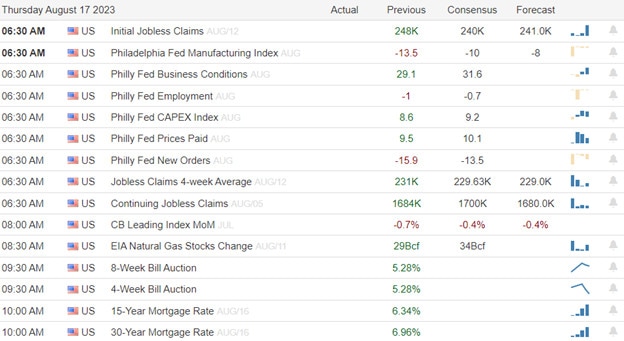

Indexes continued to slide on Wednesday after a miss from Target and Fed minutes revealed that policymakers were concerned about higher inflation. Technical damage grew with the SPY, QQQ, and IWM failing below their 50-day averages and the VIX-X confirmed its lower high following though. However, the T2122 is signaling a short-term oversold condition suggesting a relief rally could occur at any time if the pending data can give the bulls some encouragement. Today we have several notable earnings reports with Wal-Mart leading the way this morning fullered shortly after with numbers on Jobless Claims and the Philly Fed MFG.

Asian markets closed mostly lower overnight as Fed minutes add investor worry about further rate increases. European markets trade mixed and relatively flat in a cautious morning session. With earnings and economic numbers pending the U.S. futures are trying to show confidence in a relief rally beginning but that could fade quickly if the data doesn’t support the hope. Plan for more volatility as uncertainty grows.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include AMAT, BILI, DOLE, FTCH, KEYS, LITE, ROST, TPR, & WMT.

News & Technicals’

The U.S.-China trade tensions escalated on Wednesday when President Biden signed an executive order to ban American investments in 59 Chinese companies that are allegedly involved in developing advanced technologies for military purposes. The order, which will take effect on August 2, aims to protect the national security and interests of the U.S. and its allies from the threats posed by China’s military-industrial complex. However, China’s Ministry of Commerce expressed its strong opposition to the move and warned that it would take necessary countermeasures to safeguard its legitimate rights and interests. The ministry’s spokesperson also said that China and the U.S. were in close contact on trade issues, but did not confirm the date of a possible visit by U.S. Commerce Secretary Gina Raimondo to Beijing. The spokesperson urged the U.S. to respect the market principles and the rule of law and to stop interfering in China’s internal affairs.

Russia’s central bank surprised the markets on Tuesday by raising its key interest rate to 12% from 8.5%, in an attempt to stop the free fall of the ruble, which has lost more than 40% of its value against the dollar this year. The decision came after sharp criticism from President Putin’s economic advisor, who blamed the bank’s “loose monetary policy” for fueling inflation and weakening the currency. The advisor argued that the bank should focus on stabilizing the exchange rate rather than supporting economic growth, which has been hit hard by Western sanctions and falling oil prices. However, the bank’s governor had previously defended her policy, saying that the main causes of the ruble’s decline were external factors, such as the shrinking trade surplus and the increased demand for foreign currency by Russian companies. She also warned that a higher interest rate could further damage the already fragile economy, which is expected to contract by 4.5% next year.

The stock market continued to slide in August, as the Fed’s minutes from its last meeting revealed that policymakers were concerned about higher inflation. Some investors took this as a sign that the Fed might tighten its monetary policy sooner than expected, but we note that inflation and wage growth have slowed down since the meeting. Global stocks also suffered from fears about China’s slowing economy. On a positive note, U.S. industrial production increased in July for the first time in three months, thanks to a boost in auto production. This suggests that the economy is starting the third quarter on a strong footing. The 10-year Treasury yield climbed to 4.27%, matching its highest level since last October*.

Trade Wisely,

Doug

Comments are closed.