The stage is set for an epic week of price action as the 4th quarter earnings ramp up amid geopolitical and economic uncertainty. Despite the considerable danger, retail speculation remains remarkably high, so plan for big point whipsaws, overnight reversals, and short squeezes to challenge the talents of even the most experienced traders. We remain overdue for a relief rally, but if it begins, be wary of thinking it’s a market bottom. Earnings guidance and stock buybacks will be far more critical than the company hitting the vastly lowered estimates, so be patient jumping right after the headline report.

Asian markets traded mixed overnight as recession weighs on investors despite China holding firm on medium-term rates. European markets trade cautiously higher, waiting on UK fiscal statements and hoping they calm the currency fluctuations and repair some of the ECB credibility. Premarket futures are again pumping up a bullish open on earnings speculation but will the big banks inspire the bulls or the bears after reporting? Of course, anything is possible, so plan carefully.

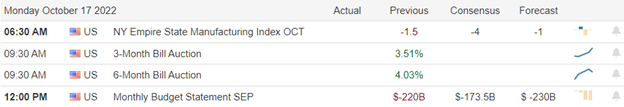

Economic Calendar

Earnings Calendar

We begin the week relatively light on the earnings calendar, but we have some potential market-moving big bank reports in focus. Notable reports include BAC, BK, SCHW & ELS.

News & Technicals’

The UK’s new finance minister plan to scrap almost all planned tax cuts hoping to calm the markets. However, markets are uncertain by various factors, such as the prospect of much higher government debt. The worries include the enormous subsidies for consumer and business energy bills, the BOE’s current monetary tightening, and the government’s stimulus package. In addition, European solidarity is being tested as Russia’s war in Ukraine continues to cause energy turmoil for countries across the bloc. Paolo Gentiloni, the EU’s economics commissioner, has called for a “united approach,” while Pascal Donohoe, President at Eurogroup, says he “understands” why individual countries are bringing forward their monetary policies.

Stellantis’ electric vehicle plans to compete with firms such as Elon Musk’s Tesla and companies like Volkswagen, Ford, and GM. According to the International Energy Agency, electric vehicle sales are on course to hit an all-time high this year.

After two years of port congestions and container shortages, disruptions are now easing as Chinese exports slow in light of waning demand from Western economies and softer global economic conditions, logistics data shows. “The retailers and the bigger buyers or shippers are more cautious about the demand outlook and are ordering less,” logistics platform Container xChange CEO Christian Roeloffs said in an update on Wednesday. “On the other hand, the congestion is easing with vessel waiting times reducing, ports operating at less capacity, and the container turnaround times decreasing, which ultimately frees up the capacity in the market.”

The ramp-up of 4th quarter earnings, the volatility of last week, and the massive willingness to speculate despite the danger set the stage for an epic week of wild price action. Earnings have the potential to trigger a short squeeze, punishing reversals, and huge intraday whipsaws. Keep an eye on bond yields, and currency fluctuations as the quantitive tightening threaten a banking currency crisis. Company guidance and stock buyback news will be more important than the actual earnings because of the massively lowered estimated targets. We are overdue for a relief rally, and perhaps a bear market rally is possible but be careful thinking it’s a market bottom until we finally see a higher low in the charts. Day traders will likely have the upper hand due to volatility, but they will likely have challenges due to the speed of the potential price swings.

Trade Wisely,

Doug

Comments are closed.