General Market Analysis

Tuesday 1-5-21 e-Learning

Tuesday 1-5-21 e-Learning

Bulls continue to run, and no price seems too high, setting new records as traders and investors hope for more federal stimulus. Today we get the latest reading on the Employment Situation, but it may not matter as we saw on Wednesday when private payrolls declined and the market soared. That said, stay focused and prepared because if a bearish move were to begin, price supports are painfully lower so, have a plan. Also, keep in mind, this could be a particularly newsy weekend on the political front.

Overnight Asian markets mostly rose, with the NIKKEI soaring 2.36%. European markets trade higher this morning, and ahead of the Employment Situation report, U.S. futures point to more record highs. Remember to take some profits after such a steep rally as we head into the weekend.

We have had a very light day on the Friday earnings calendar with only one verified report coming from the small-cap company LEDS.

The market continued to rally after congress certified the Biden presidency. In the final days of the Trump administration, there has been a call to invoke the 25th amendment to remove him from power. Congress is also threatening the 2nd impeachment to remove the president. How these events might impact the market is anyone’s guess. As of now, the bulls seem very confident the Biden administration will put the printing presses into overdrive, adding additional federal stimulus, resulting in new market records with the Dow more than 1100 points above the Monday low. Sadly at the same time, the daily death rate from the pandemic also set a new record, topping 4000 for the first time.

A look at the index charts, and there is not much to say other than the bulls remain in control, and no price seems too high as traders and investors rush into already extended stocks. Today we will get a reading on the Employment Situation. Consensus suggests job growth declined in December due to pandemic restrictions. Still, I’m not sure that matters in this current environment as we saw on Wednesday with private payrolls falling and the Dow rallied sharply. The T2122 indicator is once again signaling a short-term overbought condition, and the VIX remains elevated above 20 handles as we continue to push higher. Stay with the trend and stay focused because a profit-taking pullback has the potential of beginning at any time and could be rather steep with not much for nearby price support.

Trade Wisely,

Doug

Markets gapped up a half to nine-tenths of a percent Thursday as markets got past the turmoil of Wednesday and decided they liked the idea of a united government. After the open, drifted higher and then waffled the rest of the day. On the day, all 3 major indices closed at new all-time high closes, with the SPY and QQQ putting in strong white candles that closed near the highs. However, the DIA backed off to form a cap-up Doji type candle. At the close, QQQ was up 2.42%, SPY was up 1.49%, and DIA was up 0.74%. The VXX fell almost 6% to 16.53 and T2122 fell slightly, but remains in the overbought territory at 88.67. 10-year bond yield drove strongly higher again to 1.079% (the high since last March) and Oil (WTI) was up two-thirds of a percent to $50.97/barrel.

Shortly after the close, the DOJ fined BA $2.5 billion and charged the company with conspiracy to defraud over company deception related to the 737 Max crashes in late 2018 and early 2019. The other market news was that Bitcoin broke more records again on Thursday, now trading very close to $40,000. Finally, before the open Thursday, the NYSE again reversed course (again) and decided they will delist the 3 Chinese Telecom giants.

As expected, the other major news on the day was political. Democrats and some Republicans called for the removal of President Trump by invocation of the 25th Amendment and/or Impeachment for his incitement of Wednesday’s insurrection. The larger GOP names attempted to distance themselves from Trump by either denouncing him or resigning like Transportation Sec. Chao. At the other end of the spectrum, Trump attack dogs went into hiding and radio silence in hopes that the furor will blow over by inauguration day. At day end, the President released another desperate video in an attempt to prevent others from removing him. In it, he vaguely conceded that he lost, managed to go 2 minutes without lying about winning and having the election stolen, but then lied about how he acted as soon as he saw the rioters. Either way, if the riots didn’t completely spook Wall Street, the resignations, posturing, and/or silence certainly has not done so. So, it appears Wall Street is well past the episode.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 22,137,009 confirmed cases and 374,197 deaths. The post-holiday surge is still not fully upon us yet, but we again hit national record highs of 279,154 new cases and 4,207 deaths Thursday. However, the 7-day daily average remains at 234,110 new cases and 2,831 deaths per day. The CDC announced that over 21 million doses of the PFE-BTNX vaccine have been “distributed,” but just 5.9 million doses have been administered as of day end Thursday.

