Not in a Hurry to Raise

Markets continued the relief rally on Wednesday as investors chose to hear the FOMC is not in a hurry to raise rates and ignored pretty much everything else. Big tech had a great day as buyers inspired by AMD earned results pushed higher with the added benefit of bond yields pulling back. Today we have a massive day of earnings reports that will culminate with a report from Apple after the bell. The fear of missing out is kicking in the rally extends so remember to keep an eye on overhead resistance levels as economic reports roll in this morning. Whipsaws are possible with a gap open so plan your risk carefully.

Asian markets traded mostly higher overnight with only Shanghai just slightly lower even after their big stimulus efforts. European markets trade decidedly bullish seeing green across the board adding to the relief rally after Powell’s comments. U.S. futures ahead of earnings and economic report point to a gap up open with the tech sector leading the premarket surge. Buckle up for another day of volatility.

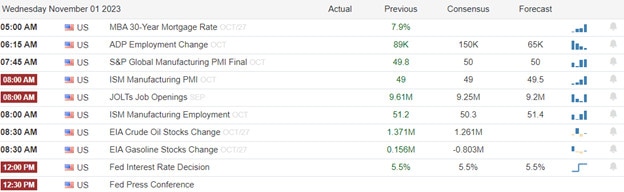

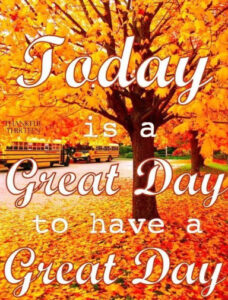

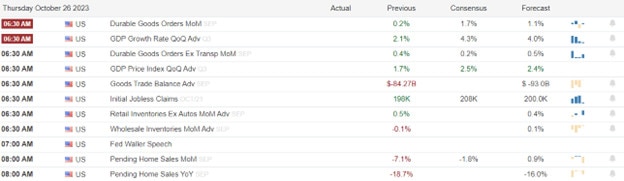

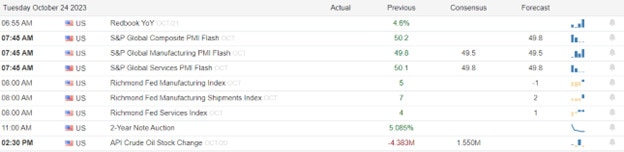

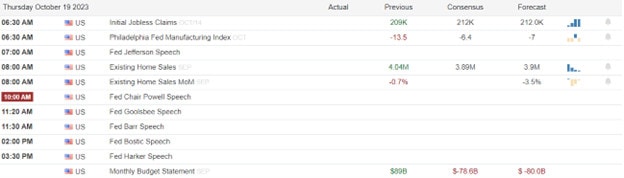

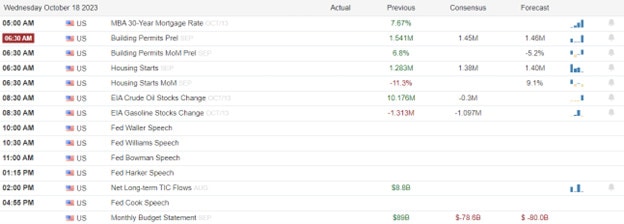

Economic Calendar

Earnings Calendar

Notable reports for Thursday include AAPL, ACAD, ACCO, ACIW, ADT, ATI, SLGT, ALGM, AEP, AMH, APTV, ARW, TEAM, AVNT, BALL, BHC, BAX, BILL, SQ, BKNG, BWA, CNQ, CARS, LNG, CHUY, CRUS, CWEN, COHU, ED, COP, CROX, CUBE, CMI, CYBR, DOCN, BOOM, DKNG, DBX, DUK, LOCO, LLY, ENTG, EOG, EVH, EXC, EXPE, RACE, FIVN, FLWS, FND, FTNT, FOXA, FOXA, FOXF, FNKO, GIL, GDDY, HAE, HELO, HEP, HWM, HIII, HMN, HURN, H, IDA, ICE, IDCC, IONS, IRM, ITT, K, KN, LYV, MAR, MTZ, MERC, MCW, MRNA, TAP, MSI, MP, MUR, NRG, OGE, OMCL, OGN, PLTR, PZZA, PARA, PH, PCTY, PTON, PENN, PNW, PXD, PBI, PTLO, PPL, QLYS, PWR, RMAX, RGA, RYAN, SPGI, SBAC, SEE, SHAK, SHOP, SWKS, SO, SWN, SRC, SPXC, SBUX, SYK, SG, TPX, TRN, OLED, VTR, VIRT, WEN, WLK, WW, YELP, & ZTS.

News & Technicals’

Starbucks, the coffee giant, reported strong results for the fourth quarter of 2021, beating analysts’ expectations. The company’s net income attributable to the company rose to $1.22 billion, or $1.06 per share, up from $878.3 million, or 76 cents per share, a year ago. The company’s net sales increased by 11.4% to $9.37 billion. The company’s same-store sales, which measure the performance of its existing cafes, grew by 8%, driven by higher average spending and a 3% increase in customer traffic. The company attributed its success to its digital initiatives, menu innovation, and loyalty program. The company also raised its dividend by 10% and announced a new $20 billion share buyback program.

Shell, one of the world’s largest oil and gas companies, reported a lower profit for the third quarter of 2023 compared to the same period last year. The company earned $6.2 billion in the quarter, which was close to analysts’ expectations, but down from $9.45 billion in the third quarter of 2022. Shell attributed the decline to lower oil and gas prices, as well as weaker refining margins and chemical performance. Despite the lower profit, Shell announced a $3.5 billion share buyback program for the next three months, signaling its confidence in its cash flow and balance sheet.

Delta Air Lines, one of the largest U.S. carriers, is cutting some of its corporate and management staff as part of its efforts to reduce costs and improve efficiency. The company did not reveal how many employees will be affected by the layoffs but said they will not impact frontline workers such as pilots or flight attendants. Delta said the move is necessary to adjust to the changing market conditions and customer expectations. “While we’re not yet back to full capacity, now is the time to make adjustments to programs, budgets, and organizational structures across Delta to meet our stated goals — one part of this effort includes adjustments to corporate staffing in support of these changes,” the company said in a statement.

The Fed’s signal that it is not in a hurry to raise interest rates helped boost both U.S. and global stocks, as long-term bond yields fell sharply. The Treasury also announced that it will slow down the increase of its long-term debt sales, easing some of the pressure on the bond market. Moreover, weaker-than-expected jobs data suggested that the labor market recovery is still uneven. The 10-year Treasury yield dropped to its lowest level in 15 days, at 4.76%. Investors favored the tech giants inspired by the big rally in AMD. Today we have a massive round of earnings events that include the behemoth market mover Apple after the bell. On the economic calendar, the bulls or bears will look for inspiration in Jobeless Claims, Productivity and Costs, Factory Orders, and a few bond auctions to keep an eye on as yields continue to decline this morning. Remember, the fear of missing out is a powerful emotion so be careful chasing stocks into major resistance levels.

Trade Wisely,

Doug