Regional Bank Woes Offset Earnings

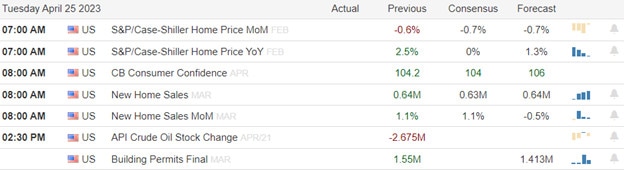

Wednesday was not the day most would have expected as regional bank woes offset earnings from the tech giants that beat estimates. Today could be as volatile with a huge round of earnings and economic reports while the banking uncertainty continues to worry markets not to mention depositors! META results will keep the tech sector inspired as we wait for AMZN after the bell today to report their results. Pops, drops, and whipsaws are likely as so continue to expect challenging price action as details emerge and banking worries simmer.

As we slept Asian markets saw mostly modest gains as the new Bank of Japan chief takes the reins. European markets trade mixes and near the flatline even as Barclays eases bank fears beating expectations. Once again U.S. futures shrug off the banking issues pointing to a substantial gap up open as earnings inspire the fear of missing out with a premarket pump. Plan for another wild day as market-moving data rolls out.

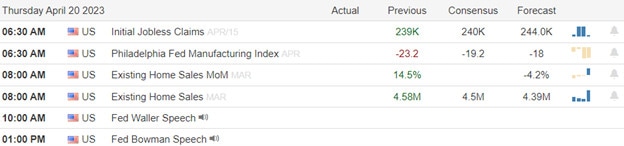

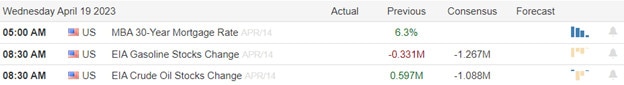

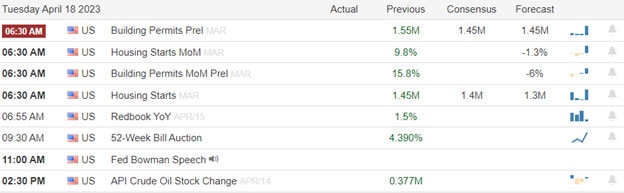

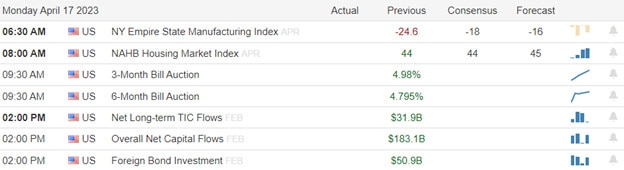

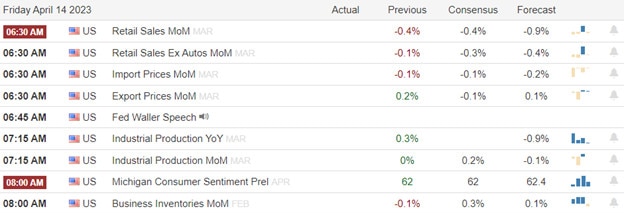

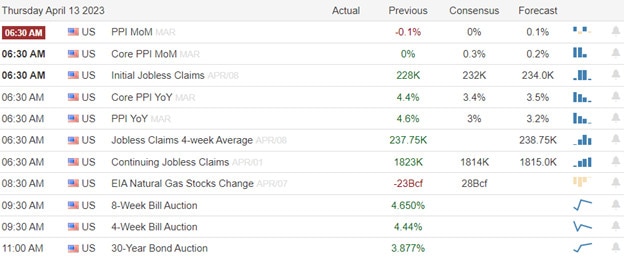

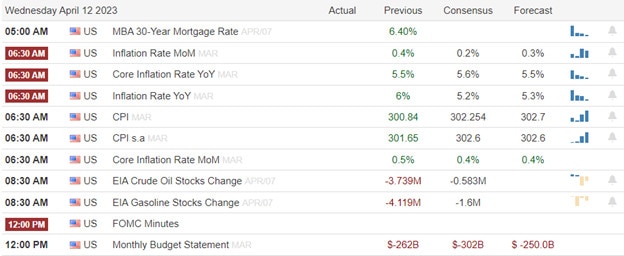

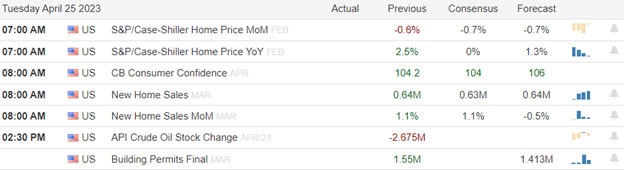

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AOS, ABBV, ATVI, AMZN, ALL, AMGN, MO, B, BZH, BJRI, BMY, BC, SAM, COF, CAT, CHE, CC, CHD, CINF, NET, CMCSA, COUR, CROX, CUBE, CLR, DPZ, LLY, ESS, FHI, FSLR, FE, GLPI, GILD, GWW, HOG, HAS, HTLD, HAY, HTZ, HGV, HON, HUBG, INTC, IP, JKS, KDP, LHX, LEA, LIN, MA, MRK, MHK, MDLZ, NOC, OLN, OSTK, BTU, PINS, ROK, SPGI, SNY, SGEN, SIRI, SKK, SNAP, SO, LUV, STM, SKT, TMUS, TSCO, X, VLO, WDC, WY, WTW, & XEL.

News & Technicals’

Meta, the social media giant formerly known as Facebook, surprised investors with a strong earnings report for the first quarter of 2023. The company reported an unexpected increase in revenue of 12% year-over-year, after three consecutive quarters of declines due to regulatory pressures and user backlash. Meta also raised its guidance for the second quarter, projecting revenue growth of 15% to 18%, well above analysts’ estimates. The stock jumped 8% in after-hours trading, extending its 2023 rally of 35%. Meta attributed its performance to the growth of its virtual reality and augmented reality products, as well as its e-commerce and advertising businesses.