Globally, the numbers rose to 88,615,325 confirmed cases and the confirmed deaths are now at 1,908,948 deaths. As a reference, the world is averaging 659,484 new cases and 11,357 new deaths per day. In Europe, the EU has purchased 300 million more doses of the PFE-BNTX vaccine. A trial held in 6 countries (800 patients studied) found that a combination of 2 Arthritis drugs shows an 8.5% decrease in mortality when administered to the sickest patients. Brazil announced that the second of 2 Chinese vaccines they have studied is 78% effective during phase 3 trials. Although quite a bit less effective than the PFE or MRNS vaccines, the Chinese vaccines are much, much easier to ship and distribute because they can be stored at normal refrigerator temperatures. Speaking of China they are tightening restrictions again. In addition to the locked-down province, they have quarantined a city of 11 million residents and now commuters are required to show proof of Beijing residence and a Negative test result before they can travel to the capitol.

Overnight, Asian markets were mostly in the green. South Korea (+3.97%), Singapore (+2.97%), and Japan (+2.36%) led the way. Mainland China was down slightly on fears over new outbreaks. In Europe we see a similar story so far today, but with much smaller gains. The FTSE (+0.02%) is flat with the DAX (+0.79%) and CAC (+0.53%) being more typical again. As of 7:30 am, US Futures are moderately green this morning. The QQQ is again strongest, implying a +0.55% gap up open, while the SPY (+0.38%) and DIA (+0.28%) are implying more modest gains at the open. However, we are likely waiting on data at 8:30 before deciding the open.

The major economic news for Friday includes Dec. Avg. Hourly Earnings, Dec. Nonfarms Payrolls, Dec. Unemployment Rate, and Dec. Participation Rate (all at 8:30 am). There is also a Fed speaker (Clarida at 11 am). There are no major earnings reports on the day Friday.

With any fear from the Washington riots in the rearview mirror, the markets have been running hard. There is a data dump at 8:30 am which may influence short-term sentiment, but the bulls seem to have decided they like a Democratic-run government coming soon. That said, don’t get over-exposed to the upside ahead of the weekend if you can’t stand headline risk. Trump won’t like being sidelined and may do something just to make sure everyone knows he’s still around.

As always, lock in profits (base hits are better than long fly-outs) and stick with your discipline. Follow the trend, respect both support and resistance, and don’t chase the moves you have missed. There will be another opportunity and we don’t need to trade every day. Focus on the chart and your trading process. Remember, trading is a marathon, not a sprint. Finally, remember it’s Friday…don’t forget to pay yourself.

Ed

Swing Trade Ideas for your consideration and watchlist: AAPL, PANW, PINS, CHGG, QCOM, MNST, BLUE, UBER, NIO, MTCH. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

After a hideous and disgraceful display of politically fueled violence, Congress went back to work to certify the election for our Joe Biden. Let’s hope this country can now begin to heal. The bulls are clearly in control with hopes that more government stimulus is on the way under the new administration. Futures point to a modestly bullish open ahead of our biggest day of earnings this week and an economic calendar that includes a reading on Jobless Claims.

Asian markets closed mixed but mostly higher while China telecom shares plunged after the flip-flopping NYSE delisting decision. European markets are mostly higher this morning, and the U.S. futures indicate new market records at the open. Keep in mind before the bell tomorrow; we will get the latest reading Employment situation number, so plan your risk accordingly.

On the Thursday earnings calendar, we have our most significant day with 21 confirmed reports. Before the bell, we will hear results from ANGO, AYI, BBBY, CAG, CSVI, HELE, LNN, LW, NTIC, PKE, REVG, SCHN, STZ, WBA, & WEI. After the bell, ACCD, AEHR, DCT, FC, MU, PSMT, & WDFC.

