Bulls Remain Resolute

Although the Dow shed 190 points yesterday the SP-500 and the NASDAQ stood resolute and well defended by the bulls. Even with the IMP once again cutting global growth forecasts last night, the futures are pointing to a bullish open this morning. Asia closed mixed but mostly lower due to growth concerns but European markets appear largely unconcerned as they wait for an ECB rate decision and Brexit summit.

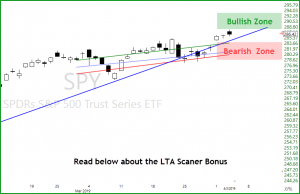

Technically speaking the SPY and QQQ continue to look very strong holding support levels and trend. Though the DIA and IWM found some sellers yesterday the bears have not shown much conviction. After the morning rush doesn’t be surprised to more light and choppy price action as we wait for the FOMC minutes this afternoon.

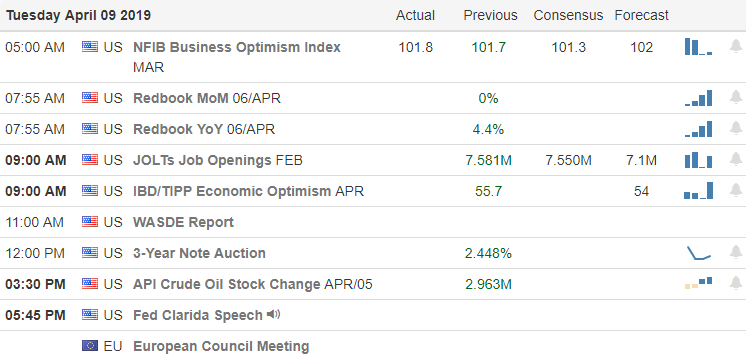

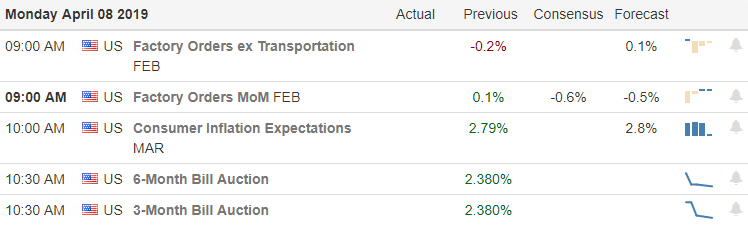

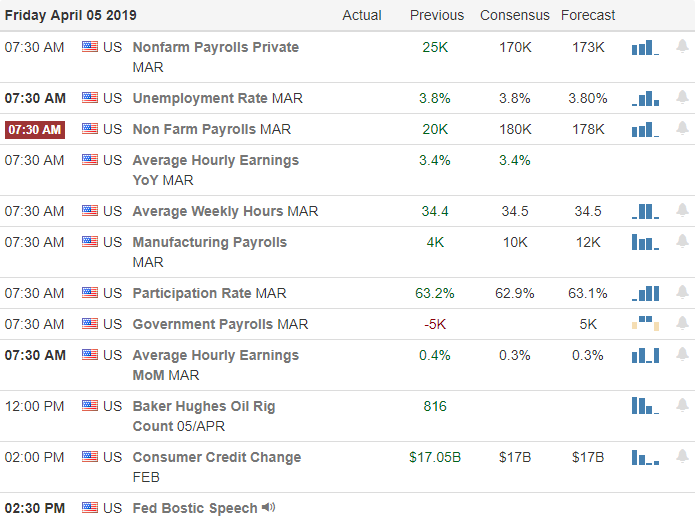

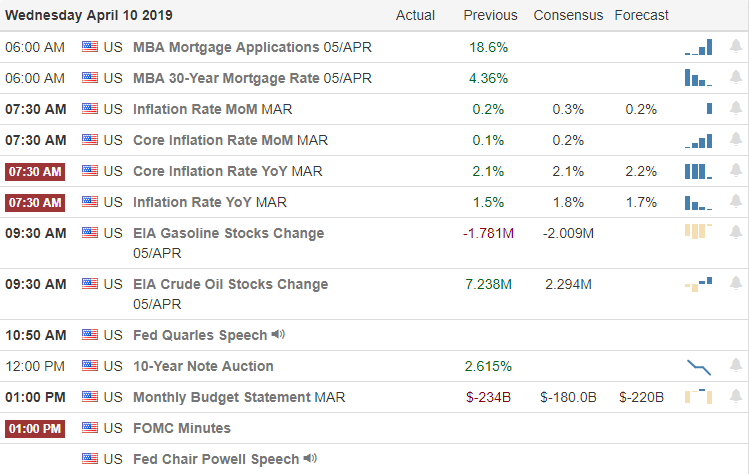

On the Calendar

We have a light day on the Earnings Calendar today with just 11 companies reporting. Notable reports include DAL before the bell and BBBY reporting after the close.

Action Plan

During the evening the IMF once again cut global growth forecasts getting a negative reaction lower by Asian markets closing mixed but mostly negative. European markets however are slightly higher ahead of ECB rate decision and a Brexit summit. US Futures currently seem unconcerned about the IMF report this morning pointing to bullish open ahead of the CPI report and release fo the FOMC minutes.

Although the SPY and QQQ closed lower yesterday there has been on technical damage as they continue to hold supports and trend. Although the DIA slipped back below a level of resistance yesterday the bears seemed to lack downside conviction. The IWM remains the weakest of the indexes leaving behind a possible failure pattern at price resistance. I would not be at all surprised to more light choppy price action today as the market waits for the FOMC minutes and the kick off to 2nd quarter earnings on Friday.

Trade Wisely,

Doug