Hawkish Fed tough talk engaged the bears on Thursday as disappointing inflation data brought the thing the market hates the most, uncertainty! The challenging big-point whipsaws and the short-term extension of the SPY, QQQ, and IWM exacerbates the situation as we move toward a 3-day weekend. Of course, one day does not make a trend, and I wouldn’t expect the bulls to give up easily. However, should price support levels break, fear could quickly spike as traders run for the door to protect capital heading into the long weekend. So expect another day of wild price swings as the drama unfolds.

Asian markets sold off across the board last night due to possible rate increases and the plunging Singapore exports. After notching record highs, European markets trade decidedly bearish this morning as traders grapple with the prospect of Fed uncertainty. U.S. futures also see the bears engaged this morning, pointing to a gap down open that could threaten support levels and the current bullish trends.

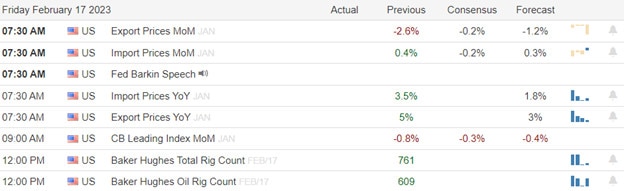

Economic Calendar

Earnings Calendar

We get a break in the pace of earnings today, but we still have some market-moving reports. Notable reports for Friday include AMCX, ABR, AN, B, CNP, & DE.

News & Technicals’

Dropbox recorded a real estate impairment of $162.5 million in the fourth quarter, bringing the markdown for the year to $175.2 million. The company signed a record office lease for its San Francisco headquarters in 2017 and then got hit with the Covid pandemic and a market downturn. “We were relatively quick to market with our subleasing plans, but the market has deteriorated, with many companies reducing their real estate footprint,” finance chief Tim Regan said Thursday.

The three unmanned aerial objects that were shot down over the weekend by the U.S. military were “most likely tied to private companies, recreation or research institutions,” President Joe Biden said. “Nothing suggests they were related to China’s spy balloon program,” he added. The remarks came after days of mounting pressure on the White House from Democrats and Republicans in Congress to share more of what was known with the public.

DoorDash reported better-than-expected sales for the fourth quarter and gave upbeat guidance for the current period. As a result, the stock climbed in extended trading on Thursday. The food delivery company said it authorized a buyback of up to $750 million of its shares.

Disappointing wholesale inflation numbers and hawkish Fed speeches encouraged the bears to engage yesterday with another huge point intraday whipsaw to keep traders guessing. However, the DIA remained within its wide-range chop zone by the end of the day, and the current bullish trends in the SPY, QQQ and IWM held above support levels by the close of trading Thursday. Although the price action left behind some concerning daily candle patterns, we must remember that one day does not make a trend. With Friday being a much lighter day of economic and earnings reports, the tough-talking Fed members and uncertainty that may create could be the driving force as we slide into a 3-day weekend. Expect the big point swings to continue on this expiration Friday with high emotions and indexes extended away from crucial moving averages.

Trade Wisely,

Doug

Comments are closed.