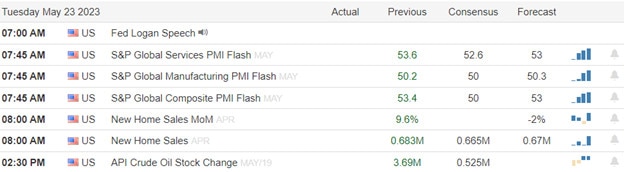

While waiting for a debt ceiling deal the major indexes chopped in a narrow range with the Dow, particularly volatile with sharp whipsaws through the day. Lowe’s reported a disappointing quarter this morning but we still have several notable reports today to inspire the bulls or bears. We also face PMI, New Home Sales, and Richmond MFG numbers with more Fed member talk while debt ceiling pontificating continues. Expect some sharp big point moves in this emotionally charged market environment.

Asian markets turned mostly lower overnight led by selling in China down 1.52% as real estate default worries reemerge. European markets trade mostly lower this morning while monitoring debt ceiling negotiations. With political wrangling continuing along with earnings and economic data pending, U.S. futures suggest a modestly bearish open.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include A, AZO, BJ, DKS, INTU, PANW, LOW, TOL, URBN, VFC, VIPS & WSM.

News & Technicals’

Lowe’s Cos Inc, one of the largest home improvement retailers in the United States, has cut its full-year sales and profit forecasts for 2023, as demand for its products wanes amid high inflation and a shift in consumer spending patterns. The company reported a decline in net sales and comparable sales for the first quarter, missing analysts’ expectations. Lowe’s attributed the weak performance to adverse weather conditions, falling lumber prices, and lower spending on discretionary items such as appliances and tools. The company now expects its full-year comparable sales to drop by 2% to 4%, compared to its previous guidance of flat to down 2%. It also lowered its full-year adjusted earnings per share range from $13.60-$14.00 to $13.20-$13.

JPMorgan Chase CEO has warned that some banks could face trouble, especially in certain markets and sectors. He said that commercial real estate is the area most likely to cause problems for lenders, as remote workers are reluctant to return to offices and high inflation forces consumers to cut back on spending. He said that banks need to be prepared for interest rates to rise far higher than most expect, and that credit is already tightening up as banks try to retain capital. Dimon made these remarks during his bank’s investor conference on Monday.

Shell, the British oil giant, is facing an over at its annual general meeting on Tuesday. A group of climate-focused investors, led by the Dutch activist group Follows This, has proposed a resolution that urges Shell to align its emissions targets with the Paris Agreement and cut its carbon footprint by 45% by 2030. The resolution has been backed by some of Shell’s largest shareholders, including Dutch pension managers MN and PGGM. Shell, which reported record profits of $39.9 billion for 2022, has rejected the resolution and said it is already committed to becoming a net-zero emissions business by 2050.

The major indexes chopped in a narrow range Monday, with the S&P 500 rising just 0.02%, as markets tread water while debt-ceiling negotiations continue. Fed officials continued to talk hawkishly yesterday adding uncertainty leave markets searching for any indications of whether June will bring another hike or a pause. Traders today will have a few more notable earnings reports, PMI, New Home Sales, Richmond MFG numbers along with more Fed speak and of course the debt ceiling drama to navigate.

Trade Wisely,

Doug

Comments are closed.