Increasing geopolitical concerns engaged the bears on Wednesday as bond yields and rising interest rates reversed Tuesday’s gains. Mortgage rates topped 8% for the first time since 1995 and unfortunately, the yields continue to rise this morning as we wait on Jerome Powell’s comments at mid-day. Bulls or bears will have plenty of earnings results and economic data to inspire price volatility with an afternoon filled with bond auctions and Fed speakers to keep traders guessing. Anything is possible folks so plan your risk carefully.

Asian markets closed sharply lower overnight with Japan reporting a surprise trade surplus and the Bank of Korea holding rates steady. European markets trade red across the board this morning as the Middle East war hampers sentiment and increases winter energy prices. Ahead of earnings and possible market-moving economic reports, U.S. futures point to mixed but overall flat open but that could change substantially as the data rolls out.

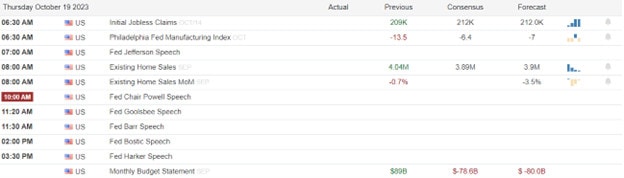

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ALK, AAL, T, BMI, BX, CSX, FITB, FCX, GPC, ISRG, KEY, KNX, LNN, MAN, PM, POOL, SNA, TFC, UNP, WDFC, WBS & WNS.

News & Technicals’

Netflix, the streaming platform, reported better-than-expected results for the third quarter, sending its shares up nearly 14% in premarket trading on Wednesday. The company added 8.8 million subscribers in the quarter, the highest number since the peak of the pandemic. The company attributed its strong performance to its diverse and original content, as well as its expansion in international markets. Netflix also said that it expects to add 8.5 million subscribers in the fourth quarter, surpassing the market expectations. Netflix’s results showed that it remains the dominant player in the streaming industry, despite the increasing competition from other platforms.

Tesla, the electric car maker, reported lower-than-expected earnings for the third quarter, as its operating margin declined sharply from a year ago. The company earned 66 cents per share on an adjusted basis, missing the analysts’ estimate of 73 cents per share. The company’s operating margin, which measures how much profit it makes from each dollar of revenue, was 7.6%, down from 17.2% in the same quarter last year. The company said that the lower margin was due to higher costs and lower prices for its vehicles. Tesla CEO Elon Musk said on the earnings call that the company was facing challenges in the global economy and that it was working on making its cars more affordable for more customers. Tesla also said that it delivered a record number of vehicles in the quarter and that it expects to achieve its full-year delivery target of 750,000 vehicles.

TSMC, the world’s leading chipmaker, reported a third-quarter profit of NT$211 billion on Thursday, beating the analysts’ expectations. However, the profit was the lowest since the first quarter of 2019, as the demand for consumer electronics remained weak after the pandemic. The Taiwanese company produces the most advanced processors for various devices, but the post-pandemic recovery has been uneven and slow for the consumer electronics sector. TSMC said that it expects the demand to improve in the fourth quarter, as it ramps up its production capacity and launches new products. TSMC also said that it is confident in its long-term growth prospects, as it invests in new technologies and markets.

The bears attacked the indexes on Wednesday, as bond yields and interest rates surged higher as geopolitical issues weighed on investor’s minds. The energy sector was the only one that did well, as oil prices rose due to supply concerns. The defensive sectors, such as consumer staples, utilities, and health care, also performed better than the cyclical sectors, such as small caps, which suffered more. That said, better-than-expected earnings results from NFLX may help improve investor spirits in the QQQ. Unfortunately, TSLA’s overnight decline and the bond yields continuing to rise may well mute that bullish bright spot. Today traders will have to deal with Jobless Claims, Philly Fed MFG, Existing Home Sales, Natural Gas, and a slew of Fed speakers that include Jerome Powell at noon Eastern time. We also have a busy day of earnings to add to the volatile price action this morning so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.