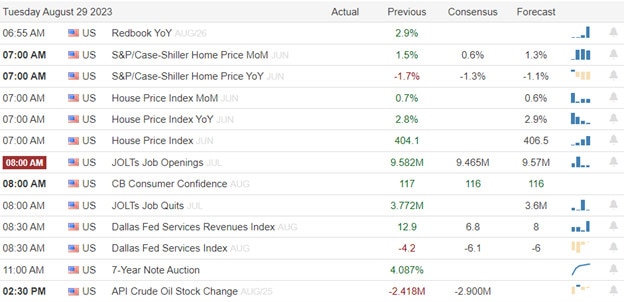

Markets around the world enjoyed a relief rally with choppy price action in the U.S. with overhead resistance levels holding with bond yields adding worries to future rate increases. Today traders will have much more earnings and economic data to inspire with Case-Shiller, Consumer Confidence, and JOLTS figures pending. Light choppy price action could be possible as we wait for the Wednesday release of the GDP providing the uncertainty.

Overnight Asian markets continued their relief rally led by Hong Kong up 1.95% at the close as Japan reported higher than expected unemployment. European markets also advance building on the bullish momentum. Ahead of earnings and economic data, U.S. futures point to a bullish open with the uncertainty of the GDP report looming Wednesday.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AMBA, AMWD, BBY, BIG, BOX, CTLT, DCI, HPE, HPQ, SJM, MBUU, NIO, PDD, PVH, & ZTO.

News & Technicals’

Lithium is a metal that is used in various applications, such as batteries, electric vehicles, aerospace, and medicine. It is considered a critical mineral for the transition to a low-carbon economy. However, the supply of lithium may not be able to keep up with the growing demand, as a research unit of Fitch Solutions warned. According to BMI, “Global lithium supply is expected to enter a deficit relative to demand by 2025”. This means that there could be a worldwide shortage of lithium soon, which could affect the prices and availability of lithium products. The main factors that contribute to the supply-demand imbalance are the limited production capacity, the environmental and social challenges, and the geopolitical risks of lithium mining and processing. Therefore, it is important to find alternative sources of lithium, such as recycling, seawater extraction, and geothermal brines.

Toyota Motor, the world’s largest automaker by sales, has faced a major disruption in its production system due to a technical glitch. The company announced on Tuesday that it has halted operations at all 14 of its assembly plants in Japan, affecting its domestic output of about 30,000 vehicles per day. The company said that the malfunction occurred in its information system that connects the production lines and the parts suppliers, causing delays and errors in the delivery of components. The company apologized for the inconvenience and said that it is working to restore the system as soon as possible. The suspension of operations could have a significant impact on Toyota’s sales and profits, as well as on its global supply chain and customers.

Artificial intelligence (AI) is a powerful technology that can have both positive and negative impacts on humanity. Brad Smith, president and vice-chairman of Microsoft, one of the leading companies in AI development, said that AI has “the potential to become both a tool and a weapon”. He stressed the need for human control over AI to “slow things down or turn things off” in case of any harmful or unethical outcomes. His statement came amid the growing popularity and controversy of ChatGPT, a generative AI-powered chatbot that can produce humanlike responses to any input. ChatGPT has been praised for its creativity and versatility, but also criticized for its potential risks of spreading misinformation, manipulation, and violence. Some tech leaders have warned that AI poses a human extinction risk on par with nuclear war if it becomes too intelligent and autonomous. Therefore, it is important to establish ethical principles and regulations for AI to ensure its safe and beneficial use for humanity.

Indeses enjoyed a relief rally in the U.S. on light choppy price action with bond yields rising during government auctions. Today investors have more data on the earnings and economic calendars for the bulls or bears to find inspiration. Asian and European relief rallies are helping to lift premarket bullish spirits despite their weakening economic figures. Keep a close on overhead resistance levels in price and technicals such as the 50-moving averages that could harbor entrenched bears. Don’t be too surprised by light volumes and choppy price action with the uncertainty of the GDP report coming Wednesday morning.

Trade Wisely,

Doug

Comments are closed.