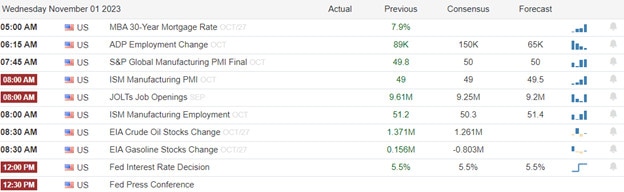

Markets edged higher on building on Monday’s gains but momentum was weak with all the uncertainty facing the Wednesday market. Not only do we have three-quarters of a Trillion government funding debit raise announcement but we also have an FOMC decision and press conference so keep a close eye on bond yields that have been ticking higher this morning. Add in Mortgage Apps, ADP, PMI, ISM, Construction Spending, JOLTS, Petroleum Status, and the huge number of earrings today the statement, “challenging price action”, could be a massive understatement! Buckle up and be ready for just about anything.

While we slept Asian markets closed mostly higher with the Nikkei surging 2.42% while Hong Kong slipped slightly lower. European markets trade cautiously this morning chopping between gains and losses as they monitor the big day of data releases. However, U.S. futures suggest a bearish open ahead of all the market-moving earnings and economic reports likely to keep volatility high as traders react.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AFL, ABNB, ALB, ALKT, ALL, ATUS, AFG, AIG, AWK, APO, ASTE, ACA, CAR, AXTA, BALY, BHCO, BMRN, BXP, EAT, BLDR, CHRW, CRC, CWH, GOOS, CDW, CF, CAKE, CHEF, CLH, CTSH, CFLT, CLB, CVS, DIN, DASH, DD, DXC, ELF, EA, ET, ETR, EL, ETSY, EXAS, EXTR, FSLY, FWRG, GRMN, GNRC, GSK, HLF, HST, HPP, HUM, IDXX, IR, IIPR, IQV, JHG, KHC, LMND, LNC, LMND, LNC, MGY, MTW, MOR, VAC, MLM, MCK, MLNK, MET, MSTR, MDLZ, MUSA, NSA, NOG, NCLH, NUS, NTR, PGRE, PK, PYPL, PRU, PTC, QRVO, QCOM, RDN, RDWR, RYN, RVLV, ROKU, SMG, SCI, SIMO, SBGI, SITM, SEDG, RGR, SMCI, TEL, TT, TRMB, TYL, VRSK, W, WERN, WMB, WING, YUM, & ZG.

News & Technicals’

AMD, one of the leading chipmakers in the world, announced its third-quarter earnings on Tuesday. The company is known for making high-end graphics processing units (GPUs), which are essential for training and deploying generative AI models. Generative AI models are capable of creating new and realistic content, such as images, videos, texts, and sounds, based on existing data. AMD said that its AI GPU sales could surpass $2 billion in 2024, as the demand for generative AI applications grows. The company also said that it is investing in developing new and innovative AI GPUs that can deliver better performance and efficiency. AMD’s earnings report showed that the company had a strong quarter, with revenue up 54% year-over-year and net income up 68% year-over-year.

The Treasury Department will announce on Wednesday the details of its refunding, which is the process of issuing new debt to pay off the maturing debt. The refunding announcement will reveal the size and duration mix of the Treasury auctions, which are the primary way of selling government debt to investors. The refunding announcement is expected to attract more market attention than usual, as investors are concerned about the rising government borrowing and its impact on the interest rates and the economy. The Treasury Department gave a preview of its borrowing plans on Monday when it said that it will auction off $776 billion of debt in the fourth quarter of 2021. The market will be watching closely the actual sizes of the auctions and the maturities mix, which are the key variables that affect the supply and demand of Treasury securities. The Treasury Department has been increasing the issuance of longer-term debt, such as 10-year and 30-year bonds, to lock in low-interest rates and reduce refinancing risks. However, this also exposes the government to higher interest payments and inflation pressures.

The Bank of England (BoE) is expected to keep its interest rate unchanged at 4.5% on Wednesday after it stopped its streak of 14 consecutive rate hikes in September. The market is pricing in a high probability of a second hold, as the BoE faces a mixed economic outlook. The BoE has been raising its interest rate since 2020 to curb inflation, which reached 5.2% in August, well above the BoE’s target of 2%. However, the BoE also has to consider the impact of its monetary policy on economic growth, which slowed down to 0.4% in the third quarter, below the BoE’s forecast of 0.7%. Mike Riddell, an analyst at Allianz Global Investors, said that it was “striking that the market’s central case is for the BoE to not cut interest rates below 4% ever again.” He said that this implies that the market expects inflation to remain high and persistent and that the BoE will not be able to ease its policy in the future.

Equities rallied to close higher on Tuesday, building on Monday’s gains, but unfortunately, the momentum was weak as investors worried about the pending data. Bond yields retreated slightly yesterday but are once again ticking higher as the Treasury moves forward with a three-quarters of a Trillion debt raise to keep the government spending practices funded. Today we have a very big day of earnings events and the economic calendar is chalked full of potential market-moving reports to keep traders guessing. Although it is very unlikely the Fed will raise the rate today be prepared to hear hawkish talk from Jerome Powell suggesting their work is not done on inflation. Plan for considerable price volatility as the data is revealed.

Trade Wisely,

Doug

Comments are closed.