladimir Putin is planning on invading the country. Moscow denies such claims, saying it has a right to place troops where it likes within its territory. Draghi’s government, comprised chiefly of politicians from different parties and some technocrats, has appeased markets due to its parliamentary support and reform plans. However, analysts at Goldman Sachs said Draghi’s departure would “trigger uncertainty regarding the new government and its policy effectiveness.” Over 1,000 of the country’s parliament and regional representatives will begin voting on Jan. 24. North Korea is seeking to build up its missile capability to boost its “bargaining position,” says one political analyst, who pointed to the country’s latest attempt last week to test-fire a hypersonic missile. On Thursday, state media claimed the country had test-fired a “hypersonic missile” the previous day. “You start the new year, and North Korea does this type of test that shines the light back on it,” John Park, director of the Korea Project at the Harvard Kennedy School, told CNBC’s “Squawk Box Asia” on Monday. Treasury yields climbed higher in early Monday trading, with the 10-year rising to 1.7975% and the 30-year trading at 2.1469%.

After finishing the week lower, the market will turn its attention to inflation and the congressional testimony of Jerome Powell. While the DIA remains in a bullish technical position, the SPY, QQQ, and IWM indexes now have some challenges to overcome if the bulls want to remain in control. The overhead resistance level is substantial, but I’m guessing there are still some very high hopes that earnings season can provide the inspiration needed. We kick off the big bank earnings on Friday. The Fed testifying in congress, inflation data, retail sales numbers, and the beginning of earnings season! Add in geopolitical tensions with Russia and North Korea chiming in, and we have a week of uncertainty ahead. What could go wrong with that? Expect uncertainty and price volatility to remain high so plan your risk accordingly.

Trade Wisely,

Doug