In my opinion, yesterday’s attack on the U.S., the capital, was one of the most shocking and disappointing events as our countrymen disgraced our republic. As a former military officer, I will pick up my M16 and defend the people’s right to protest. However, no matter your cause, there is no excuse for violence that puts our fellow countrymen in harm’s way. There is no excuse for this kind of behavior! After a very long night session, Congress certified the election for president-elect Joe Biden. Let’s hope the healing can now begin.

The bulls were out in force yesterday as it became evident that the Senate would flip after the runoff elections in Georgia, with the market celebrating a hopefulness of more government stimulus. The DIA and IWM closed at new record highs while the SPY pullback late in the day, losing its hold on an intraday record high. Trends remain bullish in the DIA, SPY & IWM while the QQQ displays a bit of weakness breaking its short-term uptrend. This morning, futures point to modest gains, ahead of International trade numbers and the weekly Jobless Claims report. As you plan forward, keep in mind that we will get the Employment Situation number before the bell on Friday, which is often a market mover.

Trade Wisely,

Doug

As has been the case each day this year, markets gapped one way and then charged the other direction immediately. Wednesday saw the gap down followed by a strong morning rally. About 11:30 markets started to grind sideway, even drifting a bit higher until shortly after 2 pm. Then our deluded President’s conspiracy theory lies believing followers were incited to riot and storm the US Capitol building. Markets sold off as the seat of government was under siege for hours, but still managed to hold on to some of the morning gains. The DIA even closed at another all-time high close. On the day, DIA gained 1.44%, SPY gained 0.60%, and QQQ lost 1.39%. The VXX actually lost half a percent to 17.55 and T2122 jumped up into the overbought territory at 92.48. 10-year bond yield shot higher again to 1.039% and Oil (WTI) gained another percent to $50.52/barrel.

Lost amongst the coverage of insurrection was that the Democrats won both of the GA Senate runoff elections. So, President-elect Biden’s party will also control both Houses of the Congress (through VP Harris’ tie-breaking vote). Some had said an expectation of that outcome was the reason for the gap down. However, then markets immediately rallied, so it is hard to divine what Markets think about that change in governance. Still, it makes the increase to a $2,000/person direct payment much more likely.

The other story lost in the wash was that the riots helped to accelerate the weakness in the dollar. It has now fallen to the levels not seen since 2017. This has helped drive the Euro to a level that currency has not seen since 2014. Obviously, as the dollar falls, dollar-denominated commodity prices rise. This partially explains the gains in Gold and Oil. It also increases the pressure on the Fed and fiscal stimulus, which goes less far as each dollar of stimulus buys less. Overseas, it makes it harder for Central Banks and Governments to repay their own debt and to sell goods to the US. As a result, Bloomberg reports that some analysts are expecting the ECB and China to take action to lower the value of their own currencies to offset dollar weakness.

It’s hard to believe, but on a day with 4,100 virus deaths in the US, COVID-19 took a back seat. Related to the virus itself, US infections continue to rage as the US. The totals have risen to 21,857,616 confirmed cases and 369,990 deaths. As mentioned, we did hit another national record high in deaths, but also in new cases at 260,973 on Wednesday. However, the 7-day daily average remains at 228,891 new cases and 2,742 deaths per day.

Globally, the numbers rose to 87,763,513 confirmed cases and the confirmed deaths are now at 1,893,873 deaths. As a reference, the world is averaging 645,896 new cases and 11,250 new deaths per day. In Japan, the PM has declared a state of emergency in Tokyo and surrounding areas as they also reported a record number of new cases. Travel bans from international travel, especially from the UK and South Africa continue to be added. In Europe, the EU approved the MRNA vaccine, which means it will begin rollout across the EU by next week.

