Yield Tumble and AZN News May Help Bulls

Markets opened blah on Friday and then ground sideways in a tight range all day, up until a late-day selloff. This left indecisive Doji and Spinning Top in the SPY and QQQ. On the day, DIA lost 1.02%, SPY lost 0.51%, and QQQ gained 0.35%. The VXX fell 4% to 12.77 and T2122 rose a bit, but remains in the mid-range at 60.53. After having risen during pre-market, 10-year bond rates were flat at 1.73% on the day, and Oil also gained strongly overnight, but was flat on the day at $61.42/barrel.

Over the weekend, CP agreed to buy KSU for $25 billion in the rail space. In Oil, Saudi Aramco announced earnings 44% down for 2020, but decided to maintain its $75 billion dividend and it remains the world’s most profitable company. Finally, after completing its $100 billion media deal, the NFL also working on a $100-$250 million data deal to provide play-by-play statistics to sports betting companies.

Early today, Richmond Fed President Barkin (voting member) told a conference in Europe “the US is on the brink of completing its recovery.” However, he fears economic scarring left by the year-long crisis will suppress growth prospects in the medium and longer-term. (The US economy contracted 3.5% in 2020, but is estimated to grow 6.5% in 2021 and 4% in 2022 according to both Fed and OECD, a non-US expert source.) Barkin’s main “scarring” concerns are parents who left the workforce (especially mothers), small businesses having closed, and working off the tremendous Federal Debt.

Related to the virus, US infections are plateauing at a level above the fall level after a month and a half of steep and steady decline in new cases. The totals have risen to 30,521,774 confirmed cases and deaths have now passed half a million at 555,314 deaths. As mentioned, the number of new cases has plateaued at an average of 55,630 new cases per day. However, new deaths continue to fall to 1,048 per day. In bad news, Covid cases are rising again in 21 states. Meanwhile, in Miami Beach, Spring Breakers packed the streets (mostly unmasked) and rioted when police tried to break up crowds. However, in more hopeful news, AZN released a new US-based trial of their vaccine that showed 79% efficacy (but like the JNJ, PFE, and MRNA vaccines, 100% effective against severe symptoms and hospitalization).

Globally, the numbers rose to 123,935,536 confirmed cases and the confirmed deaths are now at 2,729,028 deaths. The trends have been good, but we saw a significant uptick today. The world’s average new cases are rising again (about 10,000 per day) and are not at 481,856 per day. Mortality, which lags, also ticked up, now at 8,756 new deaths per day. Greece has drafted private doctors to help the strained medical system after a public plea resulted in few volunteering. With a major lack of vaccine in the EU, EU Commissioner Von der Leyen told AZN, “first fulfill your contract with Europe before you start delivering to other countries.” So, the argument with the UK is now hot again. Germany is seeking a lockdown extension as cases are rising again in the country’s third wave. In Asia, India reported a spike with the most new cases of any day since November.

Overnight, Asian markets were mixed but leaned strongly red again. Japan (-2.07%) and India (-1.49%) led the losses while Shanghai (+1.14%) and Shenzhen (+1.14%) are among the few bright spots. However, in Europe, markets are mostly green on modest trading with only 2 showing any red so far this morning. The FTSE (+0.10%), DAX (+0.23%), and CAC (-0.23%) are typical of the continent at mid-day. As of 7:30 am, US futures are pointing to another mixed and modest open. The DIA is just on the red side of flat at -0.04%, while the SPY (+0.20%) is implying a slightly higher open, and the QQQ (+0.80%) is implying a moderate gap higher.

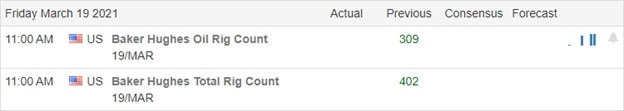

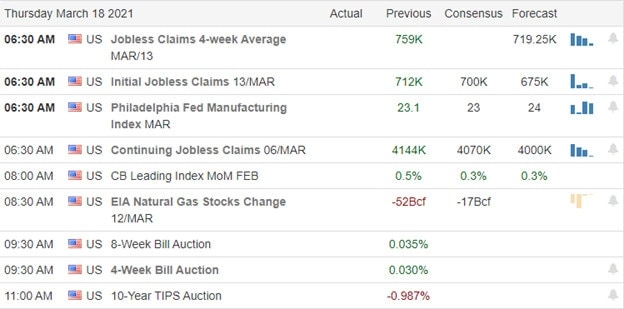

The no major economic news scheduled for Monday is limited to Feb. Home Sales (10 am). Major earnings reports before the open are limited to ZIM. Then after the close SNX and TME report.

Although today’s news is limited, Fed Chair Powell and Treasury Sec. Yellen jointly-testify before Congress on both Tuesday and Wednesday this week. So, there may be some waiting today for more direction from those two Monetary and Fiscal leaders. However, 10-year yields fell significantly overnight, which may fuel the bulls. In addition, gaps and volatility have been the hallmarks of the past few days, where intraday swings of more than 1.5% have been the norm. And we still sit just a couple percent from the all-time highs. So, exercise caution and prudence.

Follow the trend for your trading horizon, respect both support and resistance, and don’t chase the moves you missed. Another trade will be along any minute. As always, consistency is the key to long-term trading success. So, keep taking your trade goals (profits) off the table when you can, stick to your rules, and maintain that discipline.

Ed

Swing Trade Ideas for your consideration and watchlist: PFE, QS, DAC, BOOT, CSAH, FDX, MVIS, KOPN, STKL, MGNI. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service