The FOMC signals no rate increases for the rest of the year but the market seems very unimpressed by the action. While the market has been trying to ignore the clues of an economic slowdown the Fed appear to have taken a no-confidence vote in its strength. Financials quickly reacted negatively to the news and are looking slightly lower this morning.

Asian and European market responded mostly higher on the news but the US Futures currently show mixed reviews. The Dow indicates a slightly lower open while the NASDAQ is suggesting slightly higher. Technically speaking the SPY and the QQQ are in very good shape but the Dow and the IWM having printed lower highs at resistance there is reason for a little caution. Also keep an eye on the VIX that once again quietly crept up yesterday. If that continues it could trigger a little profit-taking as we head toward the weekend.

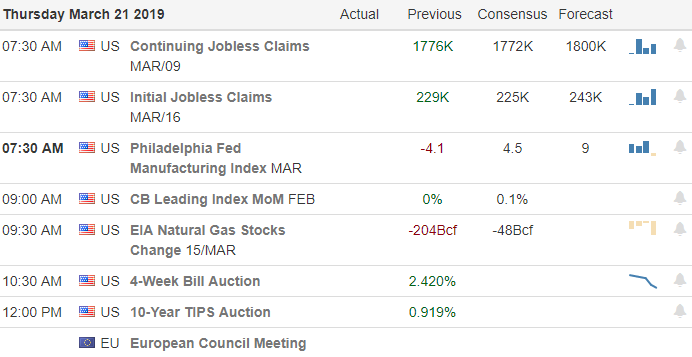

On the Calendar

We have nearly 100 companies reporting earnings today with the most notable being, NKE, CSIQ, CTAS, CEO, CAG, DRI, LE, PTR & TCEHY.

Action Plan

The market seems quite unimpressed by the FOMC decision to avoid raising interest rates for the rest of the year. Normally low rates would inspire the market but in this case the FOMC appears not so confident in the overall economy. During the night the Dow Futures were down about 100 points even though Asian and European markets responded marginally higher. As I write this futures have rallied in the pre-market pump but it would not surprise me to the overnight lows tested sometime today.

The QQQ remains very strong, the SPY is holding firm in consolidation but the DIA and IWM continue to signal a little caution due to their lower high prints. All indexes continue to have resistance challenges above making the path forward difficult to determine. The VIX edged higher again yesterday suggesting a little fear might be creeping in which could lead to some profit-taking if that were to continue as we head toward the weekend.

Trade Wisely,

Doug

Comments are closed.