Stimulus Not Done Trump Wants Change

Tuesday brought us a small gap down in the large-caps and a small gap up in the QQQ. After the open, the DIA slowly ground lower, the SPY and QQQ undulated more sideways. The DIA printed a Bearish Harami and the QQQ printed a long-legged Doji, while the SPY printed a run-of-the-mill black-bodied candle. On the day, QQQ gained 0.27%, SPY lost 0.17%, and DIA lost 0.69%. The VXX fell a little under 2% to 18.11 and T2122 rose near, but just outside of the overbought territory at 77.03. 10-year bond yields fell to 0.921% and Oil (WTI) fell almost 2.5% to $46.80/barrel.

President Trump felt the need to lash out again overnight. This time his tweet called the Stimulus bill a disgrace and demanded Congress change the $900 Billion bill to add bigger direct payments to Americans. He did not overtly threaten a veto, but the threat was implied. This came out of the blue, especially since his own Treasury Sec. (Mnuchin) was one of the lead negotiators. The President’s demand for larger direct payments also flies in direct opposition to the Senate GOP position that there should have been no additional direct payments (which was then negotiated up to the final agreed number of $600). If vetoed, the move would also kill the $1.4 trillion omnibus spending bill, which would close the government. Treasury yields climbed and futures moved down on the news.

In other after-hours Tuesday news, the NYSE announced that most of their trading floor personnel will go back to remote work as of December 28. This includes all the market makers. This follows the same rules as the historic floor operations shutdown back in March and is based on a new level of outbreak in the New York City area.

Related to the virus itself, US infections continue to rage as the US. The totals have risen to 18,684,628 confirmed cases and 330,824 deaths. The weekend saw another small reduction in new cases and deaths Monday, but the 7-day daily average remains 219,171 new cases and the average number of deaths rose to 2,781 deaths per day. This comes after we reported the second-highest number of daily deaths on Tuesday.

Globally, the numbers rose to 78,476,586 confirmed cases and the confirmed deaths are now at 1,726,558 deaths. As a reference, the world is averaging about 648,000 new cases and almost 11,700 new deaths per day. In Europe, France agreed to reopen border crossing with the UK, but only for people who can present a negative test that had been taken within 72-hours of the crossing. However, with a queue that has already grown for 48 hours, it will take time to get drivers the test and clear the backlog. In the meantime, German airline Lufthansa has begun flying special cargo flights of fresh produce to the UK. (Sort of the opposite of the Western airlift into Berlin during the Berlin Blockade.) That said, Germany reported its highest daily death toll since the beginning of the virus.

Overnight, Asian markets were mostly in the green. Among the major exchanges, South Korea (+0.96%) and Hong Kong (+0.86%) led the way. The only losses were in smaller exchanges like Thailand (-0.59%) and Indonesia (-0.24%). Europe is also mixed, but leans to the green side so far today. Among the big 3 bourses, the FTSE (-0.09%) is on the red side of flat, but the DAX (+0.52%) and CAC (+0.46%) are green and more typical of the continent. As of 7:30 am, US futures are pointing to a flat, but mixed open. The DIA is implying a slight gain of +0.15%, the SPY also implying a slight gain of +0.16%, and the QQQ implying a small loss of -0.09%.

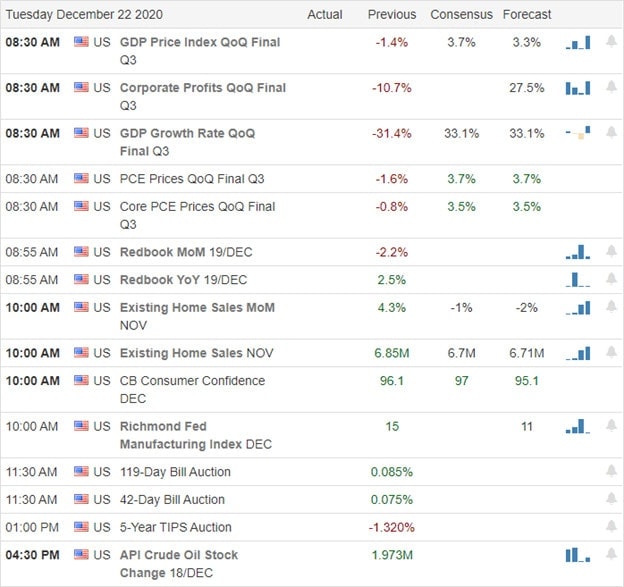

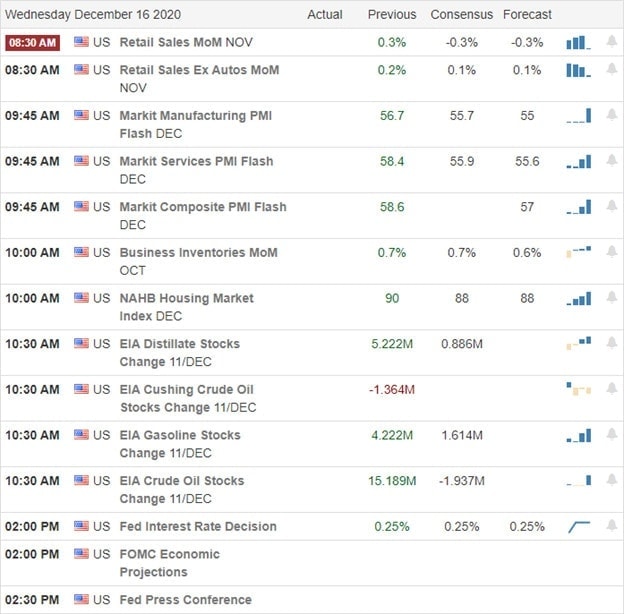

The major economic news on Wednesday includes Nov. Core PCE, Nov. PCE Price Index, Nov. Personal Spending, and Weekly Jobless Claims (all at 8:30 am), Univ. of Michigan Cons. Sentiment and Nov. New Home Sales (bot hat 10 am), and Crude Oil Inventories (10:30 am). The only major earnings report on the day will be PAYX before the open.

With the holiday fast approaching, more and more traders will be away from the market. The President’s ojection to the stimulus deal and fear over the virus (and almost inevitable new wave after people ignore the advice and congregate for Christmas and New Year’s Day) are fighting against holiday cheer for the mind of th market. Remember that the bulls are extremely resilient. So, be careful, but don’t take any rash actions. Stick to the chart.

Respect the trend, support and resistance, and price action. Focus on maintaining your trading rules. Keep booking those profits (and especially goals) when you have them…its all about base hits. Don’t let greed get in the way of you achieving goals. Success is built one trade at a time, not by trying to hit the lottery. In short, get rich slowly…one trade at a time, just consistently achieving goals.

Ed

Swing Trade Ideas for your consideration and watchlist: WRAP, PINS, NKE, CCOI, FVRR, GTHX Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service