Overnight, Asian markets were mostly in the green. South Korea (+2.14%), Japan (+1.60%), and Australia (+1.59%) led the gainers. The only appreciable loss was in Hong Kong (-0.52%) with a couple other exchanges just on the red side of flat. In Europe we see a similar story so far today. The FTSE (-0.47%) is one of the notable red spots with the DAX (+0.41%) and CAC (+0.31%) being more typical of the continent. As of 7:30 am, despite the deluded riots that left 4 dead and the seat of Government battered, US Futures are moderately green this morning. The QQQ is strongest, implying a +0.74% gap up open, while the SPY (+0.40%) is implying a positive, but not gappy open and the DIA (+0.28%) is implying a modest gain at the open.

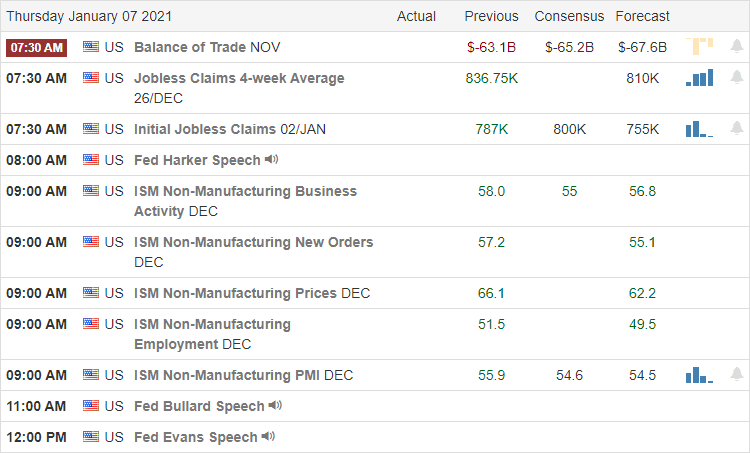

The major economic news for Thursday includes Import/Exports, Nov. Trade Balance, and Weekly Initial Jobless Claims (all at 8:30 am.), Dec. ISM Non-Mfg. PMI (10 am), and a pair of Fed speakers (Harker at 9 am and Bullard at Noon). Major earnings reports include AYI, BBBY, CAG, HELE, LW, REVG, STZ, and WBA before the open. Then after the close MU reports.

Volatility continues early in 2021. However, it would be hard to predict anything as volatile as Wednesday’s riots happening again. Even though the Cabinet apparently hasn’t had the courage to invoke Article 25, we can expect impeachment proceedings soon unless the GOP is willing to make massive concessions to buy off Democrats. At any rate, with the immediate threat behind us and President Biden’s election now certified, hopefully, we can return to the virus being the main threat for days to come. It would still be wise to remain cautious and not chase. Be ready for the market switch-backs we’ve seen each of the first several days of the year.

As always, lock in profits (base hits are better than long fly-outs) and stick with your discipline. Follow the trend, respect both support and resistance, and don’t chase the moves you have missed. There will be another opportunity and we don’t need to trade every day. Focus on the chart and your trading process. Remember, trading is a marathon, not a sprint.

Ed

Swing Trade Ideas for your consideration and watchlist: GOLD, KGC, GDX, WPM, NUGT, AGI. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Political news out of the Georgia runoff election and the Congressional vote to certify the Biden presidency with efforts to block the process could set off price action fireworks in the market today. The bulls have defended support levels, but they fell just short of clearing the price resistance above at the close yesterday. With the VIX remaining elevated, be prepared for some news related price volatility, and don’t forget the FOMC minutes’ release this afternoon.

Overnight Asian markets closed mixed but mostly higher as energy stocks surged following the OPEC action. European markets see green across the board this morning, while the U.S. Futures offer up a mixed bag of results with the Dow higher and the other indexes modestly lower heading into the open. Stay focused and flexible as anything is possible on this very political new driven day.

On the Hump Day earnings calendar, we have nine verified reports. Before the bell, we will hear from GBX, MSM, RPM, SMPL, & UNF. After the bell, LNDC, RELL, RGP, & SAR will report.

