The debt ceiling negotiations showing little progress brought out the bears Wednesday with the DIA suffering the majority of the technical damage closing below its 50-day average. The NVDA blowout report has the tech sector flying high this morning despite the Fitch AAA negative watch on the U.S. with the House saying they will go home for the weekend with no deal! Europe is now officially in a recession and the substantial decline shown in the Monday Suppy report suggests the U.S. is not far behind unless something changes soon. With a big day earnings, economic reports, and plenty of uncertainty to go around plan for substantial price volatility.

Asian markets closed mostly lower overnight with Hong Kong declining 1.93% as the Bank of Korea holds rates steady. After officially entering a recession, European markets trade mixed near the flatline this morning as they monitor the debit ceiling dog and pony show that shows little progress. With a busy morning of earnings and economic data pending U.S. futures trade mixed as the tech sector surges on the back of the NVDA homerun report.

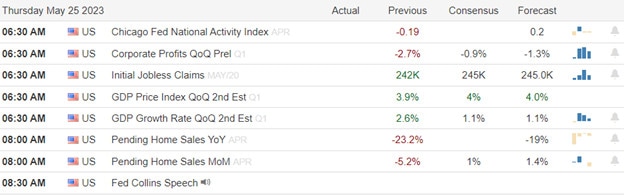

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ADSK, BBY, BURL, CTLT, COST, DECK, DLTR, GPS, GCO, MANU, MRVL. MDT, NTES, NTNX, ME, PDD, RL, SUMO, TITN, TD, ULTA, VMW, WB, & WDAY.

News & Technicals’

Nvidia, the leading provider of advanced GPU chips for artificial intelligence, reported stellar first-quarter earnings for its fiscal 2024 on Wednesday. The company beat analysts’ expectations on both revenue and earnings per share, thanks to the surging demand for its data center products. Nvidia’s shares spiked 26% in extended trading, reaching a new all-time high. The company’s CEO Jensen Huang attributed the strong performance to the growing adoption of generative AI applications like OpenAI’s ChatGPT, which rely on Nvidia’s GPU chips to train and deploy. Nvidia also raised its guidance for the next quarter, signaling confidence in its future growth prospects.

The United States’ AAA long-term foreign-currency issuer default rating, the highest possible rank by Fitch Ratings, is under threat due to the ongoing political deadlock over the debt ceiling. Fitch has placed the rating on negative watch, meaning that it could downgrade it if the U.S. fails to raise or suspend the debt limit before the x-date, which could be as early as June 1. The rating agency warned that such a scenario could lead to the government missing payments on some of its obligations, which would have severe implications for the global financial system. The news rattled the markets, as futures linked to the Dow Jones Industrial Average fell after Fitch issued its warning. However, Fitch also noted that it still expects a resolution to be reached before the deadline, as it has been in previous episodes of debt ceiling brinksmanship. House Speaker Kevin McCarthy said that negotiations with the White House were progressing toward a deal, but disagreements over spending remain.

The big overhang for markets Wednesday was the U.S. debt ceiling negotiations showing little progress engaged the bears creating some index technical damage in the DIA. Bond yields rose slightly adding pressure to already challenged banks and the Money Supply report indicated substantial contraction. After the bell, NVDA reported blowout earnings fueled by the massive interest in AI chips lighting a fire under the NASDAQ futures this morning. Today is our biggest earnings day with a GDP, Jobless Claims, Pending Home Sales, and more Fed speeches to add to the likely volatility as the House goes home for the weekend with no deal.

Trade Wisely,

Doug

Comments are closed.