The bears ran roughshod over Friday’s market as Middle East tensions worried investors with oil prices surging and bond yields holding steady. This week will be very busy with market-moving job numbers, a FOMC rate decision, and a huge number of earnings events as we slide into November. The T2122 indicator is in a short-term very oversold condition so watch for a relief rally and a possible short squeeze to get it moving. However, don’t rule out a retest of lows, and expect challenging price volatility so plan your risk carefully.

Overnight Asian markets closed mixed but mostly higher ahead of Japan’s central bank decision. European markets trade green across the board this morning reliving some of last week’s selling despite Middle Eastern worries. U.S. futures suggest a substantial gap up hoping for a relief of some of the short-term oversold conditions as we wrap up October and slide into the holiday’s highly anticipated rally.

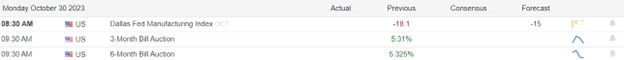

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AGNC, AMKR, ACGL, ANET, BCC, CHGG, CHKP, CRK, CWK, DENN, PLOW, FMC, FWRD, HTLF, IRT, KMPR, KFRC, LSCC, LEG, MPWR, ON, OGS, OTTR, PDM, PINS, PCH, PSMT, PCH, PSA, RMBS, SPG, SOFI, THC, RIG, VFC, VRNS, VNO, WELL, WDC, WOLF, XPO, & ZI.

News & Technicals’

Stellantis, the parent company of Chrysler, is facing a national labor strike in Canada, just days after it reached a tentative deal with the United Auto Workers union in the U.S. The strike, which started on Monday, affects two assembly plants in Ontario that produce some of the company’s popular models, such as the Chrysler 300 sedan and Pacifica minivan and the Dodge Challenger and Charger muscle cars. The workers, who are members of the Unifor union, are demanding better wages, benefits and working conditions. The strike could disrupt the production and supply of Stellantis vehicles in North America and hurt the company’s sales and profits.

The United Auto Workers union and Ford have reached a tentative agreement that includes $8.1 billion in new investments by the automaker and $5,000 bonuses for the workers. The tentative deal, which was approved by the local union leaders on Sunday, will now be presented to the 57,000 UAW-Ford members for regional meetings and voting, the union said on Sunday. The tentative agreement was achieved after the union launched selective strikes against Ford, General Motors, and Stellantis, as the three companies failed to meet the union’s demands by the Sept. 14 deadline. The union is seeking higher wages, better benefits, and more job security for its members.

Evergrande, the troubled Chinese property developer, saw its shares plummet to a record low on Monday, as it faced a possible liquidation by a Hong Kong court. The company’s shares dropped more than 20% from last Friday’s close of 23.6 Hong Kong cents to 18.8 Hong Kong cents in early Monday trading, before recovering slightly to 22.2 Hong Kong cents. The company is facing a winding-up order from a group of bondholders who claim that Evergrande has defaulted on its debt obligations. A Hong Kong judge said that the Dec. 4 hearing would be the last one before a decision is made on the order, according to Reuters. Evergrande is the world’s most indebted property developer, with more than $300 billion in liabilities. The company’s financial woes have sparked fears of a contagion effect on the Chinese and global economy.

The stock markets ended Friday with bears overwhelming the bulls as Middle East tensions grew and those pesky bond yields held firm. The S&P 500 and the Nasdaq, finished the week with more than 2.5% losses and are now more than 10% below their highs on July 31. However, the sell-offs in large tech companies like Google and Facebook (Meta) after they announced their earnings took some shine off the “Magnificent 7”. As we finish up October about 40% of companies will come out from under their blackout period meaning buybacks could prove an increase in market breadth. Today is the only light day of economic reports and keep in mind the earnings events will continue to increase through Thursday afternoon when Apple reports earnings. Jobs numbers will be in focus this week as well as the FOMC rate decision on Wednesday afternoon. Plan for significant volatility.

Trade Wisely,

Doug

Comments are closed.