We face an interesting day in the market with a lot of political news that has the potential to move the market. First, we have the runoff elections that are drawing closer to flip the Senate raising concerns it will clear the deck for higher taxes. We also Congress try to certify the Biden election win, but a group also moves to block the effort, and protests have already begun. The 10-year Treasury yield rose above 1% for the first time since March in reaction to current Georgia runoff results, and Bitcoin surged above $35,000 for the first time. While politics preoccupy the market, the daily death toll hit new records as more than 3800 Americans succumb to the virus. Sadly, a grisly reminder we may have a long way to go to win this pandemic battle.

Yesterday’s bullish price action lifted the index charts just enough to challenge price resistance but failed to clear the level by the close. We should plan for the possibility of price volatility based on the political wrangling in Congress and Georgia. We also have some economic news to keep an eye on, such as releasing the FOMC minutes at 2:00 PM Eastern to create some price action fireworks. The VIX remains elevated as we attempt to rally, and the Absolute Breadth Index continues to show a concerning decline. Stay with the bullish trend but stay on your toes should the sentiment quickly shift.

Trade Wisely,

Doug

Markets opened slightly lower on Tuesday. However, after a rollercoaster first hour, the bulls took control and led a sustained rally up until the last hour, which gave back just a touch of the gains. On the day the QQQ gained 0.82%, the SPY gained 0.69%, and the DAI gain 0.50%. VXX fell over 3% to 17.64 and T2122 shot back up to sit just below the overbought territory at 77.17. 10-year bond yields rose sharply to 0.955% and Oil (WTI) shot up over 4.5% buoyed by Saudi Arabia announcing production cuts, leaving it at $49.80/barrel after trading above $50 for the first time since last February.

Politics takes center stage again today without much real short-term impact. One of the two GA Senate races is projected to go to the Democrat challenger while the other election is too close to call, with the Democrat currently in the lead. If both Democrats win, the Senate becomes a stalemate for 2 years with Democratic VP Harris then being the deciding vote. If either seat remains Republican, current Majority Leader McConnell retains the power to obstruct all Democratic plans for 2 years. Meanwhile, the delusion of conspiracy theories comes to a crescendo as the President and some of his supporters will hold political theatre before accepting the Nov. election results.

Mortgage demand pulled back 0.80% in the last 2 weeks of December, despite record low interest rates (2.68% for 30-year conforming loans, which was way down from 2.90% in the previous reporting period). The volume of applications was up 3% above the same period a year prior, but the volume had been running at 20% or more higher than the previous year since the beginning of the pandemic. So, this may be signaling an end to the home buying surge.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 21,579,641 confirmed cases and 365,664 deaths. The post-holiday surge is still not fully upon us yet, but we did hit a national record of 3,775 deaths Tuesday. However, the 7-day daily average remains at 222,771 new cases and 2,678 deaths per day. As mentioned yesterday, the hospital capacity in the Los Angeles area is critical. Ambulance crews have told to perform 15 minutes of life-saving at any scene and then only transport patients that do not have a low likelihood of survival. Beyond that, each ambulance may experience an hour or more of wait time at the hospital before a patient can be seen and they freed up for another call. In addition, all non-essential (beyond just elective) surgeries have been canceled in the region.

Globally, the numbers rose to 86,959,936 confirmed cases and the confirmed deaths are now at 1,878,706 deaths. As a reference, the world is averaging about 637,000 new cases and 11,250 new deaths per day. As in the US, in Europe, delays in vaccinations are a major storyline. The Netherlands just gave its first vaccination on Wednesday as their National Health Ministry had bet on the wrong vaccine to be ready first. In France the pace is also far, far behind with just a few thousands of doses given. Italy also received 100,000 fewer doses than they expected. Meanwhile, for comparison the UK has vaccinated 1.3 million people and Germany almost 400,000. In China, over 100 cases were reported in one province and that region is being locked down with a negative test required to enter or leave the province as of today.

