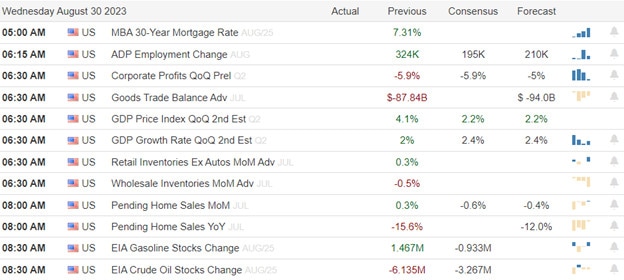

The relief rally expanded with a big bullish follow-through after seeing a sharp decline in the JOLTS report hoping that will ease the hawkish Fed. However, we also ignored the sharp decline in consumer confidence suggesting that consumers are likely changing spending habits due to their weariness of high prices. This morning expect price volatility with ADP, GDP, International Trade, and inventories data before the bell. We also have Pending Home Sales and Petroleum numbers and several notable earnings reports to inspire the bulls or bears.

Asian market closed mostly higher drawing on the bullish energy of the U.S. rally with only Hong Kong closing flat on the day. European markets gave up some early gains after Germany and Spain released data that brought out the bears. U.S. futures gave back overnight gains suggesting a flat to slightly bearish lean as the GDP data looms.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include BF.B, CHWY, CONN, COO, CRM, CRWD, FIVE, MCFT, OKTA, PDCO, VEEV, & VSCO.

News & Technicals’

The Bank of England (BoE) is facing a significant increase in losses on its bond-buying program, which is aimed at supporting the U.K. economy during the pandemic. According to Deutsche Bank, a leading financial institution, the BoE’s losses on its asset purchase facility (APF) will be “materially higher than projected” by the BoE itself. The APF is a scheme that allows the BoE to buy government and corporate bonds from the market, injecting money into the economy and lowering borrowing costs. However, as interest rates rise, the value of these bonds falls, resulting in losses for the BoE. The BoE estimated in late July that it would need the U.K. Treasury to cover £150 billion ($189 billion) of losses on its APF. However, Deutsche Bank Senior Economist Sanjay Raja said that this figure is too low and that the actual cost to the Treasury will be around £173 billion ($218 billion) over the next two fiscal years. This is £23 billion higher than the forecast made by the Office for Budget Responsibility (OBR) in March. This means that the Treasury will have to borrow more money or raise more taxes to compensate for the BoE’s losses, which could have implications for the U.K.’s fiscal policy and public debt.

Spain and Germany, two of the largest economies in the eurozone, have reported contrasting inflation and trade data for August and July respectively. Spain’s inflation rate rose to 2.6% year on year in August, matching the analysts’ expectations, according to the flash estimate released by the National Statistics Institute (INE). This was the highest inflation rate since October 2012, driven by higher energy and food prices. The inflation rate was also above the European Central Bank’s (ECB) target of close to but below 2%. Meanwhile, Germany’s imports fell by 13.2% year on year in July, the biggest decline since January 1987, according to the data published by the Federal Statistical Office (Destatis). This was much worse than the analysts’ forecast of a 4.5% drop, reflecting the impact of supply chain disruptions and labor shortages on the German economy. The trade surplus also narrowed to 12.3 billion euros ($14.5 billion) in July, from 15.6 billion euros ($18.4 billion) in June.

Indexes logged a big day of bullish follow-through after seeing a sharp decline in the JOLTS report but unfortunately, we also recorded a substantial miss in Consumer Confidence that the market chose to ignore. The bullish surge broke back above the daily 50-moving averages on the DIA, SPY, and QQQ while the IWM lagged. The big test for today, Can we follow through and prove to hold these key technical support levels? The answer will likely come down to the data we receive in the GDP. We will also deal with ADP, International Trade, Pending Home Sales, and a Petroleum number as well as some notable earnings reports to find inspiration. Plan for price volatility to remain challenging with a focus on job numbers for the rest of the week.

Trade Wisely,

Doug

Comments are closed.