Possible Silver Lining

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

After more than a 2000 point nine-day rally in the Dow, a pullback should not have been a big surprise. I warned about the possibility in yesterday’s morning video. It was not a prediction but rather just a simple observation of price action, support an resistance that anyone can do if you set aside personal bias. Clearly, volatility remains high, and with futures pointing sharply higher this morning it would be wise to keep that in mind. Don’t rush blindly with a fear of missing out, wait for your edge and trade with a well thought out plan.

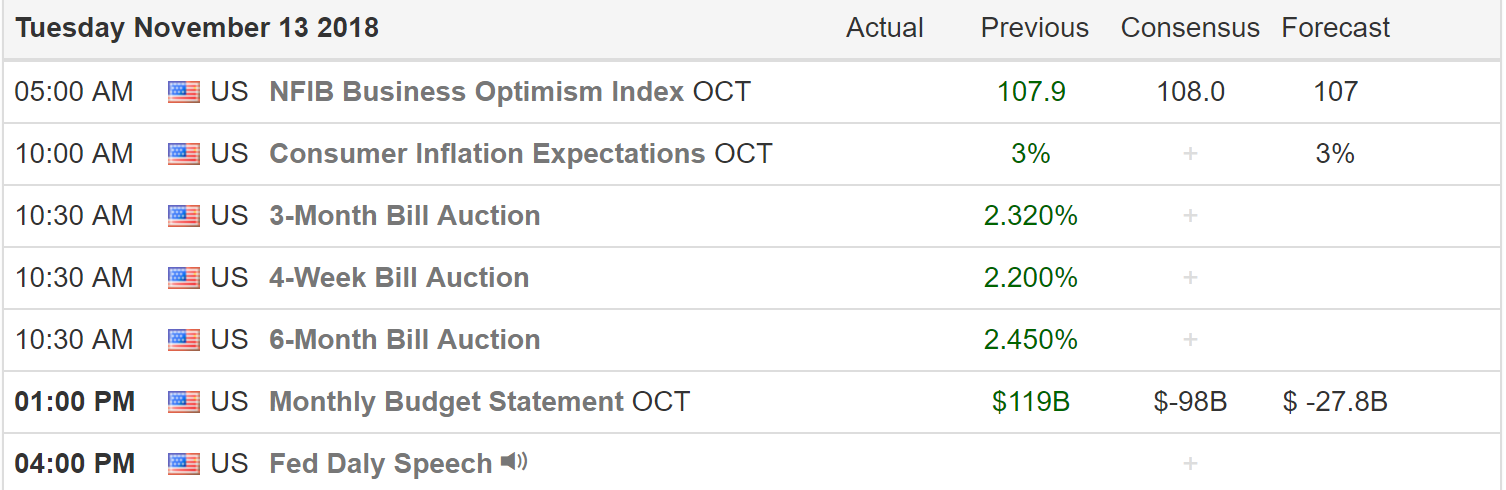

On the Calendar

On the Earnings Calendar, we have just over 200 companies reporting to keep us on our toes and volatility high.

Action Plan

I don’t need to tell you that yesterday was a brutal day of selling. The rising dollar, rising interest rates, and declining oil prices seemed to take the blame for the bearishness according to the news. Blah, blah blah. How about the fact that the Dow had gained over 2000 points in just nine days of trading! Anyone that’s been paying attention had to know a pullback was possible. In fact, I would go so far to say that yesterday’s selling was a good thing as long as key support hold.

Let’s remember our overall economy is strong. The GDP is showing 3% growth, and employment continues at historic levels, so it’s not all gloom and doom. The fact remains that the current market is very volatile and that should not be a surprise given the technical damage in the charts. As always the best we can do as retail traders is to stay focused on price action and ready to react without bias no matter the direction.

Trade Wisely,

Doug

Comments are closed.