A choppy market session found sellers after the gap up open, but bulls ultimately won the day, climbing the wall of worry to set new records. However, futures trade missed this morning, facing the latest read on Retail Sales and the beginning of the 2-day FOMC meeting. As inflation concerns linger in the bond market, worries grow that the Fed could hint of interest higher rates in 2032. Should they do so, expect price volatility to follow as investors digest the future ramifications. Plan your risk carefully!

Overnight Asian markets rallied with modest gains across the board. European markets also trading in the green this morning, with VW surging 5.6%. U.S. futures have rallied off overnight lows but continue to suggest a flat, mixed open ahead of potentially market-moving economic reports. Fasten your seatbelts; the next couple of days could be an exciting ride.

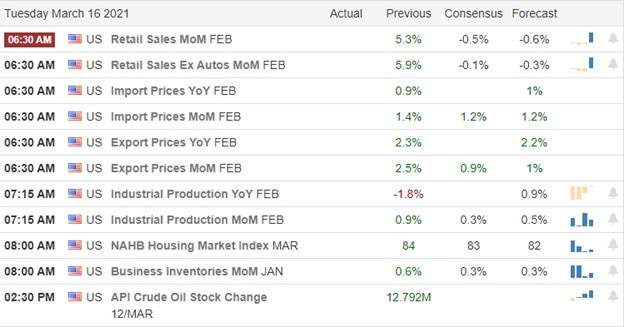

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we now have more than 100 companies, but quite a few are not verified. Notable reports include COUP, CRWD, DBI, JILL, JBL, LEN, & VEL.

News & Technicals’

The market set new records in a choppy market session that seemed to struggle with momentum. Sweden and Latvia joined Germany, France, Italy, and Spain on Monday, stopping the administration of the AstraZeneca vaccine over blood clot fears. However, the company says there is no data that really justify these decisions and could have pandemic consequences. According to the U.S. solar industry, they posted record growth in 2020, adding 19.2 gigawatts of new capacity and an increase of 43% from last year. Solar installations are planned to quadruple by 2030.

As I write this report, the U.S. futures trade mixed with retail numbers and the beginning of the FOMC meeting in focus. Consensus estimates say retail numbers will decline rather sharply from the last reading, but they have set the expectation so low it may not be that hard to top the target. With bond rates moving up and worries about rising inflation, all eyes will be on the Fed announcement Wednesday afternoon. There is speculation that the committee could suggest rate increases by 2023. A long way off, but even a hint that higher rates are possible significant price volatility could be the result. Carefully consider your risk as you plan the path forward over the next couple of days. The NASDAQ is currently pricing in a gap up to test its 50-day average as resistance this morning. Will there be any bears ready to defend? Only time will tell.

Trade Wisely,

Doug

Comments are closed.