Election Results

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

Expect very fast price action as the market turns its attention to the more than 1000 companies yet to report earnings results this week. Also, keep in mind that the FOMC begins its 2-day meeting today to adding some market stress as we wait for their decision on Thursday afternoon. A big gap like this can generate a lot of emotion and a fear of missing out. As a result, we need to stay focused on price action and disciplined to your rules to win the day.

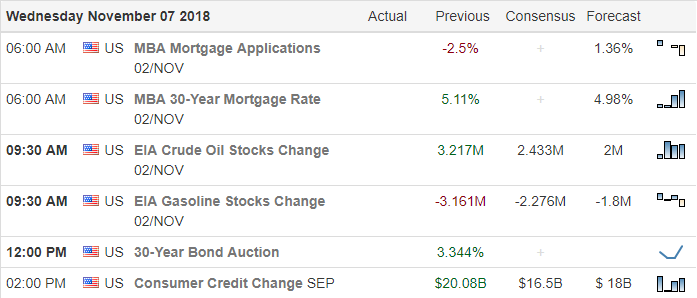

On the Calendar

On the Earnings Calendar, we have more than 400 companies reporting earnings today. Expect considerable volatility as a result.

Action Plan

Finally, the mid-term elections are behind and although there were some major changes the US Futures indicate that the market is happy with the results. As of this moment, the Dow is pointing to a gap up of more than 150 points, but let’s remember that the more than 400 companies reporting earnings today could easily change that significantly before the open.

With the election out of the way, the market will once again focus on earnings results, trade negotiations and of course the FOMC which begins its 2-day meeting today. The morning gap will propel the DIA high enough to test its 50-day average as resistance. The SPY looks to recover it’s 200-day average this morning with the QQQ looking to open very close to its 200-day while the IWM lags significantly behind them all. As happy as the market appears this morning, please keep in mind that this recovery still has a tremendous amount of work to repair the technical damage in the charts. Expect very fast price action today and the potential of a pop and drop if profit takers capitalize on the big morning gap.

Trade Wisely,

Doug

Comments are closed.