Tentative Debt Agreement

The President came to a tentative debit agreement over the long weekend providing some bullish premarket inspiration. However, tentative is the keyword here as the R’s and D’s in the congressional bodies try to pass the 2-year deal by Wednesday. I wouldn’t be surprised if we experience some substantial whipsaws as they let the rhetoric fly adding uncertainty to the process. After Friday’s rally on the disappointing Core PCE numbers we face a big week of Jobs data, a declining number of earnings events, and the question of can big tech giants continue to rally on all the AI without a correction.

Asian markets traded mostly higher overnight as they wait on the key U.S. debt vote later this week. European markets appear a bit more tentative as they wait for Congress trading mixed this morning. However, U.S. futures continue to power higher this morning driven mostly by the tech giants continuing to shrug off Friday’s rising inflation data. Watch for possible a whipsaw after the morning gap.

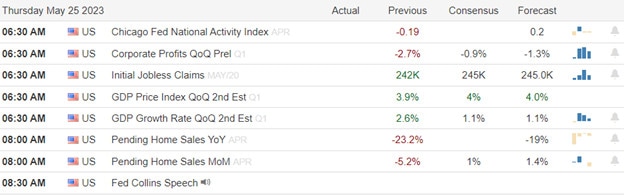

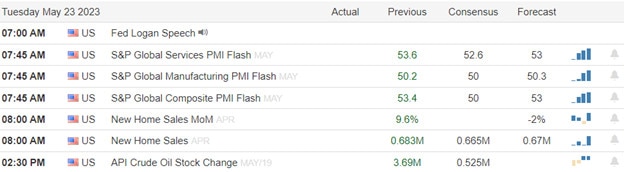

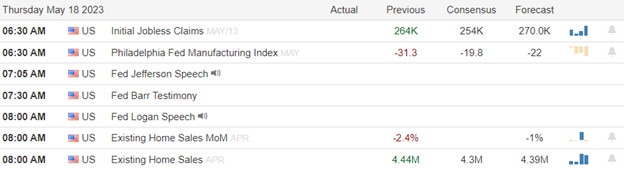

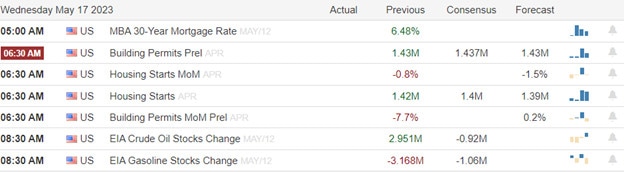

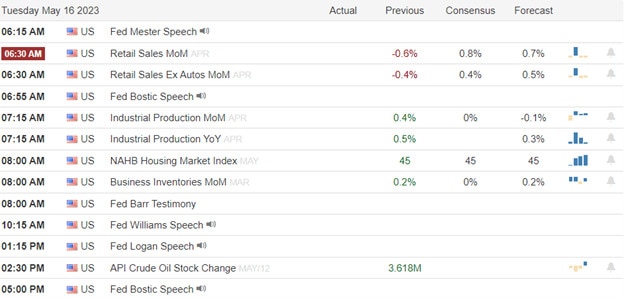

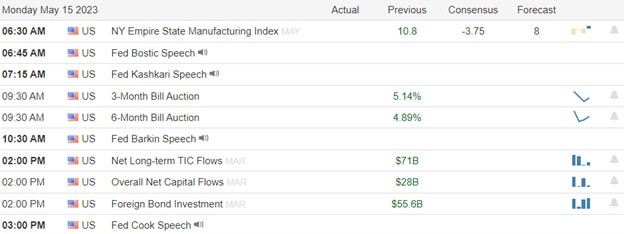

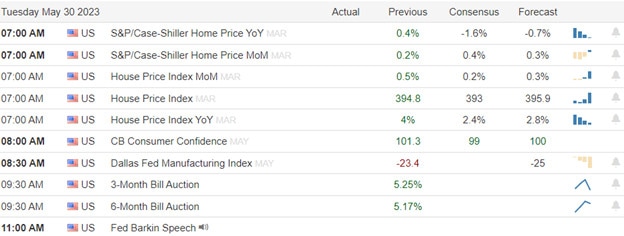

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AMBA, BOX, CGC, HPE, HPQ, & SPWH.

News & Technicals’

Stocks are set to rise on Tuesday after a deal to raise the debt ceiling for two years was reached by Biden and McCarthy. The deal needs Congress’s approval by Wednesday to avoid a default by June 5. Investors are relieved by the deal amid inflation and banking woes.

North Korea has confirmed its plan to launch a military spy satellite in June, which it claims is needed to monitor the U.S. and its allies’ military activities in the region. The announcement has raised alarm among neighboring countries, especially Japan, which has ordered its forces to shoot down the satellite or any debris if they enter its territory. The launch is seen as a provocation by North Korea, which has been testing missiles and nuclear weapons since 2022 in defiance of U.N. sanctions. The launch also coincides with the 70th anniversary of the U.S.-South Korea alliance, which has been conducting joint military exercises near the border with North Korea. The launch news has boosted the shares of South Korean defense companies, such as Firstec, Victek, and Korea Aerospace Industries, which rose by 3.8%, 3.3%, and 0.6% respectively on.

The war between Russia and Ukraine escalated on Tuesday as Moscow reported a drone attack on its capital that damaged several buildings and injured two people. The Russian Defense Ministry accused Kyiv of being behind the attack, which it said involved eight drones that were all shot down by air defenses. Ukraine has not commented on the allegation. The drone attack came after Kyiv suffered three Russian bombardments in 24 hours, killing one woman and wounding 13 others. The Ukrainian authorities said the attacks were carried out by missiles and drones launched by Russia.

As we begin a holiday-shortened week the bulls are inspired due to the tentative debt agreement between the President and Speaker. Now comes the task of passing the 2-year deal by Wednesday so I would not rule out some substantial whipsaws as the rhetoric flies between the R’s and D’s along the way. With the number of earnings declining markets will have a lot of jobs data to react to this week as traders grapple with the next FOMC rate decision coming up on June 14th after the disappointing Core PCE last Friday. Can giant tech continue to rise on AI hopes without a correction? We will soon find out, so buckle up for another wild week.

Trade Wisely,

Doug