The indexes finished the day about where they began the day with modest gains in another day of chop despite a truly awful Empire State MFG report showing a massive decline in the sector. The capacity for the market to continue to ignore these data points is remarkable and makes one wonder if its actual market strength or complacency. With an earnings miss from HD this morning we have Retail Sales, Industrial Production, Inventories, the Housing Index, and several Fed speaker to keep traders on edge. Plan for yet another day of uncertainty while hoping something happens to end the range-bound chop.

As we slept Asian market traded mixed with modest gains and losses after China reported better-than-expected retail sales activity. European markets trade with modest gains this morning as they monitor the U.S. debt ceiling negotiation progress and economic data. Ahead of a big morning of earnings and economic reports along with Fed speakers while wrangling over the debt ceiling continues, futures suggest a bearish open.

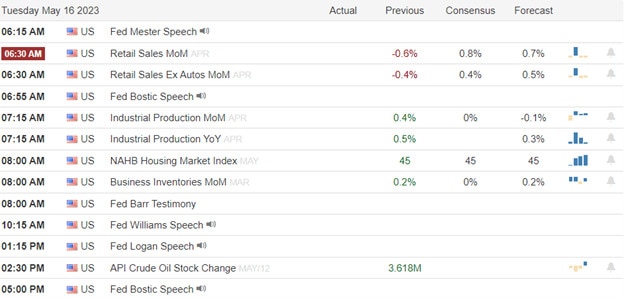

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AGYS, BIDU, HUYA, KEYS, KD, HD, SE, SSYS, TME, & TUP.

News & Technicals’

The debt limit crisis is looming over Washington as President Joe Biden and House Speaker Kevin McCarthy are set to meet again on Tuesday with other top lawmakers. The meeting comes after a week of daily negotiations between staff from both parties, but with no clear sign of a breakthrough. The federal government could face a default on its obligations as soon as early June if Congress does not raise the debt ceiling, which limits how much the government can borrow to pay its bills. Biden and McCarthy have been at odds over how to address the issue, with Biden calling for a bipartisan solution and McCarthy insisting that Democrats act alone.

Home Depot, the largest home improvement retailer in the U.S., reported disappointing results for the fiscal first quarter of 2023. The company missed analysts’ estimates for revenue and lowered its outlook for the full year, citing weaker demand for big-ticket items and smaller home improvement projects. Home Depot’s Chief Financial Officer Richard McPhail said that customers are spending less on items such as patio sets and grills, which typically drive sales in the spring season. He also attributed the lower revenue to colder weather and falling lumber prices, which reduced the average ticket size.

China’s crackdown on due diligence consultancies, such as Capvision, has raised concerns among foreign investors about the country’s openness and transparency. Capvision is the latest firm to be accused of violating national security laws by providing sensitive information to overseas clients. This follows the recent restrictions on foreign access to China’s data and information platforms, which have hampered the ability of investors to conduct research and analysis. Some experts argue that China’s enforcement of its anti-espionage law is arbitrary and vague, as the term “national security” is not clearly defined or delimited.

Despite a terrible Empire State Mfg. number the indexes experienced another day of chop ending the day slightly positive about exactly where they began the day. Retail giants, HD, Target, and Walmart prepare to report their earnings and lawmakers will meet this afternoon hoping to reach a deal on the debt limit. The Nasdaq led the gains among the major indexes, while the S&P 500 Index and Dow Jones also advanced. Treasury yields edged up, with the 2-year Treasury yield approaching 4.0% again. However, yields are still well below their early March peaks. The market expects the Fed to lower rates by September but that thought process does not seem to be shared by the voting members of the Fed. We shall see! Oil prices also rose slightly, with WTI crude oil recovering above $71, but still down by about 11% this year. Today before the bell we have the market moving Retail Sales figures followed by Industrial production, Inventories, Housing Market along with several Fed speakers.

Trade Wisely,

Doug

Comments are closed.