After gapping lower in reaction to hotter-than-expected Retail Sales numbers the bulls rushed back in producing a very whippy and volatile Tuesday as bond yields surged higher with worries about inflation. After surging higher to test resistance levels index prices softened leaving behind more questions than answers with the declining market breadth. Today we have a very busy day of earnings and economic reports to inspire the bulls or bears. However, the war in the Middle East and the increasing tensions add a level of caution and uncertainty to the morning as oil prices surge higher.

Asian market closed the day mixed with modest gains and losses despite the better-than-expected economic figures out of China. European markets trade red across the board this morning as they monitor Middle East tensions and worry about inflation as energy prices rise. U.S. futures suggest a slightly bearish open due to the war tensions, but anything is possible by the open of the day with earnings and economic reports before the bell. Expect another day of challenging price action.

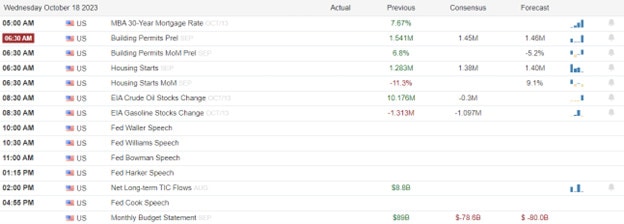

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ABT, AA, ALLY, ASML, CFG, CCI, DFS, EFX, FNB, FHN, KMI, LRCX, LVS, MTB, MS, NDAQ, NFLX, NTRS, PPG, PG, REXR, SLG, STT, STLD, TSLA, TRV, USB, WGO, ZION.

News & Technicals’

China’s economy grew faster than expected in the third quarter of this year, according to the latest data from China’s National Bureau of Statistics. The data showed that China’s gross domestic product (GDP) increased by 4.9% year-on-year in the July to September period, beating the 4.4% growth forecast by economists. China’s retail sales also exceeded expectations, rising by 4.3% year-on-year in September. China’s urban unemployment rate dropped to 4.7% in September, the lowest level since November 2019. The data indicated that China’s economic recovery from the Covid-19 pandemic was gaining momentum, as domestic consumption and industrial production improved. China was the only major economy to report positive growth in 2020 and is expected to maintain its growth momentum in the fourth quarter of this year.

Roblox, the online gaming platform and game creation system, has announced a change in its work policy that will require its employees to relocate to the office. Roblox CEO David Baszucki said in a memo on Tuesday that the company will adopt a hybrid work model, where employees will have to work from the office on Tuesdays, Wednesdays, and Thursdays, starting from January 2024. Employees who choose not to relocate to the office can opt for a severance package and leave the company. The new policy is a reversal from the previous one, which allowed employees to “primarily work remotely” since May 2022. Baszucki said that the change was necessary to foster collaboration, innovation, and culture at Roblox.

United Airlines, one of the largest U.S. airlines, has warned that its profits will be affected by higher fuel costs and the conflict in the Middle East. The airline said that the price of jet fuel has increased by 50% since the beginning of the year and that the war between Israel and Hamas has reduced the demand for travel to the region. United Airlines and other airlines with large international networks have enjoyed a boost in overseas travel this summer, as more countries reopened their borders and eased travel restrictions. The summer season is usually the most profitable period for airlines, as they generate most of their revenue in the second and third quarters. However, United Airlines said that the rising fuel costs and geopolitical uncertainty will offset some of the gains from the recovery in international travel.

Index prices produced a whippy and volatile Tuesday after gapping lower after the retail sales report came in hotter than expected driving bond yields higher yet finishing the day nearly unchanged. The industrial production also surprised to the upside, growing by 0.3% month-over-month in September, while the forecast was for a 0.1% drop. However, the market was also affected by the weak housing market index, which fell to 40 in October, the lowest level since January. The index showed that the higher interest rates have hurt the demand for housing, and the 2-year bond surging back above 5% yesterday added more pressure. Today, investors face a big day in earnings events as the 4th quarter season heats up with NFLX, and TSLA numbers pending. We also have Mortgage Apps, Housing Starts, Petroleum Status, and several Fed speakers throughout the day. With renewed concerns in the Middle East this morning oil prices are surging adding inflation worries to the mix of uncertainties the market faces.

Trade Wisely,

Doug

Comments are closed.