All about the Mid-Term

Everywhere I look I see another talking head trying to predict the outcome of the mid-term election. To be honest, that’s far easier to do that than trying to predict how the market will react to the results! What I can say with 100% certainty is that no one knows what that reaction will be and trying to trade it is straight up gambling. As traders, we all gamble from time to time but let’s be honest with ourselves and have our eyes wide open if you choose to do so today.

Everywhere I look I see another talking head trying to predict the outcome of the mid-term election. To be honest, that’s far easier to do that than trying to predict how the market will react to the results! What I can say with 100% certainty is that no one knows what that reaction will be and trying to trade it is straight up gambling. As traders, we all gamble from time to time but let’s be honest with ourselves and have our eyes wide open if you choose to do so today.

It’s highly likely the market will gap Wednesday morning substantially. Which means all trades held through the close today are at a higher than normal risk. If you do decide to add risk today, I suggest you keep the positions small to minimize the losses if your guess of the market reaction is incorrect. Also, keep in mind that you don’t have to play the guessing game! There is no shame in standing aside protecting your capital and waiting to trade the reaction when you have a better edge.

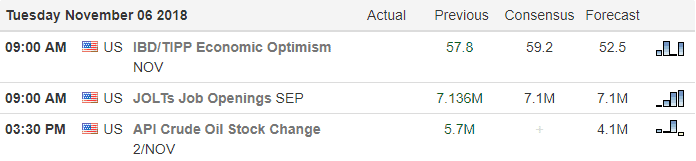

On the Calendar

On the Earnings Calendar, we have more than 350 companies reporting today. Keep checking and stay focused on the number of reports grows even more through Thursday.

On the Earnings Calendar, we have more than 350 companies reporting today. Keep checking and stay focused on the number of reports grows even more through Thursday.

Action Plan

Asian markets caught a bit of bounce last night but by the close finished mixed. European markets, however, are all slightly bearish this morning and that sentiment seems to have translated directly to the US Futures market. Although futures are currently suggesting a modestly lower open, that could easily change due to all the earnings reports. I would normally expect a considerable amount of volatility but with the market waiting on mid-term election results price action may be choppy and subdued.

While many are trying to predict the election outcome its impossible to know how the market will react. However, react it will, and likely with a big gap up or down on Wednesday morning increasing the risk of every position we hold. Carefully consider that risk if you plan to enter new positions today or carry any positions into the close today. As a result, it’s very unlikely that I will be trading today except for the possible quick intraday trade to take advantage of volatility and stave off the boredom of an election day market.

Trade Wisely,

Doug

Comments are closed.