As we waited on big tech reports worries of regional bank failures reemerged creating a cautious mood on Tuesday. However, after the bell bullish earnings results from the tech giants generated big after-market gains in the sector with NASDAQ futures pointing to a huge gap up this morning. This bull/bear battle could provide significant price volatility today as we toss in another huge round of earnings and economic events to keep investors guessing. Watch for the potential of intraday whipsaws particularly if the regional bank rout continues today.

Surprisingly even after strong tech earnings Asian markets closed mostly lower as banking worries overshadow earnings results. European markets also trade red across the board this morning favoring the regional banking woes over the tech bullish results. However, U.S. futures are going a different route, celebrating the tech reports suggesting a bullish gap up and shrugging off financial sector concerns.

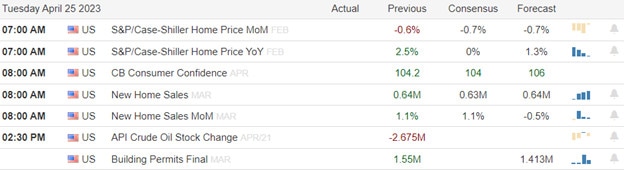

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ALGN, AB, AMT, AWK, NLY, ADP, AVP, BA, FFIV, CHRW, CP, CHDN, CME, DOV, EBAY, EW, ETR, EQT, ETD, GD, GGG, HELE, HP, HESS, HLT, HUM, KLAC, LC, MAS, MAT, MSFT, MTH, MOH, NSC, ODFL, ORLY, OTIS, QC, PAG, PTEN PPC, PXD, RJF, ROKU, R, NOW, SLAB, SAVE, SHOO, STAG, SUI, TEL, TDOC, TER, TMO, UMC, URI, WM, & WH.

News & Technicals’

The U.S. economy is facing a challenge from the banking sector, which has been hit by a crisis since the beginning of the year. The crisis has mainly affected small banks, which are the main source of credit for small businesses and households. As these banks reduce their lending, the impact will be felt by the average Americans who rely on them. However, the economy is still expected to show positive growth in the first quarter, thanks to the strong consumer spending that drives most of the economic activity. The future outlook will depend on how well the consumers can cope with the credit crunch.

First Republic is on the brink of collapse and needs a lifeline from its big bank peers. CNBC has learned that the bank’s advisors are trying to persuade other U.S. banks to buy its bonds at inflated prices, even if it means taking a hit of billions of dollars. The alternative is worse: If First Republic goes under, the other banks will have to pay about $30 billion in fees to the Federal Deposit Insurance Corporation (FDIC). The advisors hope that by shoring up First Republic’s balance sheet, they can attract new investors who are willing to buy its stock.

The quarterly earnings season brought good news for three big companies on Tuesday. Microsoft delivered strong results on both the top and bottom lines, driven by the robust growth of its cloud services, especially Azure. The company also provided positive guidance for the next quarter. Alphabet, which owns Google, also beat the estimates on revenue and earnings and revealed a huge $70 billion share repurchase plan. The company was able to reduce its expenses and increase its online ad revenue in a tough market. Chipotle also impressed investors with its earnings and revenue, which were higher than what Wall Street expected. The restaurant chain achieved high growth in same-store sales, even though it hiked its menu prices by around 10% from a year ago.

Investors were in a cautious mood on Tuesday, as FRC plunged nearly 50% leading many regional banks lower, and raising worries of a remerging crisis in the sector. However, the earnings reports of some of the biggest technology companies, such as Microsoft and Alphabet, beat estimates lifting bullish hopes in that sector as futures surge heading toward the Wednesday open. The VIX rallied and the T2122 pulled back sharply finally reliving some of the overbought pressure in the indexes. Today we have another huge round of earnings events with META after the bell as well as the market-moving economic report Durable Goods, International Trade and Petroleum Status. Expect considerable volatility as bank worries and slowing economic growth battles the bullish reaction to better-than-expected tech results.

Trade Wisely,

Doug

Comments are closed.