Monday speculation delivered a pop-and-go-nowhere, Tuesday and pop-and-drop, Wednesday and gap down and chop with low volume, so what comes next? Uncertainties abound, making it challenging for lowered earnings estimate beats to overcome economic worries. With a big day of earnings and economic reports, bond yields rise, and currencies continue to fluctuate, so plan for more whipsaws, reversals, and wild price volatility as a deepening recession looms.

With the Japanese Yen falling to 150 per dollar, Asian markets closed red across the board overnight. European markets struggle for direction amidst the rising bond yields and the U.K. political turmoil. U.S. futures recover from overnight lows, once again pumping for a gap-up open ahead of earnings and economic figures trying to sustain a relief rally despite the economic uncertainties. Expect more whipsaws, reversals, and challenging price volatility as global recession worries continue to grow.

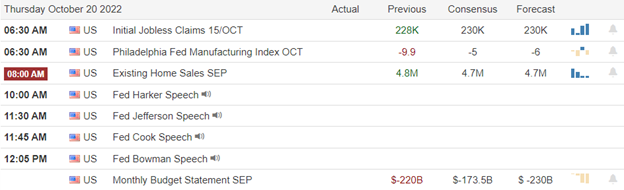

Economic Calendar

Earnings Calendar

As a general rule, Thursday is the busiest day on the earnings calendar, and that is true for today, with nearly 60 companies listed. Notable reports include ABB, ALK, ALL, T, BX, SAM, DHR, DOW, FITB, FCX, MMC, NOC, NUE, NVR, PM, POOL, SNAP, TSCO, UNP, THC, & WHR.

News & Technicals’

Tesla reported $1.05 in adjusted EPS, ahead of expectations of 99 cents, on revenues of $21.45 billion, lighter than the $21.96 billion expected. Net income (GAAP) reached $3.33 billion, more than double a year ago, while automotive revenue rose 55% from the previous year’s quarter. The company warned about a bottleneck in transportation capacity for delivering new cars in the final weeks of the quarter and said it was “transitioning to a smoother delivery pace.” On Tesla’s third-quarter earnings call, CEO Elon Musk said the company is not cutting production “in any meaningful way, recession or not recession.” “We’re very pedal to the metal come rain or shine,” Musk said. Regarding Musk’s proposed $44 billion acquisition of Twitter, he said that the company “sort of languished for a long time but has incredible potential.”

On a fast-moving day of developments, Wednesday saw a high-profile resignation, reports of parliamentarians being bullied, and further speculation over how long Truss may have left. The culmination of events prompted one member of the Conservative Party to express his anger with the government publicly. “This is an absolute disgrace,” Conservative lawmaker Charles Walker told BBC News on Wednesday evening. “I think it’s a shambles and a disgrace. It’s utterly appalling,” he said.

The Japanese yen weakened past 150 against the U.S. dollar, a key psychological level, reaching levels not seen since August 1990. The Bank of Japan’s two-day meeting is slated for next week. However, policymakers have ruled out a rate hike to defend against further weakening of the currency. On Thursday, Reuters reported Japanese Finance Minister Shunichi Suzuki said the government will take “appropriate steps against excess volatility.”

So far, the wild emotion over earning results has produced a gap and go-nowhere, a pop-and-drop, and drop and chop with low volume, so what comes next? Trouble in Britten, rising bond yields, and currency fluctuations worry markets of a possible liquidity crisis looming. Combine that with inflation, rising interest rates, and the prospect of a deepening recession, and that’s a lot of uncertainty for earnings reports to overcome! In addition, today, we have the potential market-moving economic reports from Jobless Claims, Philly Fed MFG Index, and Existing Home Sales figures to drive additional uncertainty about what comes next. So sinch up your big boy pants and prepare for another day of turbulence, speculation, talking head spin, and drama.

Trade Wisely,

Doug

Comments are closed.