Closed with Losses

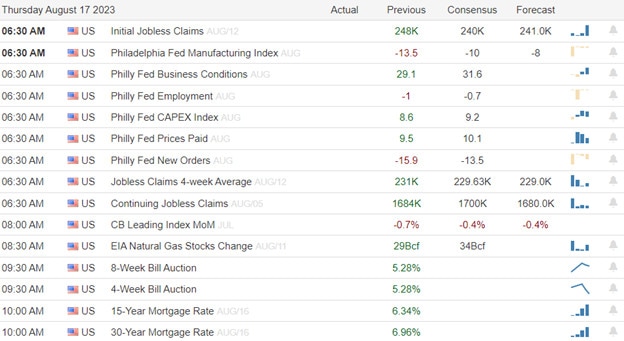

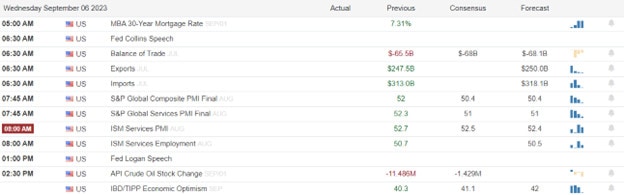

Indexes closed with losses on a light day of data here in the U.S., while Asian and European economic news started the day off with a little bearish sentiment. The pressure continued to grow as oil rose to a 10-month high adding worries to its potential inflation impact and helping bond yields to surge higher on the day. To find inspiration today we have Mortgage, Trade, PMI, ISM, Beige Book, Fed speak, and just a few notable earnings events for the bulls and bears to wrangle over. Plan for price action to remain challenging as the bulls look for anything to resume the relief rally and the bears look for some inspiration to resume selling.

While we slept Asian markets traded mixed even as Country Garden made payments allowing China real estate stocks to surge. However, European markets trade bearishly across the board as surging energy prices add additional challenges to an already struggling economy. U.S. futures also suggest a modestly bearish open ahead of earnings and economic data worried about the inflationary and economic impacts of rising energy prices.

