Release Key Data

U.S. will release key data on gross domestic product and initial jobless claims, which are highly anticipated by market watchers. Economic concerns intensified on Wednesday when former New York Fed President William Dudley advocated for lower borrowing costs, ideally at the upcoming meeting. Analysts have expressed worry that such a move might signal a sense of urgency among officials to stave off a potential recession.

European markets experienced a downturn amid a wave of corporate earnings reports. Notably, results from Nestle SA and Gucci owner Kering SA indicated a reduction in consumer spending across various sectors, from essential food items to luxury handbags. This trend reflects growing economic caution among consumers. Additionally, upcoming data releases on German consumer confidence and business activity in the euro zone and the U.K. are anticipated.

China’s central bank recently reduced the medium-term facility lending rate from 2.5% to 2.3%, following a prior cut in loan prime rates earlier in the week. This move aims to stimulate economic activity amid ongoing challenges. Meanwhile, South Korea’s GDP grew by 2.3% year-on-year, falling short of the 2.5% growth anticipated by economists polled by Reuters. On a quarterly basis, South Korea’s economy contracted by 0.2%, contrary to the expected 0.1% increase.

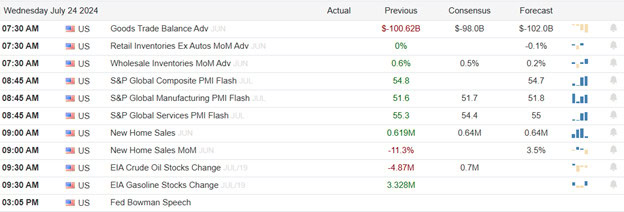

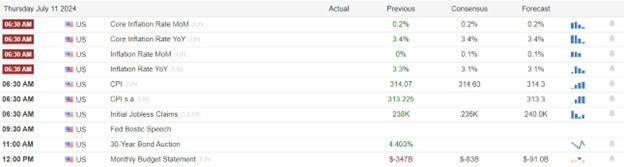

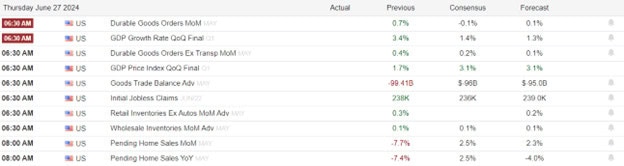

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include, ABBV, ARCH, AZN, BFH, BC, CBRE, CMCSA, CFR, DAR, DOW, DTE, EME, XPRO, FCN, HOG, HAS, HNI, HOM, IMAX, ITGR, KDP, LAZ, LEA, LKQ, MAS, MHK, NDAQ, NOC, NVCR, POOL, PDS, RS, RPM, RTX, R, SNY, SBSI, LUV, STM, FTI, TECK, TSCO, TW, TRU, TPH, UNP, VLO, VLY, VC, WST, & WEX. After the bell include AEM, ALSN, ABCB, APPF, AJG, BKR, BJRI, SAM, BYD, CINF, COLB, COLM, COUR, CUZ, CUBI, DECK, DXCM, DLR, EMN, EIX, EXPO, FHI, FFBC, FBIN, GLPI, HIG, DOC, JNPR, KNSL, LHX, TREE, LPLA, MGRC, MTX, NOV, OLN, PECO, PFG, PFS, SIGI, SKX, SKYW, SPSC, SSNC, TEX, TXRH, TFII, UCTT, VLTO, VRSN, WSBC, WY, WTW, & WSFS.

News & Technicals’

Unilever shares surged on Thursday morning following the company’s announcement of an increased full-year margin guidance. Additionally, Unilever confirmed that the spinoff of its ice cream business remains on schedule for completion by the end of 2025. The company reported underlying price growth of 1% in the second quarter of this year, a significant decrease from the 8.2% growth recorded in the same period of 2023. This update reflects Unilever’s strategic adjustments and market performance amid evolving economic conditions.

Ford Motor fell short of Wall Street’s second-quarter earnings expectations, despite surpassing revenue forecasts. The shortfall was primarily due to persistent warranty costs that have troubled the automaker for several years. In response, Ford raised its target for free cash flow but chose to maintain its 2024 earnings guidance. This decision left some investors disappointed, as they had anticipated an upward revision in earnings projections.

Auto giant Stellantis reported a first-half net profit of 5.6 billion euros ($6.07 billion), marking a significant 48% decline compared to the same period in 2023. Stellantis CEO Carlos Tavares attributed the disappointing performance to a challenging industry environment and internal operational issues. He acknowledged that the company’s results for the first half of 2024 fell short of expectations, underscoring the difficulties faced by the automotive sector in navigating current economic conditions.

Chipotle Mexican Grill reaffirmed its full-year outlook for same-store sales growth, signaling confidence in its ongoing performance. The restaurant chain exceeded Wall Street’s expectations for both quarterly earnings and revenue, showcasing its robust financial health. Additionally, Chipotle reported an impressive 8.7% increase in restaurant traffic during the second quarter, highlighting the brand’s continued popularity and effective customer engagement strategies.

The release of key data such as Durable Goods, GDP, International Trade and Jobless Claims will likely set the tenor of the morning. With the data give the bulls what’s needed to inspire a relief rally, or will the bears gain energy to follow-through with yesterday’s attack? We will soon find out but traders should plan for whipsaws and possible big point moves so plan your risk accordingly.

Trade Wisely,

Doug