The afternoon New Year’s eve record-setting rally looks to extend this morning as the bulls step on the gas on this first trading day of 2021. Trends remain bullish as vaccine results will produce a much better year for business. That said, hospitalizations hit new records as well over the holiday shutdown. One has to wonder what kind of restrictions will businesses have to face under a new administration should the surge continue. Long story short, have a plan of action to protect your capital should the market stumble.

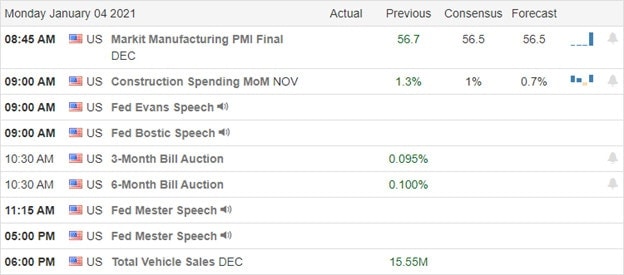

Asian markets closed mixed but mostly higher overnight, and European markets are decidedly bullish this morning. U.S. futures point to bullish open ahead of PMI Mfg. and Construction Spending numbers with a very light day on the earnings calendar. Expect possible political news sensitivity as the tenuous transition of power begins.

Economic Calendar

Earnings Calendar

Although we have several small-cap stocks listed on the earnings calendar, their reports are unconfirmed, and thus no notable earnings.

News & Technicals’

On the first trading day of 2021, the U.S. Futures look to extend the late New Year’s eve record-setting rally. With an accommodative Fed, more Governmental stimulus rolling out, and high hopes that vaccines will put the pandemic behind us, there is a reason for all the bullishness. However, with indexes already at record highs, high unemployment, and substantial economic damage to businesses, traders will have to remain focused and ready to act should the market stumble. Market P/E valuations are very high as we enter the new year, and with economic restrictions still in place, will companies be able to produce healthy enough earnings to sustain current prices? Hospitalizations hit new records highs over the holiday and did post-pandemic travel. How will the new administration respond if infection rates continue to surge? A lot to ponder as we kick-off the new year.

One thing for sure at the moment is that the index trends remain bullish, and there seems to be a relentless willingness to buy up stocks no matter the valuation. Some suggest we are in a growing bubble, and while that may be true, bubbles can continue to extend for months. As traders, all we can do is stay with the trend as long as it lasts, follow our rules, and avoid overtrading. Always have a prepared plan should the bears suddenly have reason to come back to work. Trust me, they will, and it will likely occur very suddenly. With this morning gap up to new records, the T2122 indicator will once again show a short-term extended condition. The Absolute Breadth Index remains in a concerning decline, and keep in mind the VIX-X remains above a 20 handle as we set new records in the indexes.

Trade Wisely,

Doug

Comments are closed.