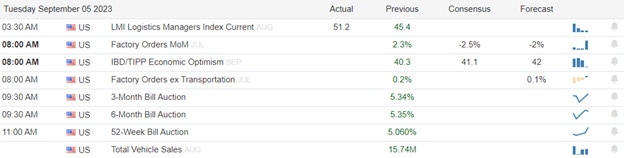

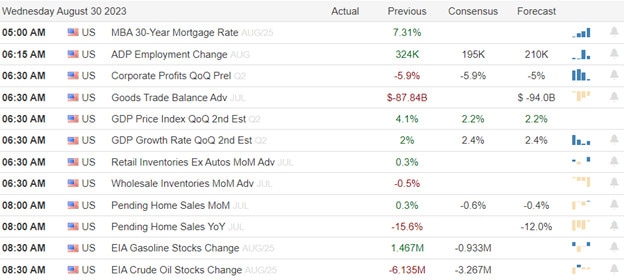

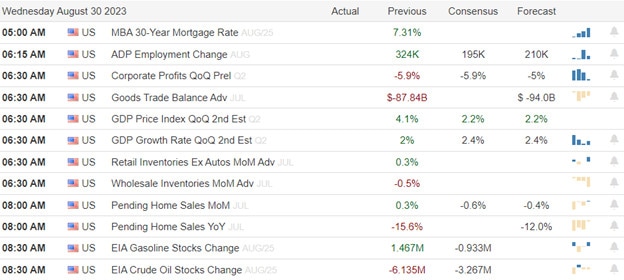

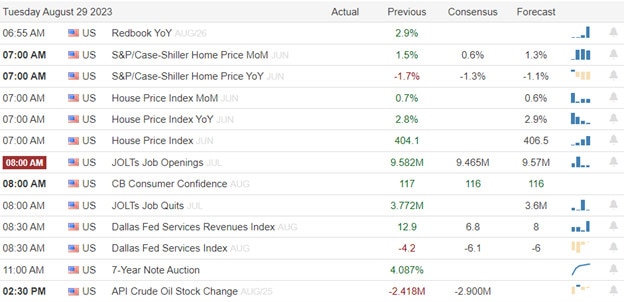

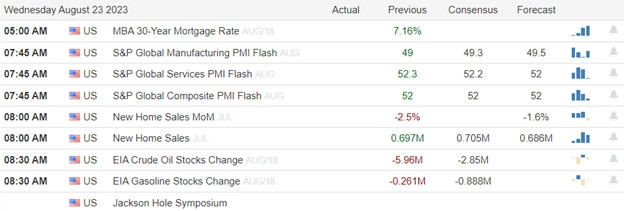

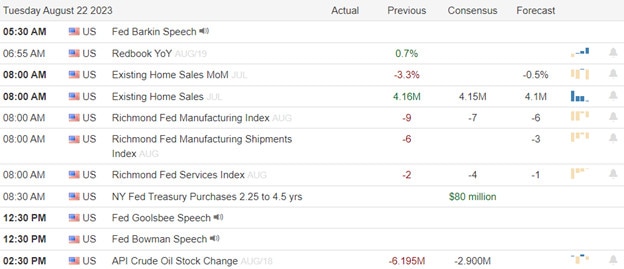

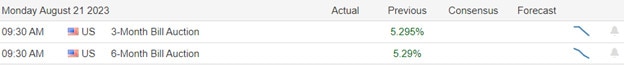

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AEO, AI, CNM, GME, PLAB, PLAY, SPWH, PATH, & VRNT.

News & Technicals’

The European Commission, the executive branch of the European Union, has announced that it has identified six tech giants as “gatekeepers” under its new Digital Markets Act (DMA) — a landmark law that aims to curb the power of the dominant digital platforms. The six gatekeepers are Alphabet, Amazon, Apple, ByteDance, Meta, and Microsoft. These are large digital companies that provide core platform services, such as online search engines, app stores, social networks, and messaging services. The DMA imposes a set of obligations and prohibitions on these gatekeepers to prevent them from abusing their market position and harming competition and consumers. The DMA is one of the first regulatory tools to comprehensively regulate the gatekeeper power of the largest digital companies. The DMA complements but does not change EU competition rules, which continue to apply fully. The European Commission is the sole enforcer of the DMA and will monitor the compliance of the gatekeepers with the law.

The U.S. government is facing the risk of a shutdown at the end of September unless Congress passes a spending bill to fund its operations. The White House and the leaders of both chambers of Congress have agreed to support a stopgap measure, also known as a continuing resolution, that would keep the government running until December 3. However, the stopgap measure still needs to be approved by both the House and the Senate, which could face some challenges from lawmakers who oppose certain provisions or demand additional funding for their priorities. A government shutdown would have negative consequences for the economy, public services, and federal employees. The last government shutdown occurred in 2018-2019 and lasted for 35 days, the longest in U.S. history.

Country Garden, a Chinese property developer, has seen its shares rise after it narrowly avoided defaulting on its bond payments. The company reportedly paid $22.5 million in bond coupon payments on Tuesday, just hours before a 30-day grace period expired. The bond payments were originally due in August, but Country Garden had requested an extension due to liquidity problems. The company has been facing financial difficulties amid the tightening regulations and slowing demand in China’s real estate sector. The successful payment of the bond coupons has eased some of the market concerns and boosted the confidence of the investors. Country Garden’s shares rose by 4.6% on Wednesday, outperforming the broader market.

Tuesday, the stock market closed with losses, while the bond market and the dollar gained. There was no major news that moved the market, but some weak economic data from abroad caught some attention. The services sector in China grew slower than expected in August, showing that the stimulus measures have not boosted consumption yet. Similarly, the final numbers for the services sector in the eurozone were lower than the initial estimates, indicating some slowdown in growth. The energy sector was the best performer today, as oil prices rose after Saudi Arabia announced that it would keep its voluntary production cuts until the end of the year. Oil prices reached a ten-month high of $87 per barrel. Today investors will have Mortgage Applications, International Trade, PMI, ISM, Beige Book, and some Fed speak along with a handful of notable earnings to find bullish or bearish inspiration.

Trade Wisely,

Doug