Despite the last-minute surge the SP-500 finished the day little changed in an overall choppy low-volume session as we waited on the market-moving reports from BAC and GS Tuesday morning with NFLX coming after the bell. We will also get a reading on the health of the housing sector with a starts and permits report before the opening of trading. Bond prices continue to be problematic but interestingly the market seems happy to ignore it as the VIX continues to fall and the T2122 indicator presses back into the overbought region. The morning session could be wild so watch for some big gaps and possible big point whipsaws as the investors react.

Overnight Asian markets closed mixed even as China beat first-quarter GDP expectations. However, European markets see nothing but green with earnings data on the horizon and the ECB signaling a possible 50 basis point rate increase. As we wait on big bank reports the U.S. futures push for a gap up open that could move dramatically as results come into the light.

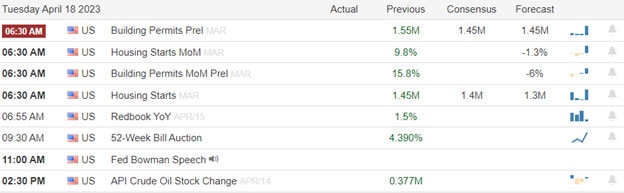

Economic Calendar

Earnings Calendar

Earnings begin to pick up today through Thursday then get really busy next week. BAC, BK, ERIC, FHN, FULT, GS, IBKR, ISRG, JNJ, LMT, NFLX, OMC, PLD, UAL, & WAL.

News & Technicals’

Apple opened its first store in India, called Apple BKC, in Mumbai. The company is also opening another store in Delhi. Apple CEO Tim Cook has long held a bullish view on India and now the company is ramping up sales and manufacturing of its flagship iPhone in the country. This highlights the importance of the Indian market to Apple’s future.

House Speaker Kevin McCarthy spoke at the New York Stock Exchange. He opened a new phase in the debt ceiling fight by saying House Republicans would pass their stand-alone debt ceiling hike with spending cuts and stricter work requirements. However, such a bill would be dead on arrival in the Democratic-controlled Senate and in Democratic President Joe Biden’s White House.

The S&P 500 was little changed after an up week that pushed it near the year’s highs. Small-caps outperformed. Earnings remain the area of focus, with 60 S&P 500 companies scheduled to report this week, including Charles Schwab and State Street today. Bank of America, Goldman Sachs, Netflix, and Tesla are due to deliver results later this week. House Speaker McCarthy is expected to outline Republican demands for spending cuts and other concessions regarding the debt ceiling. Treasury yields were higher as investors are starting to rethink the likelihood of the Fed cutting rates later this year.

Trade Wisely,

Doug

Comments are closed.