Mixed results from the retail sector suggest that consumers are inflation worry and beginning to make different choices in their spending fading premarket gains and ending the day lower. The T2122 indicator continues to signal a short-term oversold condition on a light volume day as investors dealt with more banking downgrades and higher bond yields adding to the pressure. However, the highly anticipated NVDA earnings and the talking head marketeering from Jackson Hole could quickly shift sentiment for a relief rally. Of course, the results from today’s earnings and economic reports will have something to say about direction and could keep volatility high.

Asian market traded mixed after business activity reports from Australia and Japan. European markets look to extend yesterday days gains with gains across the board this morning despite lower PMI numbers. U.S. futures once again push for a bullish open but have already faded slightly after early retail earnings results.

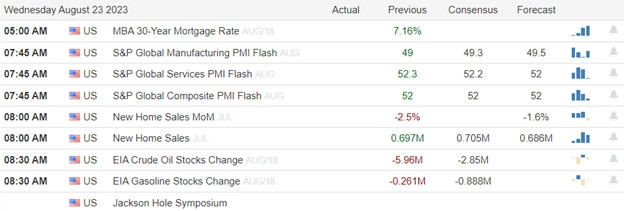

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ANF, AAP, ADI, ADSK, BBWI, DY, FL, GES, KSS, NTAP, NVDA, PTON, SNOW, SPLK, & WSM.

News & Technicals’

The eurozone economy showed signs of recovery in the second quarter of 2021, despite the impact of the Covid-19 pandemic. According to the latest data, the region’s gross domestic product (GDP) grew by 0.3% in the April-June period, compared to 0.1% in the previous quarter. However, this growth rate was still lower than the pre-pandemic level, as the data excluded the months when most countries imposed lockdowns and restrictions to contain the virus. If the pandemic months are excluded, the latest numbers point to the lowest reading since April 2013. The European Central Bank (ECB) is expected to maintain its accommodative monetary policy stance, as analysts predict that it will leave its main interest rate unchanged at 3.75%. The ECB has been providing stimulus to the eurozone economy through its quantitative easing program and its pandemic emergency purchase program. The bank will announce its next policy decision on September 7, 2021.

FedEx pilots are facing uncertainty about their future as the company struggles with a sharp decline in package volume. According to the latest statistics, FedEx Express delivered 3.19 million packages a day within the US during its fiscal year 2022, down from 3.283 million in fiscal 2021. This drop in demand is partly due to the impact of the Covid-19 pandemic, which disrupted global trade and travel, as well as the loss of some major customers, such as Amazon and Walmart. FedEx has been trying to cut costs and improve efficiency by consolidating its operations and offering voluntary buyouts to some employees. However, some pilots fear that these measures may not be enough to avoid layoffs or furloughs in the near future.

Japan is preparing to release more than a million tons of treated radioactive water from the Fukushima Daiichi nuclear power plant into the Pacific Ocean, a controversial decision that has sparked protests and criticism from its neighbors. The water release, which is expected to start in 2023 and take decades to complete, comes more than 10 years after a massive earthquake and tsunami triggered the second-worst nuclear disaster in history, causing meltdowns at three reactors and forcing the evacuation of thousands of people. Japan’s government has argued that the discharge of the water, which has been filtered to remove most of the radioactive elements except for tritium, is safe and necessary to make room for more contaminated water accumulating at the site. The U.N.’s nuclear watchdog, the International Atomic Energy Agency (IAEA), has endorsed the move, saying Tokyo’s plans are consistent with international standards and will have a “negligible” impact on people and the environment. However, neighboring countries such as China, South Korea, and Taiwan are far from happy, as they fear the water release will harm their marine ecosystems, fisheries, and public health.

U.S. stocks ended the day in the red after retail earnings showed mixed results and consumers changing spending habits. Macy’s, a major retailer, reported that it had more credit card defaults than expected in the second quarter, which made investors worry about the U.S. consumer’s spending power. The financials sector also suffered a hit, as S&P Global lowered the ratings of five U.S. regional banks on Monday and bond yields continued to rise adding additional pressure. Today we have a busier earnings calendar with the highly anticipated report from NVDA after the bell with PMI, New Home Sales, and Petroleum Status data pending on the economic calendar.

Trade Wisely,

Doug

Comments are closed.