Overnight, Asian markets were mixed, but mostly red. Indonesia (-1.17%), Australia (-1.12%) and Malaysia (-1.02%) led the losses. Shanghai (+0.63%) was the only appreciable green exchange. In Europe, markets are mostly green so far today. Among the big 3 bourses, the FTSE (+2.75%) leads as an outlier, with the DAX (+1.02%) and CAC (+0.80%) more typical. As of 7:45 am, US Futures are mixed. The QQQ is implying a large -1.44% gap down while the DIA (+0.15%) is slightly green and the SPY is implying a -0.27% open at this point.

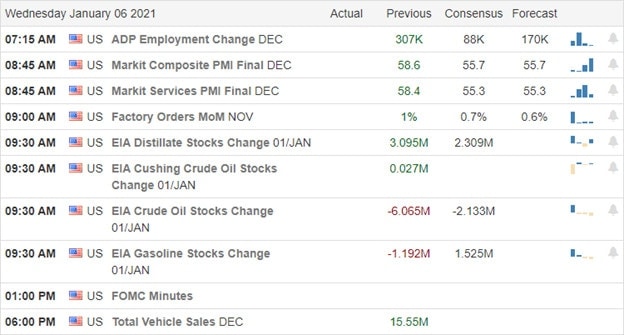

The major economic news for Wednesday includes Dec. ADP Nonfarm Employment (87:15 am), Dec. Services PMI (9:45 am), Nov. Factory Orders (10 am), Crude Oil Inventories (10:30 am), and Dec. FOMC Meeting Minutes (2 pm). Major earnings reports are limited to MSM and RPM before the open. There are no major earnings reports after the close.

Volatility continues early in 2021, with each day so far starting with markets going one direction only to slam back hard the other direction. Some pundits claim this is related to fear over the Senate, others that is it virus-related. Regardless of the cause, be cautious not to chase and be ready for market switch-backs. Safe is better than fast and nimble is better than slow…if that makes sense.

As always, lock in profits (base hits are better than long fly-outs) and stick with your discipline. Follow the trend, respect both support and resistance, and don’t chase the moves you have missed. There will be another opportunity and we don’t need to trade every day. Focus on the chart and your trading process. Remember, trading is a marathon, not a sprint.

Ed

Swing Trade Ideas for your consideration and watchlist: CX, X, GE, LTHM, TLRY, AMAT, REGI, XRT. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Yesterday selling us reminded us that bears still exist and that an overextended market condition can produce quick and painful selloffs. What happens next could be very important to the short-term future direction of the market. If the bulls are strong enough to defend yesterday’s lows over the next few days, Monday’s price action will be chalked up to volatility. However, if the bears show the ability to create a lower low in the next few days, they could gain the upper hand can create technical damage in the index charts. Expect the Georgia runoff election news to create pice sensitivity over the next 24 hours.

Overnight Asian markets recovered from early losses after the NYSE reversed its Chinese telecom delisting decision. European markets see modest losses across the board this morning as England goes into a nationwide lockdown. U.S. futures lose overnight gains turning modestly bearish as we head toward the open with ISM Mfg. Data in focus at 10 AM Eastern.

On the Tuesday earnings calendar, we have twelve companies listed but only one verified report. Keep an eye on SGH reporting after the bell today.

A late afternoon decision by the NYSE reversed their decision to delist three Chinese telecom giants helping the overnight futures trade higher. Yesterday’s pop and drop price action left behind bearish candle patterns as the market reacted to Iranian military action, the pending Georga Senate runoff election, and surging pandemic concerns. Although there is a reason for caution heading into the Tuesday open, the bulls fought back, holding on to essential supports such as the psychological Dow 30,000. Remember, one day does not make a trend, so what happens next will be very important to the market’s short-term direction. Should the bulls prove strong enough to defend and recover broken trends, yesterday’s selloff could prove to be nothing more than volatility. However, if the bears can produce a follow-through, lower low in the next few days, they could gain the upper hand.

