Another day another new record as the bulls extended the year-end run, but they stumbled slightly, failing to hold it into the close. Indeed, the indexes are very extended in the short term, but the DIA, SPY, and QQQ held above new support levels. Unfortunately, volume was again anemic as the index stretched out; traders should keep in mind that it will likely diminish more as we head toward the holiday weekend as they plan forward. Nevertheless, it may be wise to capture some gains if the bears suddenly appear.

Asian markets traded mixed but mostly lower overnight as pandemic developments tempered investors’ moods. European markets traded mixed this morning but mostly lower at the time of writing this report. However, here in the U.S., the bulls keep trying to hold bullishness in the futures, looking to extend for a sixth straight day.

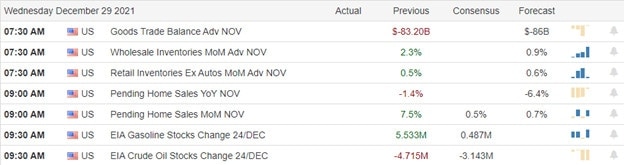

Economic Calendar

Earnings Calendar

We have eight companies listed on the Wednesday calendar, with only one confirmed report coming from FCEL.

News & Technicals’

According to financial filings published late Tuesday, Tesla and SpaceX CEO Elon Musk has sold another 934,090 shares, or about $1.02 billion worth of his holdings, in his electric car company. Since Nov. 8, Musk has been on a selling spree. The Tesla CEO has said he is partly selling shares to pay a massive tax bill that he anticipates will amount to at least $11 billion. Musk also exercised options to buy nearly 1.6 million Tesla shares at a strike price of $6.24 per share, granted to him via a 2012 compensation package. In addition, batter rivel Northvolt said it’s the first battery of its kind to have been fully designed, developed, and assembled by a homegrown European battery company. The battery cell came off the production line on Dec. 28. Most of the world’s electric car batteries are currently made in the U.S. and Asia, but Northvolt hopes to change this. Finally, there was a little market reaction to the central bank’s 2022 policy document. It said it would monitor risks related to the foreign exchange market and do what is necessary to ensure it runs smoothly. The lira slipped as far as 12.11 against the dollar and traded at 12.03 by 0742 GMT. Despite surging more than 50% last week following state-backed market interventions, it has lost 39% of its value this year. “The CBRT has no commitment to any exchange rate level and will not conduct FX buying or selling transactions to determine the level or direction of the exchange rates,” the bank said. Treasury yields inch lower in early Wednesday trading, with the 10-year declining to 1.4739 and the 30-year trading down to 1.8942%.

The bulls continued to extend the year-end run on Tuesday but stumbled slightly, pulling back from record territory. However, there was no technical damage as the DIA, SPY, and QQQ held above new support levels by the close of trading. That said, the IWM did leave behind a rather ominous shooting star candle pattern looking like a possible failure below its 50-day-average. The question now is the direction of today’s follow-through. After such a strong upside performance on low volume, a consolidation or a pullback is not out of the question. However, the bulls seem quite resolute that nothing will stand in their way. Pandemic worries and stretched valuations don’t matter in pushing for another record. As you plan, keep in mind the risk and don’t forget to take some profits just in case the bears make a sudden appearance and expect to volumes to continue to decline as we slide into the New Year.

Trade Wisely,

Doug

Comments are closed.