If the choppy price action of late has been frustrating, the wait is over, and let the volatility begin. Not only do we have the CPI and Jobless Claims, but we also kick off the wild speculation and price manipulation of the 4th quarter earnings season. While companies may hit substantially lowered earnings estimates, the guidance forward and the commitment to stock buybacks will likely be most important for the future direction of the stock prices. Expect the challenging price action to continue with the path forward, which is looking so uncertain at this time.

Asian markets declined across the board as investors traded cautiously ahead of U.S. inflation data. European markets, however, show some willing bulls as they brace for the coming numbers. This morning looks like a repeat of yesterday’s premarket pump, pointing to a bullish open ahead of earning and economic report results. I guess the question to be answered is, with this pump-up speculation be successful, or will it result in another disappointing pop and drop? Buckle up; we’re about to find out!

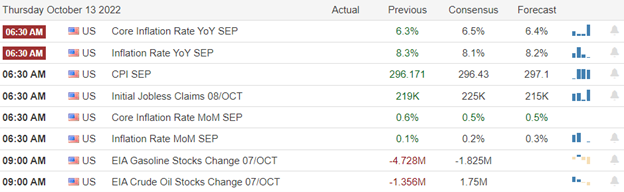

Economic Calendar

Earnings Calendar

We’ve made it to the official kick-off day of the 4th quarter earnings. Notable reports include BLK, CMC, DAL, FAST, PGR, TSM & WBA.

News & Technicals’

Belgium’s central bank chief told CNBC that the European Central Bank needs to raise interest rates into positive territory when considering inflation, despite recession fears. “My bet would be it’s going to be over 2%, and I would not be surprised if we have to go to above 3% at some point,” said Pierre Wunsch, governor of the National Bank of Belgium. However, he said that September’s hike in the ECB’s benchmark deposit rate to 0.75% meant rates were still negative in real terms.

Cash, one of the most hated corners of the market for years, is getting some newfound love from money managers as the Federal Reserve’s firm commitment to rate hikes roiled nearly every other asset class. Global money market funds saw $89 billion of inflows for the week ending Oct 7, the largest weekly injection into cash since April 2020, according to Goldman Sachs’ trading desk data. Meanwhile, the data said that mutual fund managers also hold a record amount of cash.

The Office for National Statistics estimated Wednesday the U.K. economy shrank by 0.3% in August, potentially beginning what economists expect will be a lengthy recession through the winter. In addition, postal workers, rail workers, and public barristers have all carried out strikes recently to protest pay and conditions, as wages fail to keep up with inflation running at around 10%. A worst-case scenario laid out by national electricity system operator the National Grid warned that households and businesses might face three-hour power outages over winter. Asia’s biggest economic problems next year will stem from rising interest rates. These will put increasing pressure on debt servicing in Asia and heighten capital flight from the region: IMF The U.K. bond crisis will have limited impact on Asian markets, although “anything that creates financial market turbulence will find a way” to upset other economies: IMF. As many Asian economies, such as Japan and Hong Kong, open up, increased human mobility will generate economic activity and stall a slowdown.

The wait is over, so let the volatility begin. After the disappointing PPI number, the dollar rose, the bond yields surged, and the FOMC minutes say the hawkishness is not yet over! That made for a choppy Wednesday as traders pondered the CPI, Jobless Claims, and what earnings reports might reveal. Once again, the overnight futures are working to pump up a bullish open but will it be just another pop and drop to punish those rushing in hoping to pick the bottom? We sure could use a rally with the indexes in a short-term oversold condition, but it may not be a tough sell if inflation remains resilient. As earnings number ramp up, expect wild speculation and price volatility to do the same. I think the company’s guidance and stock buyback levels will be more important this season than hitting the substantially lowered estimates. So be careful jumping in too soon and wait for the conference call before making your decision. Likely challenging times lie ahead, so plan your risk carefully.

Trade Wisley,

Doug

Comments are closed.