News out of Georgia may well create some price sensitivity and volatility today and into tomorrow open. Plan your risk carefully. Also, more news such as England going into another pandemic triggered, countrywide lockdown, New York considering making it a crime to avoid vaccination, or the possible addition of more public restrictions could add to the price volatility. Stay on your toes and be careful not to overtrade in this environment.

Trade Wisely,

Doug

Markets gapped higher between 0.3% and 0.5% at the open Monday. However, this was met by a face-ripping selloff that lasted until about 12:30 pm on fears over the holiday surge and the new, more contagious virus strain. The rest of the day was a sideways grind with a slight bullish bent to i. However, stocks closed closer to their lows than to the Open. This left us with large Bearish Engulfing candles in all 3 major indices, albeit with lower wicks. On the day, SPY lost 1.36%, DIA lost 1.13%, and QQQ lost 1.41%. The VXX gained almost 9% to 18.25 and T2122 fell sharply and now sits at 31.19. 10-year bond yields were flat at 0.915% and Oil (WTI) fell over 2% to $47.36/barrel.

In a bizarre turnaround, the NYSE announced it will not delist the 3 Chinese telecom companies in order to comply with a Presidential Executive Order. So, China Telecom, China Mobile and China Unicom will all remain listed for now.

An interesting tidbit out of the UK. Since the first of the year, the cost of moving freight to the UK from Europe has quadrupled due to extra turmoil from Brexit. This was also complicated by the extra testing requirements at the border around the new virus strain. This news came as the UK enters its third national lockdown.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 21,353,051 confirmed cases and 362,123 deaths. The post-holiday surge is still not fully upon us. However, the 7-day daily average remains high at 218,967 new cases and 2,702 deaths per day. So far, the US has vaccinated only 4.5 million people (less than 25% of 2020 goal), but has distributed well over 15 million doses. So, the hold-up is the logistics of administering the shots. Due to the extreme requirements for storage temperatures, relatively few locations in each state have the vaccine and this added to a system strain of all the new cases has slowed vaccinations. As an example of system load, Los Angeles ambulance crews were told to make triage decisions and not transport patients with little chance of survival, because the hospitals have no capacity left for such patients.

Globally, the numbers rose to 86,197,384 confirmed cases and the confirmed deaths are now at 1,863,113 deaths. As a reference, the world is averaging about 622,939 new cases and 11,170 new deaths per day. As mentioned, the UK imposed another national lockdown to fight the strain on their NHS caused by the new virus variant. A Cabinet Minister went further to say that UK citizens should not be traveling under any circumstances. Elsewhere in Europe, Italy has decided to extend its own lockdown measures at least another two weeks and Germany is discussing an extension of their own quarantine with regional leaders.

Overnight, Asian markets were mostly green again. Thailand (+2.62%), South Korea (+1.57%), and Shenzhen (+1.50%) were the strong outliers with most exchanges moving much more modestly and mostly to the upside. However, in Europe, markets are mostly red with only a few clinging to the green side of flat. Among the 3 major European bourses, the FTSE (-0.09%) is just red, while the DA (-0.64%) and CAC (-0.71%) are more typical of the continent at mid-day. As of 7:30 am, US Futures are just on the red side of flat. The DIA is implying a -0.17% open, the SPY implying a -0.15% open, and the QQQ implying a -0.10% open at this point.

