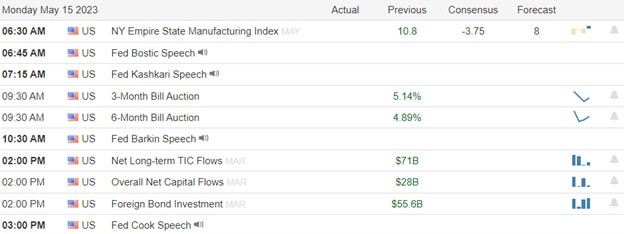

The bulls and bears battled for dominance last week with the QQQ trend remaining bullish while the other indexes continue to chop in the same price range they have been stuck in for weeks. Unfortunately, regional banking outflows continued last week which is a troubling problem as the economy continues to slow. Today we have to deal with Empire Stae MFG numbers, several fed speakers, and a declining number of earnings reports to find inspiration for movement.

While we slept Asian markets mostly rallied with Hong Kong leading the way up 1.79%. European markets also trade with modest gains across the board this morning as they monitor Turkish election results. U.S. futures recover from overnight losses to suggest a bullish open despite the uncertainties in the regional banking sector. Watch for a possible morning whipsaw with substantial resistance levels above for the DIA, SPY, and IWM.

Economic Calendar

Earnings Calendar

We have a retail theme on the earnings calendar this week. Notable reports for Monday include CTLT, RIDE, TSEM, & NVTS.

News & Technicals’

Vice Media, a digital media company that produces news, culture, and entertainment content, has filed for bankruptcy protection and agreed to sell most of its assets to a group of lenders led by Fortress Investment, Soros Fund Management, and Monroe Capital. The deal, which values Vice at $225 million, will allow the company to shed some of its debt and restructure its business amid declining revenues and audience.

The pandemic has led to a surge in the average age of cars and trucks on U.S. roads, reaching 12.5 years in 2023, according to S&P Global Mobility. This is the largest annual increase since the financial crisis of 2008-2009 when people delayed buying new vehicles due to economic uncertainty. The aging of the vehicle fleet benefits aftermarket parts retailers such as AutoZone, O’Reilly Automotive, and Advance Auto Parts, who can expect more demand for their products and services. The number of vehicles in operation in the U.S. also rose slightly to 284 million in 2023, from 283 million in 2022.

Some crypto companies are threatening to leave the U.S. if the SEC does not ease its regulatory pressure on the industry. They are trying to use their influence and leverage to persuade the SEC to adopt a more favorable approach to crypto innovation and adoption. However, it is unclear if they will follow through on their threats, as the U.S. is a major market for crypto, with more than 50 million Americans owning some form of digital currency.

Markets were lower on Friday as the bulls and bears battled for dominance amid regional bank worries. The outperformance this week comes from the communication services and consumer discretionary sectors, while areas like energy, materials, and financials all underperformed. Treasury yields remain well below the fed funds rate, with the 2-year Treasury now just under 4.0%. This comes as markets continue to price in Fed rate cuts by the September FOMC meeting. Meanwhile, the number of earnings decline provided less inspiration though there is a retail theme this week. Furthermore, traders will have decisions to make based on Empire State MFG. numbers with several fed speakers yacking it up throughout the day.

Trade Wisely,

Doug

Comments are closed.