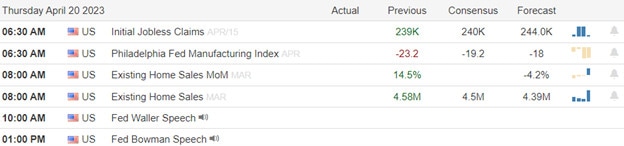

The indexes were once again plagued with uncertainty and chop as we waited for the TSLA report that came in with a 20% decline in revenue and earnings from one year ago despite topping lowered estimates. Today we have Jobless Claims, Philly Fed, and Existing Home Sales along with a busy day of earnings to keep traders guessing and price volatility high while the VIX indicates complacency is on the rise. With tech giant reports and a pending FOMC rate decision around the corner plan for just about anything over the next couple of weeks.

Asian markets closed mixed overnight with modest gains and losses in reaction to earnings results. European markets that tried to shrug off yesterday’s U.K. inflation surprise trade decidedly bearish this morning. U.S. futures also suggest a bearish open but as the earnings and economic data roll out the actual open is anyone’s guess.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ALK, AN, AXP, BX, BJRI, T, CSX, DHI, FITB, GPC, HTLD, HBAN, KEY, KNX, MMC, NOK, NUE, PM, POOL, PPG, RAD< STX, TSM, TFC, UNP, WSO, & XRX.

News & Technicals’

IBM issued stronger-than-expected first-quarter earnings on Wednesday even as the technology and consulting company reported disappointing revenue. IBM’s revenue increased 0.4% from a year earlier in the quarter, according to a statement. Net income rose 26% to $927 million, or $1.02 a share, for continuing operations. Profit rose faster than revenue as IBM’s total expenses and other income declined 4% to $6.45 billion, with reductions coming in research, development, and engineering.

Twitter CEO Elon Musk threatened Microsoft with a potential lawsuit on Wednesday, claiming the software giant used his company’s data to train its AI. “They trained illegally using Twitter data,” Musk tweeted. “Lawsuit time.” The threat came after Mashable and other publications reported that Microsoft would drop Twitter from its advertising platform.

Tesla’s Q1 2023 revenues and profits were close to expectations according to a survey of analysts from Refinitiv. However, the company’s net income and earnings dropped more than 20% from 2022. Tesla attributed the drop in earnings to “underutilization of new factories” which stressed margins, along with higher raw material, commodity, logistics, and warranty costs, and lower revenue from environmental credits.

Equity markets closed modestly lower on Wednesday as Treasury yields climbed higher on another day highlighted by uncertainty and chop. March CPI inflation rose by 10.1% YoY in the UK, above estimates of 9.8%. The S&P 500 overall is up about 8.0% in 2023, still driven largely by growth sectors like technology and communication services. Treasury yields have moved higher with the 2-year U.S. Treasury yield above its recent lows of 3.76%, up now to 4.25%. The VIX volatility index, continued to drift lower, now down over 12% for April. With a big round of earnings data ahead of today plan for the challenging price action to continue.

Trade Wisely,

Doug

Comments are closed.