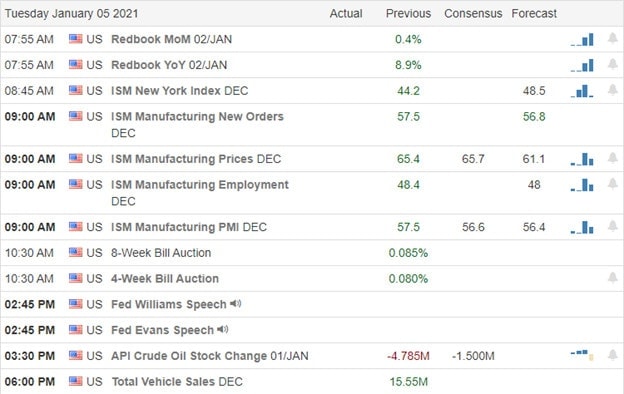

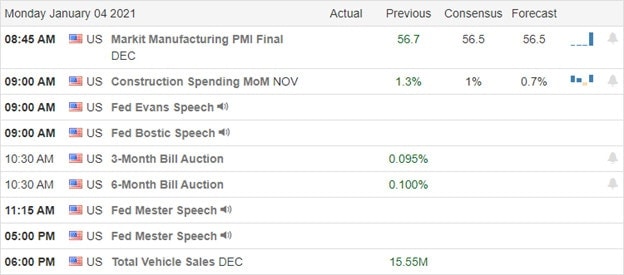

The major economic news for Tuesday is limited to Dec. ISM Mfg. PMI and Dec. ISM Mfg. Employment (both at 10 am) and a Fed speaker (Williams at 3:45 pm). There are no major earnings reports on the day.

After a rough start to 2021, markets seem to be pausing to check the wind direction. This may be due to waiting on the GA Senate elections, the Republican theatre to placate conspiracy theories, or even waiting to see the depths of post-holiday virus impacts. Regardless, there is no strong direction in pre-market this morning.

Lock in those base hit profits where you can and stick to your discipline. Follow the trend, respect support and resistance, and don’t chase moves you have missed. Focus on the chart and your trading process. Remember that trading is a marathon, not a sprint. So, don’t feel like you need to trade every day.

Ed

Swing Trade Ideas for your consideration and watchlist: WMT, AUY, LMNX, UTHR, TPR, KL. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

The afternoon New Year’s eve record-setting rally looks to extend this morning as the bulls step on the gas on this first trading day of 2021. Trends remain bullish as vaccine results will produce a much better year for business. That said, hospitalizations hit new records as well over the holiday shutdown. One has to wonder what kind of restrictions will businesses have to face under a new administration should the surge continue. Long story short, have a plan of action to protect your capital should the market stumble.

Asian markets closed mixed but mostly higher overnight, and European markets are decidedly bullish this morning. U.S. futures point to bullish open ahead of PMI Mfg. and Construction Spending numbers with a very light day on the earnings calendar. Expect possible political news sensitivity as the tenuous transition of power begins.

Although we have several small-cap stocks listed on the earnings calendar, their reports are unconfirmed, and thus no notable earnings.

On the first trading day of 2021, the U.S. Futures look to extend the late New Year’s eve record-setting rally. With an accommodative Fed, more Governmental stimulus rolling out, and high hopes that vaccines will put the pandemic behind us, there is a reason for all the bullishness. However, with indexes already at record highs, high unemployment, and substantial economic damage to businesses, traders will have to remain focused and ready to act should the market stumble. Market P/E valuations are very high as we enter the new year, and with economic restrictions still in place, will companies be able to produce healthy enough earnings to sustain current prices? Hospitalizations hit new records highs over the holiday and did post-pandemic travel. How will the new administration respond if infection rates continue to surge? A lot to ponder as we kick-off the new year.

One thing for sure at the moment is that the index trends remain bullish, and there seems to be a relentless willingness to buy up stocks no matter the valuation. Some suggest we are in a growing bubble, and while that may be true, bubbles can continue to extend for months. As traders, all we can do is stay with the trend as long as it lasts, follow our rules, and avoid overtrading. Always have a prepared plan should the bears suddenly have reason to come back to work. Trust me, they will, and it will likely occur very suddenly. With this morning gap up to new records, the T2122 indicator will once again show a short-term extended condition. The Absolute Breadth Index remains in a concerning decline, and keep in mind the VIX-X remains above a 20 handle as we set new records in the indexes.

Trade Wisely,

Doug