Is the Sky Falling?

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

In fact, the vast majority of market bottoms are formed this way. They take time, and they are always volatile and trying to fight it is a good way to go broke. As always it will be the institutions with their trillions of dollars that will decide when it’s over not the retail traders! If your being chopped to pieces in this volatility, stop trading. Study price, watch and wait for your edge to return. Better days are coming and when it does there well great stock at discounted prices.

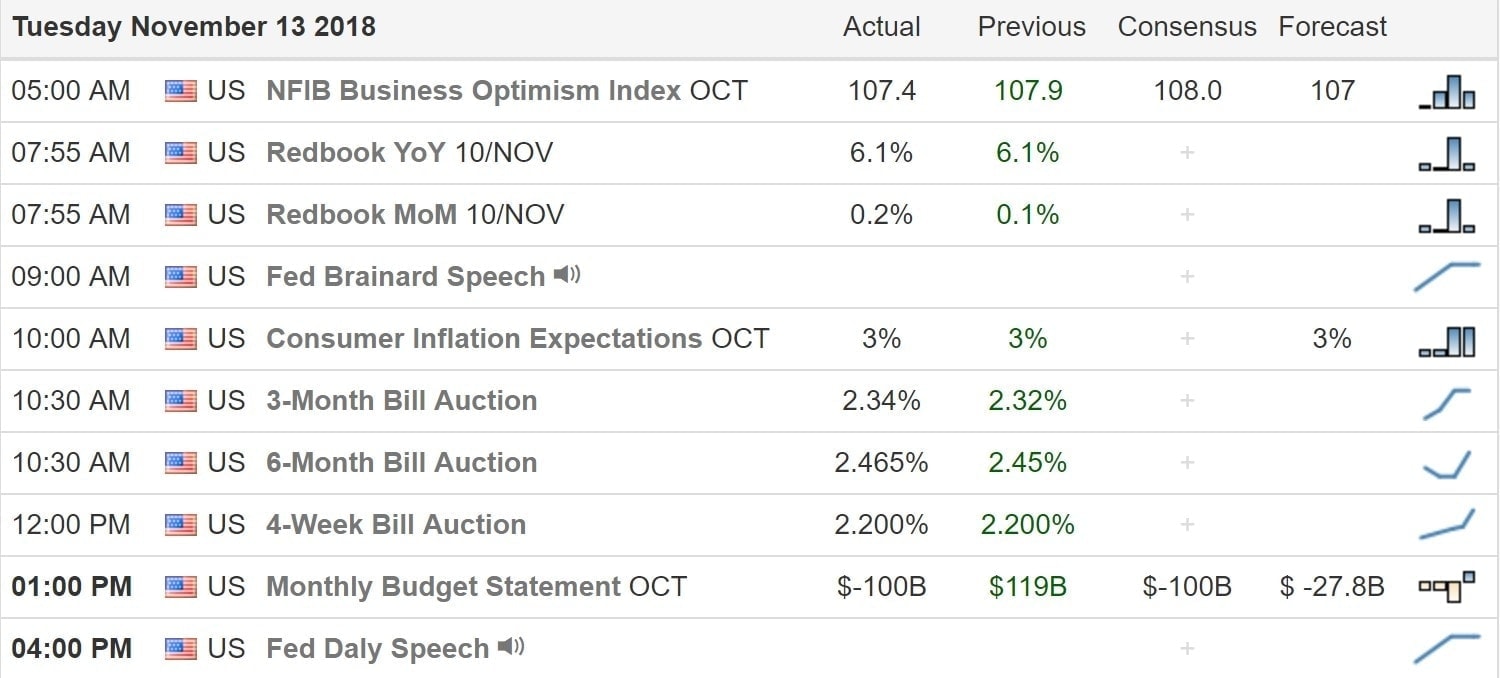

On the Calendar

On the Earnings Calendar, we have nearly 250 companies reporting results today. The bad news is this could add to market volatility with the good news is we are beginning to wind down earnings this quarter.

Action Plan

Some pretty wild price action yesterday with Dow swing more than 325 points from high to low in a very volatile session. The possible silver lining I mentioned yesterday didn’t show itself but looking at the major index charts is still possible as long as prices hold above October’s low. Having said that Bears are still in control and we must remember that anything is possible. Sadly IWM has now officially printed the so-called death cross with the 50-day crossing below the 200-day average.

Currently, futures have recovered from overnight lows and currently suggesting a flat to every so slightly bullish open. When the market downturn began in early October, I said the technical damage could take weeks if not months to repair. I have also mentioned several times that the V-bottom that had been forming after a 2000 point rally in the Dow was very rare an that has also proved to be true. That was not a prediction; it was merely a study of typical price action after a selloff. If I can do it, believe me, anyone can read price action as long as you set aside bias and remain disciplined.

Trade Wisely,

Doug

Comments are closed.