Big tech names suffered some selling yesterday, with the QQQ leaving behind a bearish engulfing candle at price resistance, and bond yields rose at their fastest new year pace in 20-years! However, the DIA set another consecutive daily record as rotation into consumer defensive names continues. Later today, we may get more insight from the Fed minutes as concerns of a more aggressively hawkish committee may raise rates as soon as the March meeting. Don’t be surprised to see more of a choppy market condition today as we wait.

Asian markets finished the day mixed but mostly lower, with tech stock falling amid rising bond yield pressures. However, when writing this report, European indexes continue to extend with modest gains across the board. Ahead of ADP, Petroleum Statis, and the Fed minutes, U.S. futures trade muted with mostly modest declines indicated at the open.

Big tech names suffered some selling yesterday, with the QQQ leaving behind a bearish engulfing candle at price resistance, and bond yields rose at their fastest new year pace in 20-years! However, the DIA set another consecutive daily record as rotation into consumer defensive names continues. Later today, we may get more insight from the Fed minutes as concerns of a more aggressively hawkish committee may raise rates as soon as the March meeting. Don’t be surprised to see more of a choppy market condition today as we wait.

Asian markets finished the day mixed but mostly lower, with tech stock falling amid rising bond yield pressures. However, when writing this report, European indexes continue to extend with modest gains across the board. Ahead of ADP, Petroleum Statis, and the Fed minutes, U.S. futures trade muted with mostly modest declines indicated at the open.

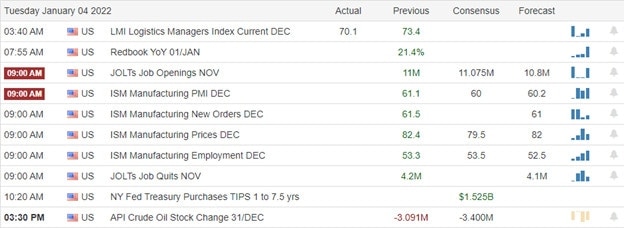

Economic Calendar

Earnings Calendar

We have another light day on the hump day earnings calendar with 15 companies listed and only four verified. Notable reports include RPM, SMPL, & UNF.

News & Technicals’

The updated guidance comes after the CDC faced criticism last week for shortening its recommended isolation period without asking for people to get tested. The CDC said people are most contagious two days before symptom onset and three days afterward. Dr. Rochelle Walensky, the CDC’s director, said during a White House Covid update last week that up to 90% of transmission happens during that period. The company announced that once-prominent Chrysler plans to reinvent itself as an all-electric vehicle brand by 2028. Those plans begin with Chrysler Airflow and a crossover concept unveiled online for the CES consumer technology show in Las Vegas. The concept is a preview of an upcoming production vehicle slated for 2025. Walmart announced Wednesday that it would expand the availability of its InHome delivery service from six million to 30 million households. InHome allows employees wearing cameras to enter a customer’s home to deliver groceries and other purchases or to pick up returns, even when the customer is not there. Walmart also said it would hire 3,000 employees to support the service’s expansion. Treasury yields declined slightly in early Wednesday after surging upward the last two days. The 10-year dipped to 1.6438%, and the 30-year declined to 2.047%.

Another day of records for the DIA, but with big tech selling off in reaction to surging bond yields, the SPY could not hold onto a new record. Bond yields rose at their fastest new year pace in 20 years as the market turned its attention to a more aggressively hawkish Fed. As a result, worries are growing that an interest rate increase may be on the way as early as the March meeting. Today we may get some insight into the thinking of the Fed with the release of the last meeting minutes later this afternoon. The bearish engulfing candle left behind on the QQQ index adds a little uncertainty and is beginning to confirm the intuitional rotation we identified into defensive consumer staple names. If big tech were to see follow-through selling, a break of the 50-day average could signal some uncertainty ahead.

Trade Wisley,

Doug

Comments are closed.