The bulls were in full force and driving upward until news came out raising questions about the US/China trade negotiations bringing out the bears to reverse the days progress. After the close, FDX reported disappointing earnings raising more questions about global growth concerns. Asian markets were tepid and cautious overnight closing mixed but mostly lower. European markets are currently trading lower across the board this morning as well.

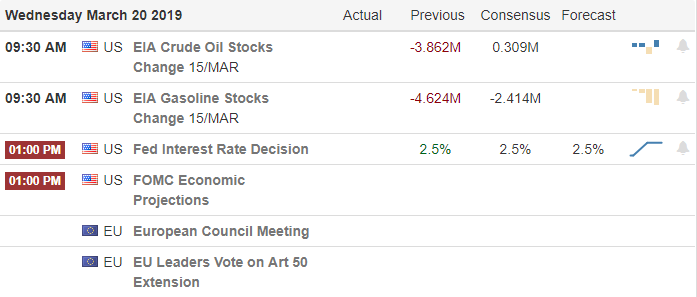

US Futures are pointing to a flat open and would not be a surprise to see light and choppy price action until the FOMC reveals it’s a decision on interest rates and delivers their forecast at 2:00 PM Eastern. Directly after expecting some wild price volatility that could extend through the chairman’s press conference scheduled at 2:30 PM. Setting that aside, the candle patterns left behind on yesterday index charts increases the caution level with their placement at or near price resistance.

On the Calendar

We have 52 companies on the Earnings Calendar stepping up to report today. Among the notable reports: GIS, GES, MU and WSM.

Action Plan

Early bullishness yesterday faded away in the afternoon session after a news report suggesting the trade negotiations with China had run into new challenges. Candle patterns left behind at or near resistance levels suggest a little caution might be in order as the market tries to digest the full measure of the issue. The disappointing market price action dealt with another disappointment as FDX missed earnings and tumbling nearly 7%.

Today is all about the FOMC and although the committee is not likely to raise rates, their forward forecast and decisions on balance sheet unwinding will have the market’s attention. The festivities begin at 2:00 PM Eastern with the Chairman’s press conference at 2:30. It would not be a surprise to see light choppy price action as we wait for the Fed announcement followed by a period of volatility and wild price swings directly after. Currently futures are pointing to falt open with European markets currently in red across the board and Asian markets having closed flat to mostly lower overnight.

Trade Wisely,

Doug

Comments are closed.