Samsung, the world’s largest maker of memory chips and smartphones, suffered a sharp drop in profit in the first quarter of 2023 due to the persistent slump in the chip market and weak demand. The company reported an operating profit of 640 billion Korean won (roughly $478.55 million), a 95% decline from 14.12 trillion won a year earlier, marking its worst quarterly result since the first quarter of 2009. Samsung’s memory chip business, which accounts for more than half of its revenue, saw its profit plunge by 71% as prices for DRAM and NAND chips continued to fall amid oversupply and sluggish demand from data center and smartphone customers. Samsung’s mobile division, however, posted a 40% increase in profit thanks to the launch of its latest flagship smartphone, the S23 series, which feature improved cameras and battery life.

Investors are facing a huge amount of confusion as they grapple with the conflicting signals of recession risk and inflation fears, according to a strategist. Bob Parker, senior advisor at International Capital Markets Association, said the market was struggling to reconcile the possibility of a global economic slowdown in 2023 with the rising prices of commodities and consumer goods. “I think the big theme in markets at the moment is confusion,” Parker told CNBC’s “Squawk Box Europe” on Thursday. He added that investors were unsure whether to buy cyclical stocks that benefit from economic growth or defensive stocks that offer protection in a downturn. Giles Keating, director at Bitcoin Suisse, echoed Parker’s sentiment and said there was a general pessimism about the outlook for the world economy.

The U.S. stock market ended the day mixed as regional bank woes offset the positive impact of strong earnings from tech giants. The Dow and the S&P 500 moved lower with their 50-day average support near, while the Nasdaq gained ground boosted by earnings estimate beats. First Republic’s stock plunged nearly 30% following reports that the Fed may limit its borrowing capacity due to its shrinking deposits. The bank had reported a 40% drop in deposits in the first quarter a day earlier. Today we have a huge day of earnings that includes AMZN after the bell as well as market-moving GDP, Jobless Claims, and Pending Home Sales economic reports. Watch for pops, drops, and whipsaws, and don’t rule out the possibility of a SPY and DIA 50-day morning average test particularly if banking concerns persist.

Trade Wisely,

Doug